CLOs Have Too Much Money and Are Running Out of Things to Buy

(Bloomberg) -- The $1.3 trillion collateralized loan obligation market is about to become a victim of its own success because managers can’t create the bonds fast enough to meet demand and are running out of things to buy.

Most Read from Bloomberg

Justice Department to Charge Boeing, Seeks Guilty Plea from Planemaker

France’s Market Rally Falters as Investors See Enduring Risk

Trump as President or Private Citizen: Why Supreme Court’s Immunity Ruling Is a Test

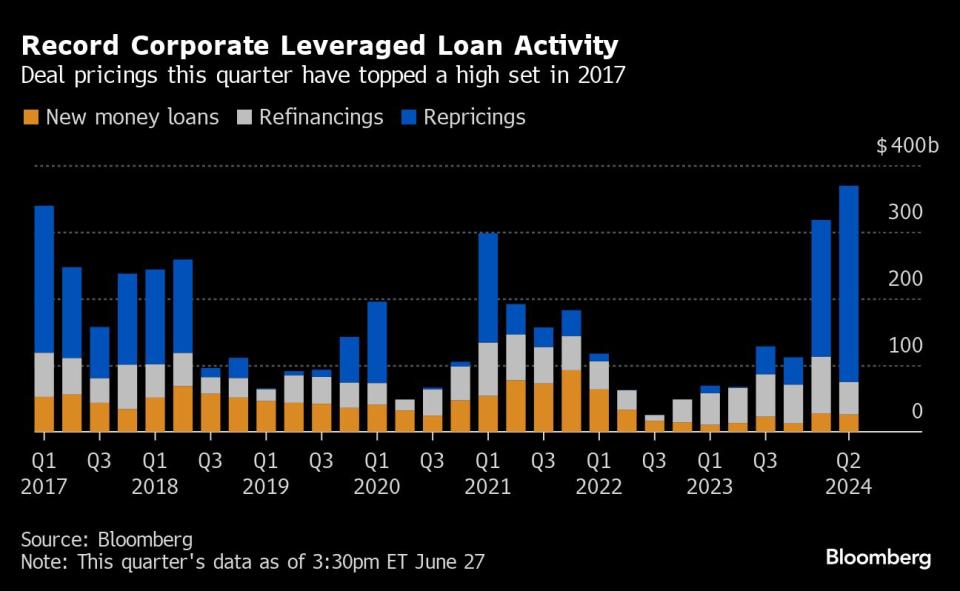

A slowdown in mergers and acquisitions after borrowing costs rose is continuing to deprive the lenders of the leveraged loans that the industry was built on. About $311 billion of M&A deals have been announced and completed so far this year, roughly $1 trillion below the same level two years ago when interest rates began to rise, according to data compiled by Bloomberg.

That may soon end up impacting the equity arbitrage — the gap between the yields that CLO managers can earn on the loans they buy and the bonds they sell — which may hurt new issuance in the coming months. It’s also sent more managers into the secondary market, where about 60% of loans now trade above par, making it that much harder to find bargains to put together a portfolio.

“There’s too much demand for CLO bonds and too little loan supply. CLO managers can’t keep up much longer,” said Pratik Gupta, who leads CLO research at Bank of America Corp. “It’s becoming a challenge.”

Demand for the safest CLO tranches soared this year after an influx of money into exchange-traded funds. Banks have also been piling into the AAA bonds, and some Japanese institutions may scoop up more of the debt. On top of that, Bank of America estimates that about $64 billion of the debt has been paid back so far this year, including amortizations and called CLOs, meaning asset owners have more capital to put to work.

“If you’re an existing investor, you’re getting so much money in the door that’s creating demand in and of itself,” said Amir Vardi, a managing director at UBS Asset Management, at the Global ABS conference in Barcelona earlier this month, referring to amortizations and called CLOs.

“Forget about increasing the budget to get more,” he said on a panel. “You’re just trying to keep what you have invested.”

Demand is so strong that even an 86% increase so far this year in US sales of new issue CLO bonds from the same period in 2023 hasn’t been enough to sate investors’ appetite. As a result, spreads on the AAA debt have compressed by more than 100 basis points over the benchmark since late 2022, when the tranches were reaching eye-popping levels that made equity returns unattractive for investors.

Click here for a podcast about how BlackRock is seeing opportunity in commercial mortgage-backed securities.

Lenders are also trying to circumvent the dearth of paper by increasing their holdings of corporate bonds — both investment-grade and junk — in an attempt to preserve arbitrage returns, Gupta said. The rise of private credit is also crimping opportunities for leveraged loan lenders by winning business from them, even as Barclays Plc forecasts M&A volume to grow by as much as 20% over the next 12 months.

“The supply and demand balance is out of whack, it’s become more difficult to find assets at attractive levels,” said Christina O’Hearn, portfolio manager for the leveraged loan and CLO business at Pretium Partners. “We expect to see continued refi and reset activity but not as many new issue CLOs.”

Week in Review

The Federal Reserve’s rate hike campaign is boosting corporate bonds in an unexpected way, as investors plow coupon payments back into the market.

The AI revolution is increasingly being funded in a little-watched part of the debt market, where sales of bonds backed by data centers and fiber-optic cables are soaring.

A recent deluge of cash into ETFs tracking US collateralized loan obligations is spurring money managers to try to replicate the model in Europe.

Political divisions rocking France threaten a successful credit trade: buying European corporate bonds over their US counterparts.

French companies are rushing to secure funding ahead of any potential disruptions following the first round of parliamentary elections.

Banks led by Goldman Sachs Group Inc. have launched one of the largest leveraged loan deals this year to refinance BMC Software’s upcoming maturities.

Spanish football club Real Betis Balompie SAD is nearing an agreement to refinance its €120 million ($128 million) debt in a deal arranged by Goldman Sachs Group Inc.

Carlyle Group Inc. and Goldman Sachs Private Credit have lent a $1.1 billion payment-in-kind note to fund administrator Apex Group.

Middle East lenders — flush with deposits as oil revenue buoys the region — are chasing ever-bigger deals, often offering terms that Wall Street banks can’t compete with.

D.E. Shaw is raising its second fund in roughly 16 months to invest in the synthetic securitizations banks issue to manage their capital requirements, one of the hottest asset classes on Wall Street.

The $1.7 trillion private-lending industry is still “in batting practice” before it swells to a $25 trillion market, according to one of its powerhouses, Blackstone Inc.

Basic Fun Inc., a seller of children’s products including Lincoln Logs and Tinker Toys, filed for Chapter 11 bankruptcy.

On the Move

A pair of Barclays Plc bankers that work on significant risk transfers, namely Charles Langsford and Matthew Carson, are leaving.

Apax has hired Derek Jackson from Canada Pension Plan Investment Board to head its credit strategy in Europe and North America.

Mizuho Financial Group Inc. is hiring more bankers to capitalize on its recent acquisition of Greenhill & Co. and take advantage of a gradual rebound in mergers and acquisitions.

S&P Global Inc. named Martina Cheung, the president of its credit ratings division, as its next chief executive officer.

Abu Dhabi Investment Council has recruited Michael Phillips as head of corporate credit.

Malay Patel, a collateralized loan obligations and structured credit investor at D.E. Shaw, has left the hedge fund.

Citi named David Bailey as head of debt capital markets in Australia and New Zealand.

HSBC has appointed Nour Safa as head of Middle East and North Africa debt capital markets.

--With assistance from Charles Williams and Kevin Kingsbury.

Most Read from Bloomberg Businessweek

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

The FBI’s Star Cooperator May Have Been Running New Scams All Along

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance