Chinese Ride-Hailing Giant Didi Boasts $14 Billion Value, One Year After NYSE Delisting

(Bloomberg) -- A delisting from the US Big Board often marks the end of a company’s traction with big investors. For Didi Global Inc., the story couldn’t be more different.

Most Read from Bloomberg

Hedging Failure Exposes Private Equity to Interest-Rate Surge

These Are World’s Most Expensive Cities for High-Class Living

Forty Hours of Oxygen Left for Titanic Vessel That’s Missing

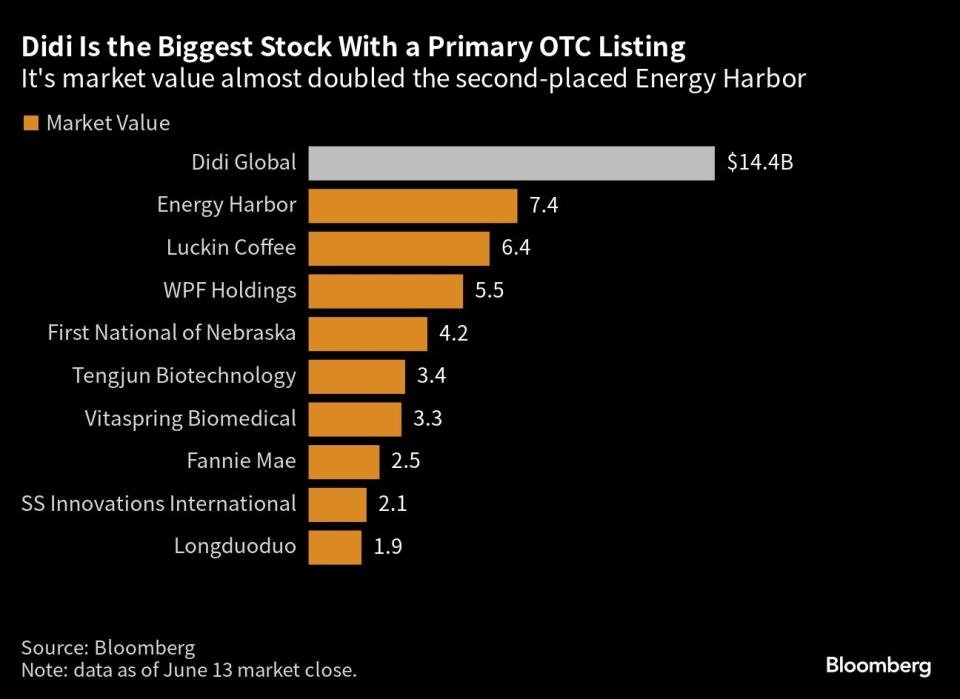

One year after its exit from the New York Stock Exchange following Beijing’s tech crackdown, the Chinese ride-hailing giant boasts a market value around $14 billion as of Tuesday’s close. That’s larger than any other firm whose shares are primarily quoted over-the-counter in the US, and even puts it in the top 11% of NYSE-listed firms, when including American Depositary Receipts, data compiled by Bloomberg show.

The stock still appeals to some seasoned institutional investors, even though its delisting from the NYSE forced many others to dump positions. Davis Selected Advisers’ $6.1 billion New York Venture Fund, Macquarie Group’s $5 billion Delaware Emerging Markets Fund and France’s Carmignac are among those holding Didi, according to filings at the end of May. The funds declined to comment.

Such a lineup is rare for companies traded on OTC markets, which are home to thousands of tiny firms unable to meet listing requirements of main exchanges. OTC trading tends to be dominated by retail investors due to the heightened market volatility and limited transparency. But Didi has bucked that trend, partly because it has indicated a plan to list in Hong Kong, which would likely lure investors and buoy the shares.

“Many people have bought or held on to Didi expecting that it will relist in Hong Kong at some future date,” said Jason Hsu, chief investment officer at Rayliant Global Advisors in Hong Kong. “It really is much too large and too successful to be on the OTC.”

Read more: Didi’s Move From NYSE to Hong Kong — What to Know: QuickTake

The firm was at the heart of Beijing’s clampdown on the internet industry. Regulators launched a cybersecurity review days after its US public market debut in 2021. The country’s officials asked Didi to delist from the US on data security fears, Bloomberg reported in late 2021. It moved to OTC trading on June 13 last year after 11 months on the NYSE, and China fined the company $1.2 billion in July 2022.

Out of the spotlight, the poster child of regulatory scrutiny has outperformed. The stock has gained almost 20% since dropping off the NYSE, while the Nasdaq Golden Dragon Index — a gauge of US-listed Chinese stocks — is roughly flat. Hong Kong’s Hang Seng Index is down about 8% in that period.

Didi has maintained a roughly 70% share in China’s ride-hailing market, even though it couldn’t enroll new users or recruit new drivers to its platform for a year and a half, Atlantic Equities analyst Sophie Xiao said in a text message.

Its main competitor, Amap – a subsidiary of Alibaba Group Holding Ltd. – operates as an aggregator and doesn’t have full control over driver or vehicle supply. That has slowed its expansion, Xiao said. Another rival, Meituan, curtailed its ride-hailing ambitions in March.

“Didi has been surprisingly resilient,” Xiao said. “Its current share price does not reflect the value of the underlying business, primarily due to the regulatory overhang from July 2021.”

2023 Swings

After rallying following China’s Covid reopening in January, Didi shares have declined nearly 40% from a peak that month amid a waning economic rebound.

Still, investors are on the lookout for a Hong Kong listing, though the company hasn’t offered a concrete timeline. The move will allow existing shareholders to convert their holdings and would attract new investors.

A Didi representative didn’t respond to an emailed request for comment.

In January, Didi’s main apps returned to China’s biggest mobile stores, paving the way for the company to resume business as usual, and to eventually work toward a Hong Kong listing.

“I would not be surprised that when the timing is right, Didi will seek re-listing in HK,” Rayliant’s Hsu said. “All it would take would be a rally in Hong Kong Stock Exchange for China shares.”

--With assistance from Matt Turner, Hideyuki Sano and April Ma.

Most Read from Bloomberg Businessweek

Final Fantasy XVI Shows Off Square Enix’s Skill at Reinvention

How Many People Does It Take for the Government to Send a Text?

It’s Brutal to Get to the Ocean’s Depths. This Minisub Will Take You There

Private Credit’s Quiet, Unstoppable Rise Comes With Unknown Risk

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance