Chinese autonomous driving firm Minieye, backed by Alibaba CEO, files for Hong Kong IPO

Chinese autonomous driving firm Minieye Technology, backed by Alibaba Group Holding CEO Eddy Wu Yongming, has submitted to go public on the Hong Kong stock exchange, becoming the latest mainland self-driving tech firm looking to float on the city's bourse.

The company had gone through at least 17 rounds of fundraising before submitting its prospectus on May 27. It is looking to raise US$150 million, the International Financial Review reported. The company has not revealed a target valuation, saying only that it has exceeded the HK$4 billion (US$512 million) market capitalisation required at the time of listing.

Wu - a co-founder of Alibaba, owner of the South China Morning Post - is among the company's most high-profile backers. He holds a 2.3 per cent stake in the company, after transferring shares valued at 30.6 million (US$4.2 million) yuan in 2019, four years after his 4.5 million yuan angel investment, according to the prospectus.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

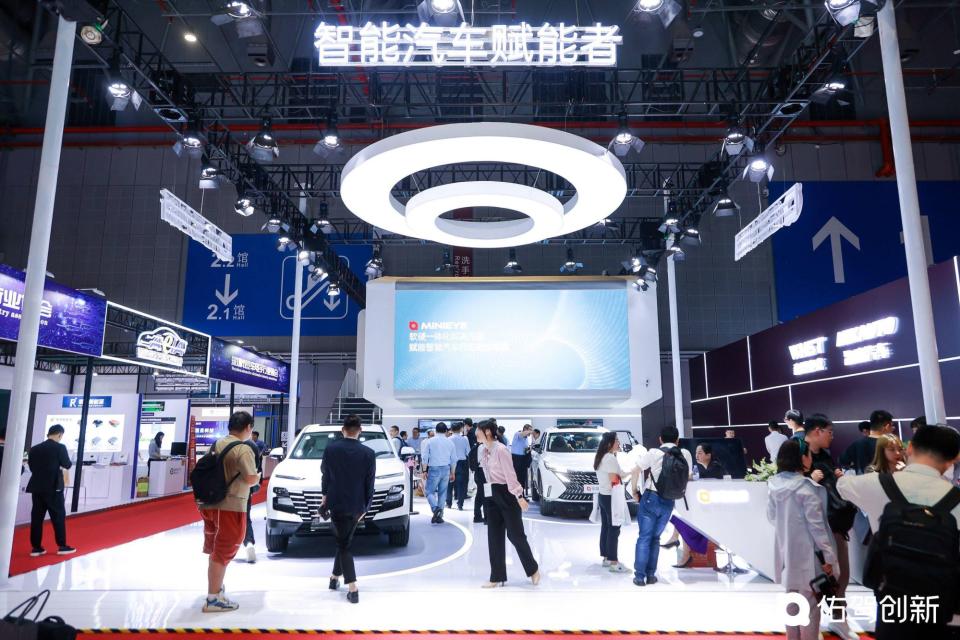

A Minieye Technology display at the Shanghai International Automobile Industry Exhibition in 2023. Photo: Handout alt=A Minieye Technology display at the Shanghai International Automobile Industry Exhibition in 2023. Photo: Handout>

The start-up's corporate backers include investment houses such as Beijing Siwei Management, Shenzhen Zeyi, and China International Capital.

Founded in 2014 by entrepreneur Liu Guoqing, who earned a PhD in computer science from Nanyang Technological University in Singapore in 2013, Minieye has supported 29 carmakers with autonomous driving solutions up to Level 2 - meaning the system is able to control steering and acceleration but requires driver monitoring, similar to Tesla's Autopilot.

Last year, Minieye sold more than 780 million of its intelligent driving solutions.

Company revenue reached 476 million yuan last year, growing at a compounded annual rate of 64.9 per cent over three years. Revenues were 279 million yuan and 175 million yuan in 2022 and 2021, respectively.

However, the company has yet to turn a profit after a decade in operation. It saw 139 million yuan in losses last year, an improvement over the 221 million yuan and 207 million yuan lost in 2022 and 2021, respectively.

As the company prepares to go public, it has been reducing research and development expenditures as a proportion of revenue.

The 150 million yuan it spent on R&D last year was up nearly 8 per cent from the 139 million yuan spent the year before, falling to 31.5 per cent of revenue compared with 49.9 per cent in 2022. R&D spending was 82.2 million yuan in 2021, or 46.9 per cent of revenue, according to the prospectus.

Hong Kong has proven to be an attractive destination for autonomous driving firms on the mainland looking to gain access to international markets. iMotion Automotive Technology, based in Suzhou just west of Shanghai, was the first Chinese automated driving company to list on the Hong Kong exchange in December.

Since then, other related firms in the world's largest car market have looked south for their initial public offerings. These include Beijing-based Horizon Robotics, autonomous driving chip maker Black Sesame Technologies and Shanghai-based Zongmu Technology.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance