Compx International Inc (CIX) Reports Increased Q4 Earnings and Operating Income

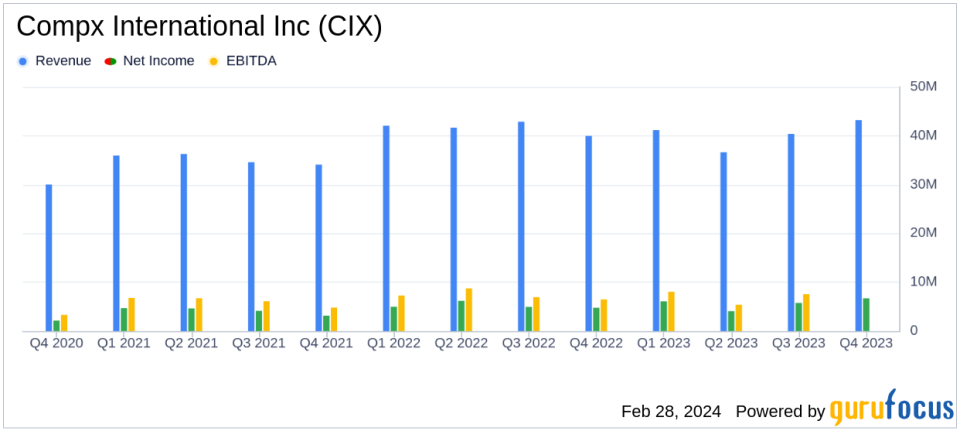

Quarterly Sales: Q4 sales rose to $43.2 million from $40.0 million in the prior year.

Operating Income: Q4 operating income increased to $7.4 million, up from $5.4 million year-over-year.

Net Income: Q4 net income grew to $6.7 million, or $.54 per share, compared to $4.8 million, or $.39 per share, in the same quarter last year.

Annual Performance: 2023 annual net sales saw a slight decrease to $161.3 million from $166.6 million in 2022, while operating income remained stable at $25.4 million.

Earnings Per Share: Annual EPS increased to $1.84 from $1.69 year-over-year.

On February 28, 2024, Compx International Inc (CIX) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a prominent manufacturer of security products and recreational marine components, operates across three locations in the U.S. and employs approximately 555 people. Compx International Inc is engaged in producing mechanical and electrical cabinet locks and other locking mechanisms, with its Security Products segment generating the majority of its revenue, primarily within the United States.

Quarterly and Annual Financial Highlights

Compx International Inc reported a notable increase in sales and net income for the fourth quarter of 2023. The company's sales for the quarter increased to $43.2 million, up from $40.0 million in the same period of 2022. This rise was attributed primarily to higher Security Products sales related to a pilot project for a government security customer, which helped offset a decline in Marine Components sales, particularly to the towboat market.

Operating income for the quarter rose to $7.4 million, compared to $5.4 million in the fourth quarter of the previous year. This improvement was due to higher sales and an improved gross margin percentage in the Security Products segment, despite lower sales and gross margin percentage in the Marine Components segment. Net income for the quarter also saw an increase, reaching $6.7 million, or $.54 per basic and diluted common share, compared to $4.8 million, or $.39 per basic and diluted common share, in the fourth quarter of 2022.

For the full year of 2023, Compx International Inc experienced a slight decrease in net sales, which totaled $161.3 million compared to $166.6 million in the previous year. However, the company maintained a stable operating income of $25.4 million for both years. The annual net income for 2023 was $22.6 million, or $1.84 per basic and diluted common share, an increase from $20.9 million, or $1.69 per basic and diluted common share, for the same period in 2022. The company's ability to maintain operating income levels despite a decrease in annual sales highlights effective cost management and operational efficiency.

Operational and Market Challenges

Despite the positive quarterly results, Compx International Inc faced challenges throughout the year, particularly in the Marine Components segment, which saw decreased sales to the towboat market. However, the company successfully offset these challenges with higher gross margin percentages across both segments, primarily due to lower production costs, and increased Security Products sales to the government security market.

The company's management has indicated that while they are optimistic about the future, there are substantial risks and uncertainties that could impact expected results. These include market volatility and the potential for changes in demand within the industries they serve. Compx International Inc has emphasized its commitment to adapting to these challenges and continuing to deliver value to its shareholders.

Investor Considerations

For value investors and potential GuruFocus.com members, Compx International Inc's latest earnings report presents a mixed but overall positive picture. The company's ability to increase quarterly sales and net income in a challenging market is commendable, and the stable operating income despite a yearly sales dip demonstrates prudent financial management. The increase in earnings per share also suggests that the company is enhancing shareholder value.

Investors may find the resilience of Compx International Inc's Security Products segment particularly noteworthy, as it has been a key driver of the company's financial performance. The segment's success with government contracts could indicate potential for future growth and stability. However, the Marine Components segment's performance serves as a reminder of the importance of diversification and the impact of market-specific factors on overall results.

As Compx International Inc navigates the uncertainties of its operational environment, investors should closely monitor the company's ability to maintain its gross margins and manage costs effectively. The company's strategic decisions in response to market conditions and its continued focus on operational excellence will be critical factors in sustaining its financial health and growth trajectory.

For further details and insights, investors are encouraged to review the full 8-K filing and consider the implications for their investment strategies.

Explore the complete 8-K earnings release (here) from Compx International Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance