Compelling Reasons to Hold on to Cigna (CI) Stock for Now

The Cigna Group CI continues to be aided by two solid growth platforms, acquisitions and a solid financial position. A solid 2024 guidance also acts as an additional tailwind for the stock.

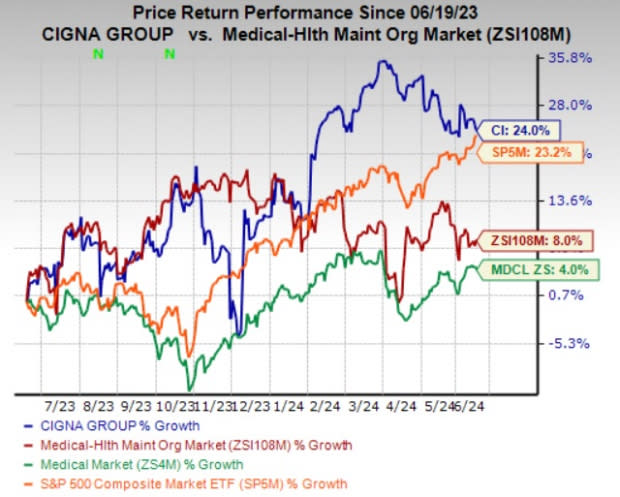

Zacks Rank & Price Performance

Cigna carries a Zacks Rank #3 (Hold), at present.

The stock has gained 24% in the past year compared with the industry’s 8% growth. The Medical sector and the S&P 500 composite index have increased 4% and 23.2%, respectively, in the same time frame.

Image Source: Zacks Investment Research

Favorable Style Score

CI is well-poised for progress, as evidenced by its impressive VGM Score of A. Here, V stands for Value, G for Growth and M for Momentum, and the score is a weighted combination of all three factors.

Robust Growth Prospects

The Zacks Consensus Estimate for CI’s 2024 earnings is pegged at $28.47 per share, indicating an improvement of 13.5% from the year-earlier reading, while the same for revenues is $235.7 billion, implying a 20.7% increase from the prior-year actual.

The consensus mark for 2025 earnings is pegged at $31.97 per share, indicating 12.3% growth from the 2024 estimate. The same for revenues is $245.8 billion, which indicates a rise of 4.3% from the 2023 estimate.

Solid Surprise History

Cigna’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 3.29%.

Optimistic Outlook for 2024

This year, Cigna anticipates adjusted revenues to be a minimum of $235 billion, which indicates growth of at least 20.3% from the 2023 reported figure.

Adjusted earnings per share are expected to be a minimum of $28.40, which implies minimum growth of 13.2% from the 2023 figure.

Growth Drivers

Cigna's performance is bolstered by its two growth platforms: Evernorth and Cigna Healthcare. The Evernorth platform's growth is driven by a suite of specialty pharmacy services, which, in turn, boosts the pharmacy revenues of the parent company. Pharmacy revenues advanced 31% year over year in the first quarter. The unit is projected to witness long-term average annual adjusted income growth between 5% and 8%.

Meanwhile, Cigna Healthcare benefits from a large and expanding customer base in its U.S. Healthcare businesses. Long-term average annual adjusted income growth is estimated within the 7-10% range in the Cigna Healthcare unit, thanks to expanding U.S. Employer, Individual and Family Plans, and International Health businesses.

An increasing customer base leads to higher premiums, the most significant revenue component for a health insurer. As of Mar 31, 2024, Cigna's total medical customers were 19.2 million. An aging U.S. population is expected to sustain strong demand for its Medicare plans in the future.

Alongside premium growth, the Cigna Healthcare unit also benefits from continuous product expansions and new collaborations or contract extensions with well-known healthcare systems.

Cigna strategically acquires businesses to enhance its solutions and capabilities, expand into new regions and strengthen its presence in existing markets. To focus on its high-potential growth platforms, Cigna has divested its non-health units.

A growing cash balance and strong cash generation capabilities enable Cigna to invest in business growth and strategically deploy capital through share repurchases and dividend payments. Over the next five years, management expects CI to generate operating cash flows of around $60 billion.

In February 2024, management approved a 14% increase in the quarterly dividend. Cigna's dividend yield of 1.7% exceeds the industry's average of 1.4%.

Stocks to Consider

Some better-ranked stocks in the Medical space are Bioventus Inc. BVS, Encompass Health Corporation EHC and Lantheus Holdings, Inc. LNTH. While Bioventus sports a Zacks Rank #1 (Strong Buy), Encompass Health and Lantheus carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Bioventus’ earnings surpassed estimates in three of the last four quarters and missed the mark once, the average surprise being 151.67%. The Zacks Consensus Estimate for BVS’ 2024 earnings is pegged at 27 cents per share, which indicates a nearly 14-fold increase from the prior year figure. The consensus mark for revenues implies an improvement of 6% from the prior-year tally. The consensus mark for BVS’ earnings has moved 68.8% north in the past 60 days.

The bottom line of Encompass Health outpaced estimates in each of the trailing four quarters, the average surprise being 18.74%. The Zacks Consensus Estimate for EHC’s 2024 earnings indicates a 12.6% rise while the same for revenues implies an improvement of 10.5% from the respective prior-year tallies. The consensus mark for EHC’s earnings has moved 3.5% north in the past 60 days.

Lantheus’ earnings outpaced estimates in each of the trailing four quarters, the average surprise being 13.61%. The Zacks Consensus Estimate for LNTH’s 2024 earnings indicates a 14.1% rise while the same for revenues implies an improvement of 17.2% from the respective prior-year tallies. The consensus mark for LNTH’s earnings has moved up 8.2% in the past 60 days.

Shares of Bioventus and Encompass Health have gained 95.3% and 30.1%, respectively, in the past year. However, the Lantheus stock has lost 8.8% in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cigna Group (CI) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

Bioventus Inc. (BVS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance