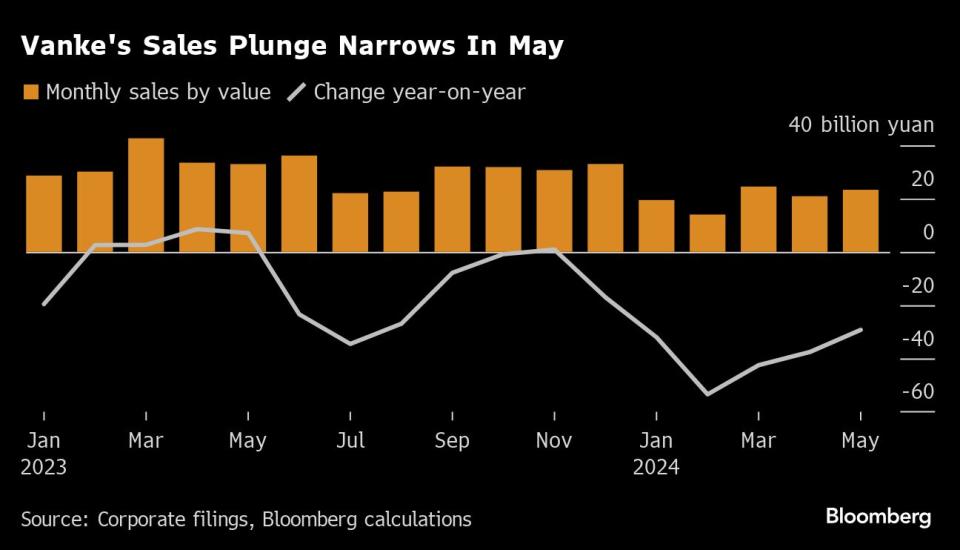

China Vanke’s Sales Slump Eases as Housing Market Picks Up

(Bloomberg) -- China Vanke Co.’s sales slump moderated in May, as a thaw in housing market sentiment boosted the state-backed developer that’s become a focus of the nation’s property crisis.

Most Read from Bloomberg

Modi Vows to Stay in Power Even as Party Loses India Majority

Short Sellers in Danger of Extinction After Crushing Stock Gains

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

How Billionaires Bought 70% of Detroit’s Offices and Transformed the City

NYSE Fixes Issue That Showed 99% Drops, Triggered Trading Halts

The value of homes sold gained 11.5% last month from April to 23.3 billion yuan ($3.2 billion), the Shenzhen-based company said. From a year earlier, sales dropped 29.3%, narrowing for a third month.

Shares of Vanke jumped as the figures added to signs that China’s real estate slump is abating after the central government rolled out its most forceful rescue package to halt the three-year downturn. Shenzhen is among cities that have followed through by lowering downpayment ratios and minimum mortgage rates.

Vanke’s month-on-month improvement in home sales surpassed the 3.4% increase at the 100 biggest real estate companies tracked by China Real Estate Information Corp.

Shares of Vanke climbed as much as 7.4% on Tuesday morning in Hong Kong, extending gains from an April low to 56%. Its longer-dated bonds also advanced, with a 3.5% note due 2029 up 1.2 cents to 63.8 cents.

Still, the pickup in sales hasn’t been strong enough to ease a cash crunch at Vanke, which has been raising funds to calm investors’ concerns over its liquidity strains. The developer is in advanced talks with major banks for a loan of about 50 billion yuan, people familiar with the matter told Bloomberg last month.

“Vanke’s liquidity challenges are set to persist as long as its contracted sales shortfall continues,” Bloomberg Intelligence property analyst Kristy Hung wrote in a Monday note. “A fundamental recovery in sales is needed to improve the odds of staying solvent through 2025.”

Most Read from Bloomberg Businessweek

The Budget Geeks Who Helped Solve an American Economic Puzzle

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

Disney Is Banking On Sequels to Help Get Pixar Back on Track

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance