Is Cigna (CI) Nearing a Medicare Advantage Divestment Deal?

The Cigna Group CI is reportedly in advanced talks to divest its Medicare Advantage business. Per a Wall Street Journal report, Health Care Service Corporation is expected to acquire the business from Cigna in a deal that can be valued at $3-$4 billion. Shares of CI fell 2.1% yesterday.

The potential acquirer, Health Care Service Corporation, is a Blue Cross Blue Shield licensee in five states, including Illinois and Texas. An announcement regarding the deal is expected to be made within the coming days. Last month, a similar news was reported by Bloomberg, where Health Care Service Corporation had competition from Elevance Health, Inc. ELV in the bidding process.

Cigna’s intention to sell its Medicare Advantage business follows the reported breakdown of its merger discussions with Humana Inc. HUM due to disagreements over pricing. As outlined in a Wall Street Journal report, the companies had explored a potential cash-and-stock deal, sparking both investor interest and concerns. The complexities involved, including anticipated regulatory scrutiny, contributed to the challenges in reaching an agreement.

Later, Cigna announced its intention to explore "value-enhancing divestitures" and evaluate bolt-on acquisition opportunities. It also disclosed an increase of $10 billion to its share buyback program, with the goal of buying back at least $5 billion worth of shares by the 2024 first half-end.

The company’s Medicare Advantage membership reached around 599,000 at third quarter-end, across 29 states, per reports. Although the business presents a growth opportunity for companies, as evident from larger operators, Cigna has a comparatively lower share of the market. In 2022, it witnessed around 6% year-over-year decline in premium revenues from the business.

On the flip side, CI’s commercial and pharmacy benefits businesses contribute heavily toward its revenues. In 2018, the company strengthened its pharmacy benefits operations with the Express Scripts acquisition.

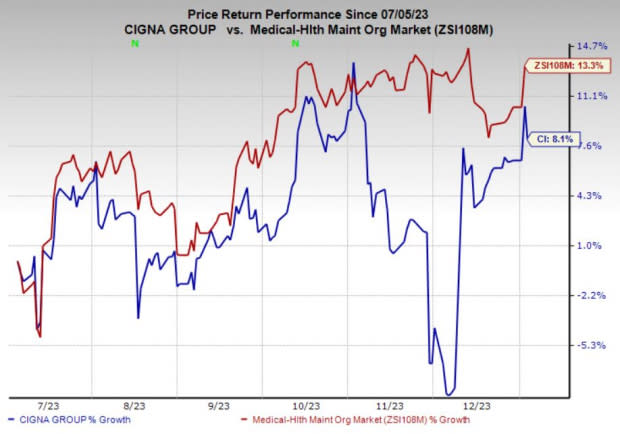

6-Month Price Performance

Shares of Cigna have gained 8.1% in the past six months compared with the 13.3% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank and A Key Pick

Cigna currently has a Zacks Rank #3 (Hold).

A better-ranked stock in the medical space is The Joint Corp. JYNT, which carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for The Joint’s 2023 full-year earnings indicates a 50% year-over-year increase to 12 cents per share. The estimate remained stable over the past week. The consensus mark for JYNT’s 2023 full-year revenues indicates 14.5% growth from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Humana Inc. (HUM) : Free Stock Analysis Report

Cigna Group (CI) : Free Stock Analysis Report

The Joint Corp. (JYNT) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance