Citigroup (C) to Sell Its Consumer Wealth Business to HSBC

Citigroup C announced that it has agreed to sell its China-based onshore consumer wealth portfolio to HSBC Holdings plc HSBC. The completion of the deal is expected in the first half of 2024. The terms of the transaction were not disclosed.

As a result of the sale, C will transfer assets under management and deposits worth approximately $3.6 billion to HSBC Bank China.

In December 2022, Citigroup announced that it would wind down its consumer banking business in China. This strategic move is in line with its broader strategic revamp to discontinue its consumer banking operations in 14 markets across Asia, the Middle East, Europe and Mexico.

Though Citigroup will exit its consumer wealth business in China, it will retain its institutional businesses where it has a preeminent position. It will continue to cater to the needs of ultra-high net worth clients of China via its regional wealth centers in Singapore and Hong Kong, through its International Personal Bank and Citigroup’s Private Bank operations.

As of now, Citigroup has divested eight markets, namely Australia, Bahrain, India, Malaysia, the Philippines, Taiwan, Thailand and Vietnam.

C is ahead of its plan to sell its consumer banking business in Indonesia toward the end of 2023. Furthermore, its plan to exit consumer business in South Korea and its overall presence in Russia are in progress. It has also declared its intention to proceed with the initial public offering of its consumer, small business and mid-market banking operations in Mexico.

Such exits will free up capital and help the company pursue investments in wealth management operations in Singapore, Hong Kong, the UAE and London to stoke growth. In fact, the company anticipates the release of roughly $12 billion (in aggregate) of allocated tangible common equity over time from such market exits. These efforts will likely help augment its profitability and efficiency over the long term.

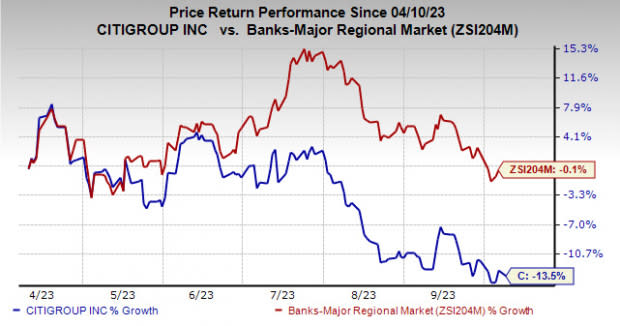

Over the past six months, shares of C have declined 13.5% compared with the industry’s fall of 0.1%.

Image Source: Zacks Investment Research

Citigroup currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inorganic Efforts by Other Finance Firms

Wells Fargo & Company WFC divested around $2 billion of private equity investments in certain funds to a group of leading investors. The move demonstrates the bank’s active investment portfolio management strategy.

Particularly, WFC sold its investment in Norwest Equity Partners and Norwest Mezzanine Partners to a buyer group, including AlpInvest Partners, Atalaya Capital Management, Lexington Partners and Pantheon.

WFC was the only institutional limited partner in these funds. Nonetheless, the company will continue its relationship and investments with venture capital and growth equity investment firm, Norwest Venture Partners.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance