Citigroup (C) Expands Footprint in Japan With New CCB Unit

As part of Citigroup Inc.’s C broader strategy, it has launched Citi Commercial Bank (CCB) in Japan with an aim to expand its commercial banking in key growth areas across certain clusters. This launch follows CCB’s introduction in France and Ireland in 2023, preceded by its launch in Germany, Switzerland and Canada in 2022.

C’s existing banking capabilities, which assist large Japanese corporations and worldwide multinational corporations operating in Japan, are enhanced by the new launch. Citi will support and cater to the daily demands, cross-border requirements and growth aspirations of mid-sized corporates in Japan through CCB. Citigroup's CCB unit provides a wide range of products and solutions tailored to meet client’s specific needs. These include trade and working capital, treasury and liquidity management, global markets capabilities, capital markets solutions and advisory services.

With its latest launch in Japan, Citigroup’s commercial banking business now operates in 12 Asian markets, which include Australia, mainland China, Hong Kong, India, Indonesia, Malaysia, Singapore, South Korea, Taiwan, Thailand and Vietnam.

Gunjan Kalra, head of Japan, Asia North & Australia, and Asia South for Citi Commercial Bank, said, “Citi is dedicated to supporting mid-sized companies with their growth journey. Playing to our strengths through our global network, Citi is well positioned to support the business ambitions of these companies. Our expansion into Japan reaffirms our commitment to serving the Japanese market and its companies and underlines the importance of the market for our global commercial banking strategy.”

Marc Luet, cluster and banking head, Japan, Asia North and Australia, stated, “With the launch of the CCB in Japan, we are pleased to be able to offer these clients the same capabilities that Citi offers the world’s largest companies, customized to their specific needs.”

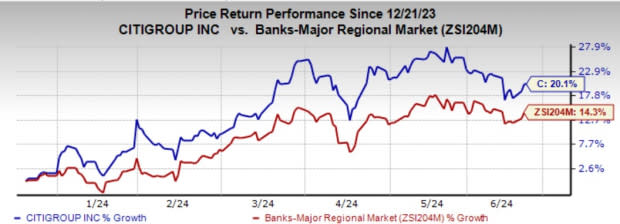

Over the past six months, shares of C have gained 20.1% compared with the industry’s growth of 14.3%.

Image Source: Zacks Investment Research

Currently, Citigroup carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Finance Firms Expanding in Japan

KKR & Co. Inc. KKR is looking to enter into the private credit market in Japan to offer an alternative to bank loans. This will strengthen its foothold in Japan.

KKR intends to expand its offerings to institutional investors and high-net-worth individuals within the country. It is currently engaged in discussions with domestic securities companies to offer products for individual investors. It already operates as a joint venture asset management company with SBI Holdings Inc. KKR will offer enhanced accessibility to its funds to institutional investors.

BlackRock Inc.’s BLK Japan unit plans to boost its investment offerings to cater to the needs of overseas clients. This move aligns with the company’s organic growth strategy of product expansion.

Hiroyuki Arita, CEO of BLK Japan, said in an interview with Bloomberg that since last year, the company has increased the headcount of portfolio managers, analysts and other personnel associated with active management of Japan equities by roughly 20% in order to attract foreign funds.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance