Cineworld among 10 most shorted UK stocks

Cineworld Group (CINE.L) is the UK’s most shorted company as of 13 November, according to research by ETF provider GraniteShares published on Thursday.

The company said 9.51% of Cineworld’s stock was held short by 10 investment firms, with Adelphi Capital LLP having the largest short position with 2.07% of the company’s shares.

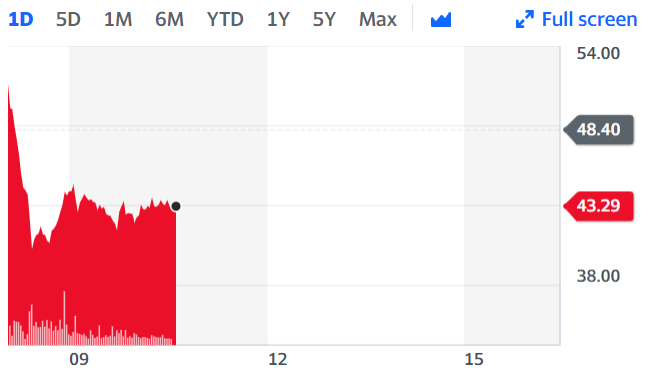

Cineworld has been trading 10.7% lower at around 10.50am in London.

“Fuelled by a number of factors including the Coronavirus crisis and the US election, we have seen some of the highest levels of market volatility for years,” said Will Rhind, founder and CEO of GraniteShares.

“Many sophisticated investors and traders have used this to try and generate returns from large shifts in the price of individual stocks.”

Travel and leisure businesses have seen wild market swings over the past year as COVID-19 cases have been rising, and in the face of UK’s two lockdowns.

This is particularly the case with Cineworld, which has suffered as customer avoid visiting theatres to watch films.

READ MORE: European markets open weaker as COVID-19 cases and fatalities keep rising

“There is no sign that the heightened levels of volatility that we have seen this year will dissipate any time soon, said Rhind. “Investors’ response to news is rapid, think of the price moves we saw on the back of the Pfizer (PFE) vaccine announcement on 9 November. There are any number of potential catalysts for the next move up or down, whether it is an EU-UK trade deal, yes or no, the smoothness of the US presidential transition, or potentially the impact of Tesla’s addition to the S&P 500 in December.”

After Cineworld, the next most shorted UK-listed company was Premier Oil PLC (PMO.L), whose short position was 9.14%, following by Tullow Oil PLC (TLW.L) and Petrofac LTD (PFC.L).

In terms of which fund managers had the most short positions on these UK-listed companies, the analysis revealed BlackRock Investment Management (UK) Limited had the highest number with 23. It was followed by GLG Partners LP, AQR Capital Management LLC, Marshall Wace LLP and Citadel Europe LLP with 22, 13, 12 and 11 short positions, respectively.

WATCH: Cineworld in talks with AlixPartners to discuss $8bn debt

Yahoo Finance

Yahoo Finance