CMS Energy (CMS) Rewards Shareholders With 6% Dividend Hike

CMS Energy Corporation CMS recently announced that its board of directors approved a hike in its quarterly dividend to 48.75 cents per share, reflecting an increase of 6% from the prior payout.

With the current hike, the company will now pay out an annual dividend of $1.95 per share. This represents an annual dividend yield of 3.06% based on its share price worth as of Feb 2. However, the annualized dividend yield is less than the industry’s yield of 3.14% but higher than the Zacks S&P 500 composite’s yield of 1.52%.

This signifies CMS Energy’s business strength and ability to generate enough cash flow to reward shareholders with an improved dividend rate.

Will CMS Energy Sustain Dividend Hikes?

The increase in the dividend payout is backed by strength in the business, which enables the company to register growth in earnings and sales. Hence, it is imperative to mention that CMS recorded a 27.7% increase in its earnings in the last reported quarter, while sales recorded a growth rate of 12.1% from the previous year’s reported figure. Such strong numbers must have encouraged a rise in the dividend payout for shareholders.

The ability to distribute excess cash to shareholders is underpinned by a company’s strategy to enhance its business structure through healthy capital investments. CMS Energy boasts a solid capital expenditure program, under which it plans to spend $15.5 billion on infrastructure upgrades and replacements and electric supply projects from 2022 to 2027, reflecting an increase of $1.2 billion from the previously planned capital expenditure.

Such an ambitious capital investment plan should enable the company to achieve its long-term earnings growth rate in the range of 6%-8%. Backed by a strong earnings growth rate, the company targets to increase dividend payouts to its shareholders in the band of 6%-8%.

In light of the aforementioned factors, one may safely conclude that CMS Energy may continue to reward shareholders with impressive hikes going forward.

Peer Moves

Buoyed by a steady performance and regulated income, utilities tend to consistently pay out dividends to their shareholders and hike dividend payouts. With that being said, apart from CMS Energy, utilities that have hiked the dividend rate to show business strength are as follows:

In December 2022, PNM Resources PNM increased the company's annual dividend payout by $0.08, which is a 5.8% increase. This represents an annual dividend rate of $1.47 per share of the common stock.

PNM has a long-term earnings growth rate of 4.2%. Shares of PNM Resources have delivered 7.8% in the past year.

In July 2022, Duke Energy DUK increased the quarterly cash dividend on its common stock by 2 cents per share to $1.005 per share. Duke Energy has paid out a cash dividend on its common stock for 96 consecutive years.

Duke Energy boasts a long-term earnings growth rate of 5.5%. DUK shares have increased 9.9% in the past three months.

In October 2022, American Electric Power AEP increased its quarterly cash dividend by 5 cents per share to 83 cents per share. This was the company's 450th consecutive quarterly cash dividend.

AEP’s long-term earnings growth rate is pegged at 6.1%. American Electric Power’s shares have risen 6.6% in the past year.

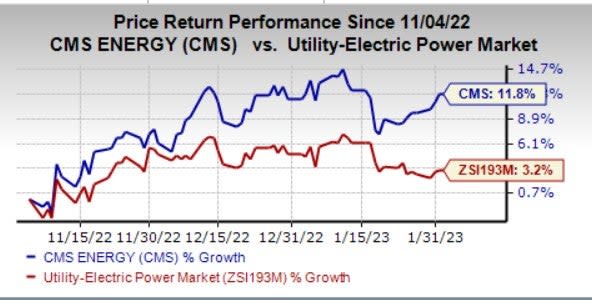

Price Movement

In the past three months, shares of CMS Energy have risen 11.8% compared with the industry’s growth of 3.2%.

Image Source: Zacks Investment Research

Zacks Rank

CMS Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

PNM Resources, Inc. (PNM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance