Columbia Financial Inc (CLBK) Faces Headwinds as Earnings Dip in Q4 and Full Year 2023

Quarterly Earnings: Net income for Q4 2023 stood at $6.6 million, a 70% decrease from Q4 2022.

Annual Earnings: Full-year net income reached $36.1 million, down 58.1% from the previous year.

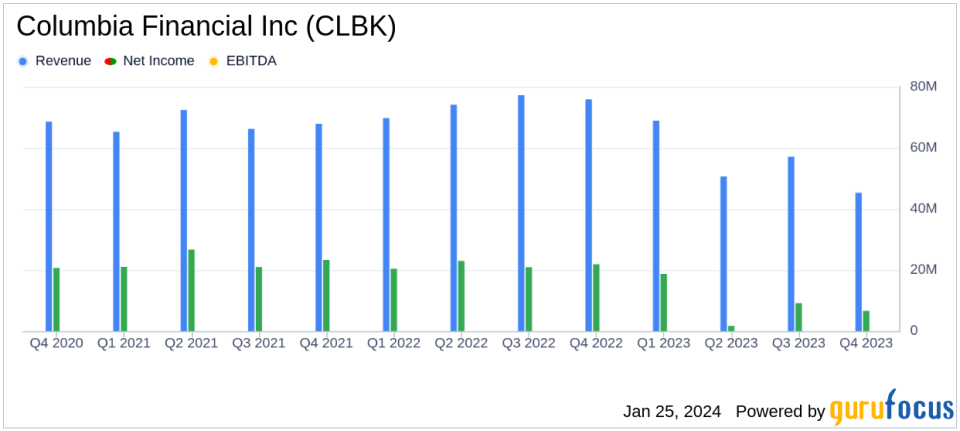

Net Interest Income: Q4 net interest income fell by 33.7% to $45.3 million, and annual net interest income decreased by 22.8% to $205.9 million.

Net Interest Margin: Q4 net interest margin contracted by 106 basis points to 1.85%, reflecting higher costs of liabilities.

Asset Quality: Non-performing loans increased to 0.16% of total gross loans as of December 31, 2023.

Stock Repurchase: CLBK repurchased 4,242,693 shares at a cost of $80.5 million in 2023.

Columbia Financial Inc (NASDAQ:CLBK) released its 8-K filing on January 25, 2024, revealing a challenging fiscal year marked by a significant decrease in net income for both the fourth quarter and the full year ended December 31, 2023. The federally chartered savings bank, which operates through Columbia Bank and Freehold Bank, reported a net income of $6.6 million, or $0.06 per basic and diluted share, for Q4 2023, a stark contrast to the $21.9 million, or $0.21 per basic and diluted share, earned in the same period the previous year. The full-year net income also saw a decline, coming in at $36.1 million, or $0.35 per basic and diluted share, compared to $86.2 million, or $0.82 per basic and $0.81 per diluted share, for the year ended December 31, 2022.

The decrease in earnings was primarily due to a lower net interest income, influenced by an increase in interest expense, a higher provision for credit losses, and higher non-interest expense. These factors were partially offset by higher non-interest income and a lower income tax expense. The bank's net interest margin for Q4 2023 decreased by 106 basis points to 1.85%, compared to 2.91% for the same quarter in the previous year. This margin contraction was a result of the increase in the average cost of interest-bearing liabilities, which outpaced the increase in the average yield on interest-earning assets.

Thomas J. Kemly, President and CEO, commented on the bank's resilience despite the difficult operating environment, emphasizing the strength of the balance sheet, asset quality, liquidity position, and capital. He noted, "This year was uniquely challenging due to a dramatic rise in interest rates, and new industry concerns that emerged from a few bank failures earlier in the year." Kemly remains focused on implementing prudent strategies to mitigate risks and build a foundation for future success and increased profitability.

On the balance sheet, total assets increased by $237.4 million to $10.6 billion as of December 31, 2023. The increase was primarily due to a rise in cash and cash equivalents, loans receivable, net, and Federal Home Loan Bank stock. However, debt securities available for sale saw a decrease of $235.1 million. The bank's non-performing loans totaled $12.6 million, or 0.16% of total gross loans, an increase from the previous year's $6.7 million, or 0.09% of total gross loans.

During 2023, Columbia Financial repurchased shares under its stock repurchase program, buying back 4,242,693 shares at a cost of $80.5 million. As of January 19, 2024, there are 1,106,841 shares remaining to be repurchased under the existing program. The bank's liquidity and capital positions remain strong, with no utilization of the Federal Reserves Bank Term Funding Program and no outstanding borrowings from the Federal Reserve Discount Window as of December 31, 2023.

For value investors, the bank's commitment to maintaining a robust balance sheet and liquidity profile, along with its cautious approach to managing the challenging interest rate environment, may present a stable investment opportunity. However, the significant decrease in net income and the pressure on net interest margins underscore the importance of monitoring the bank's performance and strategic initiatives in the coming quarters.

The annual meeting of stockholders is scheduled for June 6, 2024, where further insights into the company's strategies and outlook may be provided.

Explore the complete 8-K earnings release (here) from Columbia Financial Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance