Chongqing Rural Commercial Bank And Two More Top Dividend Stocks To Consider

Amidst a backdrop of mixed global economic signals, the Hong Kong market has shown resilience with the Hang Seng Index ticking upwards in a holiday-shortened week. This stability, coupled with current economic conditions, makes it an opportune time to consider dividend stocks which can offer potential steady income and lower volatility.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 8.00% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.37% | ★★★★★★ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.97% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 8.27% | ★★★★★☆ |

Chongqing Rural Commercial Bank (SEHK:3618) | 7.89% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.43% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 9.33% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.26% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.21% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.35% | ★★★★★☆ |

Click here to see the full list of 89 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

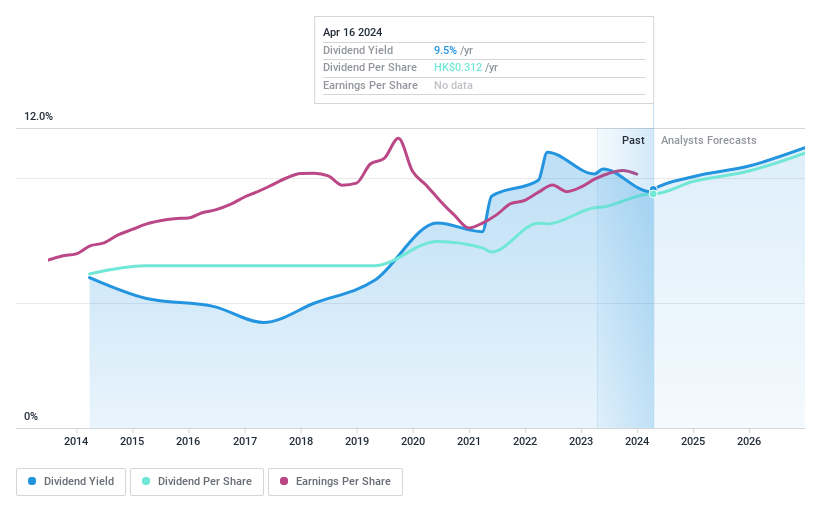

Chongqing Rural Commercial Bank

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Rural Commercial Bank Co., Ltd. operates primarily in the banking sector within the People's Republic of China, with a market capitalization of approximately HK$58.63 billion.

Operations: Chongqing Rural Commercial Bank Co., Ltd. generates its revenue primarily from banking services within the People's Republic of China.

Dividend Yield: 7.9%

Chongqing Rural Commercial Bank declared a 2023 dividend of RMB 0.2885 per share, totaling RMB 3.28 billion, reflecting a stable payout with a recent increase approved at their AGM. Despite a slight decline in net income and interest income in Q1 2024, the bank maintains a low payout ratio (32.1%), suggesting sustainability in its dividend payments. The bank's dividends are well-covered by earnings, with forecasts indicating continued coverage over the next three years (28.9% payout ratio).

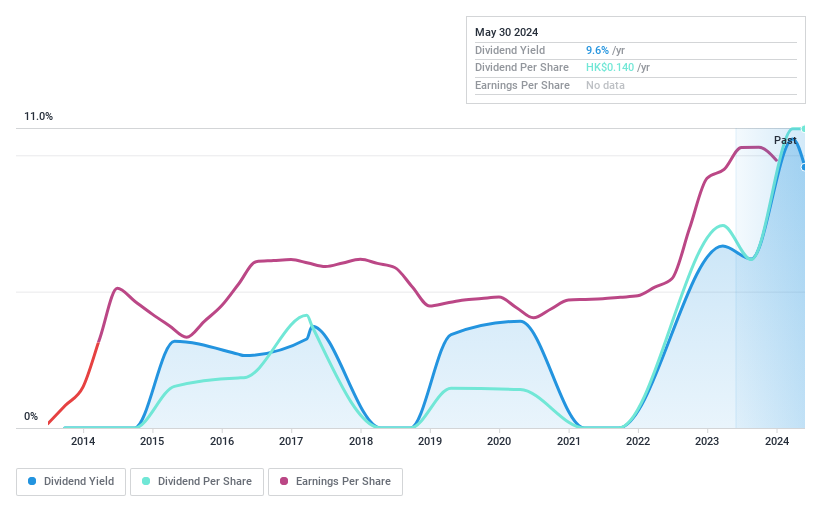

Leoch International Technology

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leoch International Technology Limited operates as an investment holding company focused on power solutions and recycled lead, serving regions including Mainland China, Europe, the Middle East, Africa, the Americas, and the Asia-Pacific, with a market capitalization of approximately HK$2.32 billion.

Operations: Leoch International Technology Limited generates CN¥13.47 billion primarily from the manufacture, development, and sale of lead-acid batteries and related items.

Dividend Yield: 8.2%

Leoch International Technology has shown a mixed performance in its dividend offerings, with a history of volatility over the past 9 years and recent reductions, such as the final dividend of 7 HK cents per share for 2023 approved at its AGM. Despite this, its dividends are well-covered by earnings and cash flows, with payout ratios of 25.4% and 54.5% respectively. The company's stock is trading at a significant discount to estimated fair value, suggesting potential undervaluation.

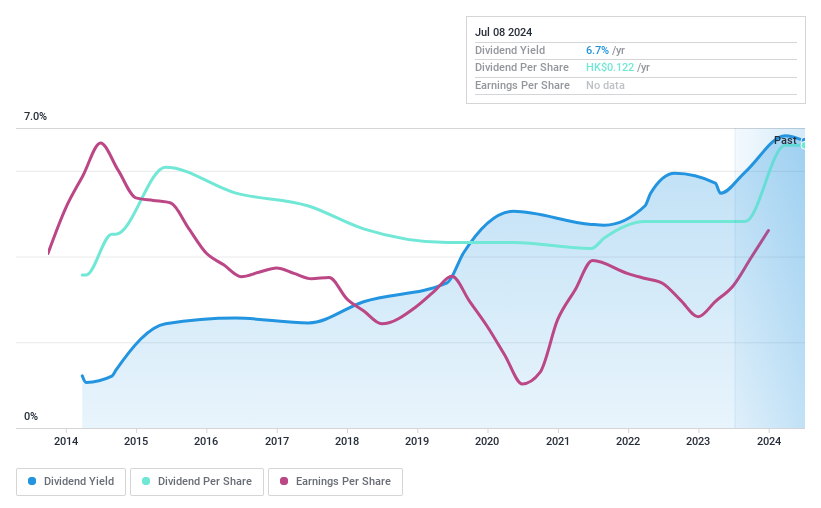

Tianjin Development Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tianjin Development Holdings Limited operates in the People's Republic of China, providing water, heat, thermal power, and electricity within the Tianjin Economic and Technological Development Area, with a market capitalization of approximately HK$1.96 billion.

Operations: Tianjin Development Holdings Limited generates revenue primarily from its utilities segment, which brought in HK$1.60 billion, followed by the pharmaceuticals at HK$1.44 billion, with additional income from hotel operations and electrical and mechanical services totaling HK$130.38 million and HK$166.77 million respectively.

Dividend Yield: 6.7%

Tianjin Development Holdings recently increased its dividend to HK$0.088 per share, reflecting a commitment to shareholder returns despite challenges in covering these payments with earnings and cash flows. The company's dividend yield stands at 6.69%, which is below the top tier in Hong Kong's market, and financial results have been affected by significant one-off items. However, dividends have shown stability over the past decade, supported by a low payout ratio of 20.7%.

Summing It All Up

Gain an insight into the universe of 89 Top Dividend Stocks by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:3618 SEHK:842 and SEHK:882.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance