Consumer Spending Is Fueling Visa's Growth

Visa Inc. (NYSE:V) is one of the largest companies in the financial sector, focused on providing transaction processing services that enable fast and secure electronic payments between financial institutions and their customers around the world.

As a leader in the global payment processing solutions market, the company is investing hundreds of millions of dollars in business expansion aimed at improving payment processing infrastructure and developing its solutions using advanced technologies such as artificial intelligence and blockchain.

On March 27, the company announced the launch of three AI-powered business services within Visa Protect, the purpose of which is to reduce fraud in immediate payments and card-not-present transactions. New solutions include Visa Deep Authorization, Visa Advanced Authorization and Visa Risk Manager, as well as a service that assesses financial risks in real time.

We believe new initiatives and the continuing improvement of the company's financial position will allow it to remain one of the leaders in the digital payments market.

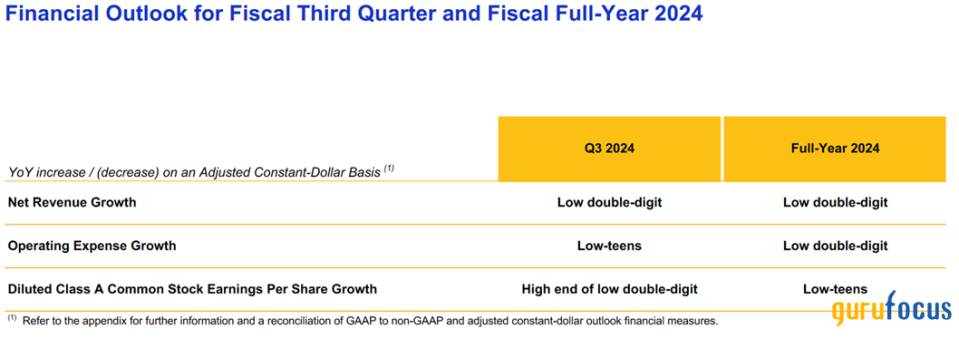

In addition, despite increased geopolitical risks caused by military conflicts in the Middle East and Eastern Europe, as well as the trade war between the United States and China, management confirmed its optimistic forecasts for 2024, including growth of revenue by low double-digit percentages.

Source: Visa

Financial position and prospects for the development of its business

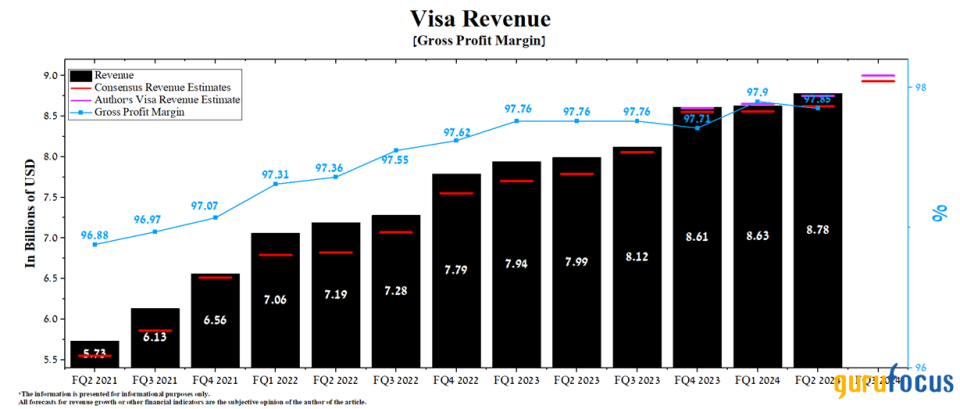

Visa's revenue for the second quarter was $8.78 billion, an increase of $150 million quarter over quarter and, more importantly, an increase of $790 million year over year.

Source: Author's elaboration, based on GuruFocus data.

In addition to maintaining a solid quarter-over-quarter growth trend, the company's actual revenue has beaten analysts' consensus estimates for the past three years.

Source: Author's elaboration, based on analyst projections.

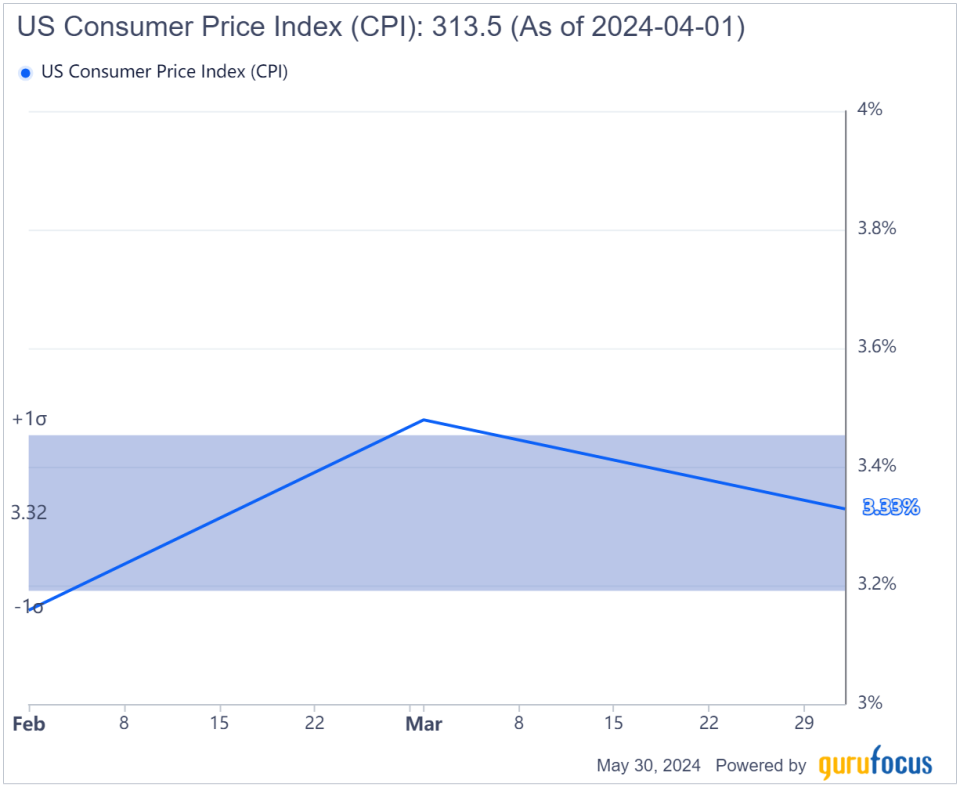

As a result, we believe this indicates the high competitiveness of the business, as well as the effectiveness of business strategies implemented under the leadership of Ryan McInerney, which allow Visa to quickly adapt to changing market conditions, especially at the current time when consumer inflation continues to remain above the U.S. central bank's 2% target.

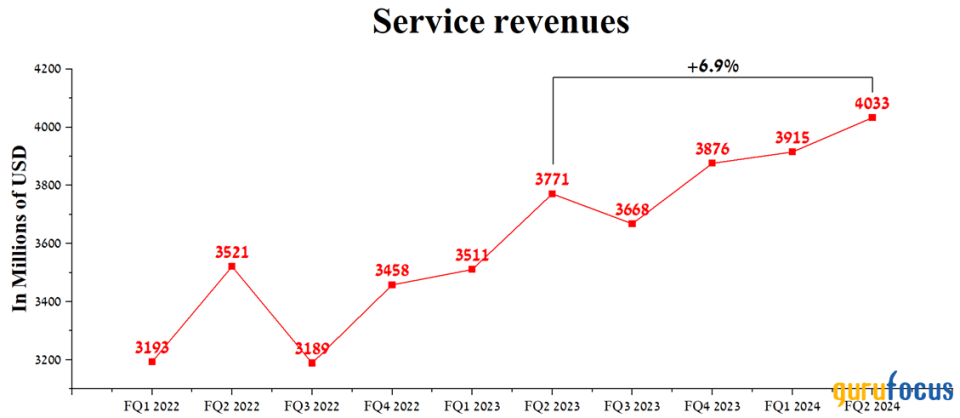

The first contributor to Visa's revenue growth and gross margin is a boost in the number of transactions processed and payment volumes, as it remains a leading player in the global payment processing market. Service revenue amounted to $4.03 billion in the first three months of 2024, an increase of 6.90% year on year.

Source: Author's elaboration, based on quarterly securities reports.

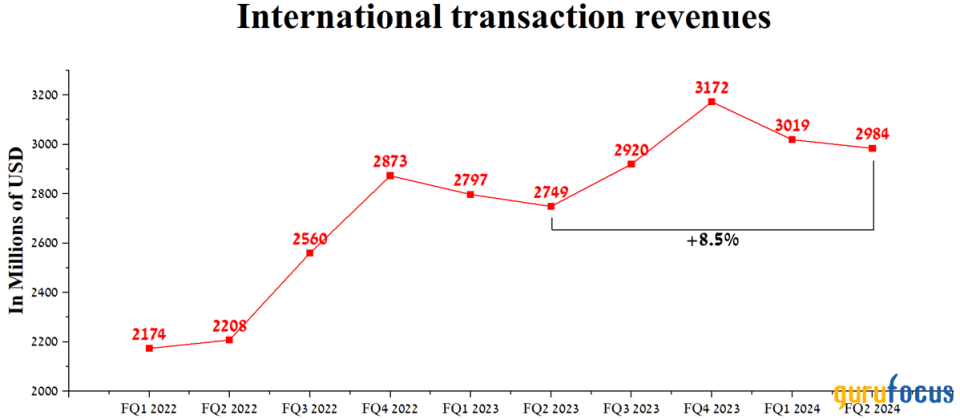

International transaction revenue continues to demonstrate strong dynamics, which is earned by Visa through currency conversion activities, as well as during the execution of cross-border operations. Total international transaction revenue was approximately $2.98 billion in the second quarter, an increase of 8.50% year over year, driven by increased international travel by people whose debit and credit cards were issued in the United States, Latin America and some countries in the Asia-Pacific region.

Source: Author's elaboration, based on quarterly securities reports.

Visa is anticipated to release financial results for the third quarter on July 24. Analysts forecast its revenue for the quarter to be between $8.77 billion and $9.13 billion, up about 10.80% year over year.

On the other hand, we expect this financial metric to reach $9 billion, which is about $70 million above the median of this range, mainly due to more optimistic expectations for the growth rate of data processing and international transaction revenues.

Source: Created by author.

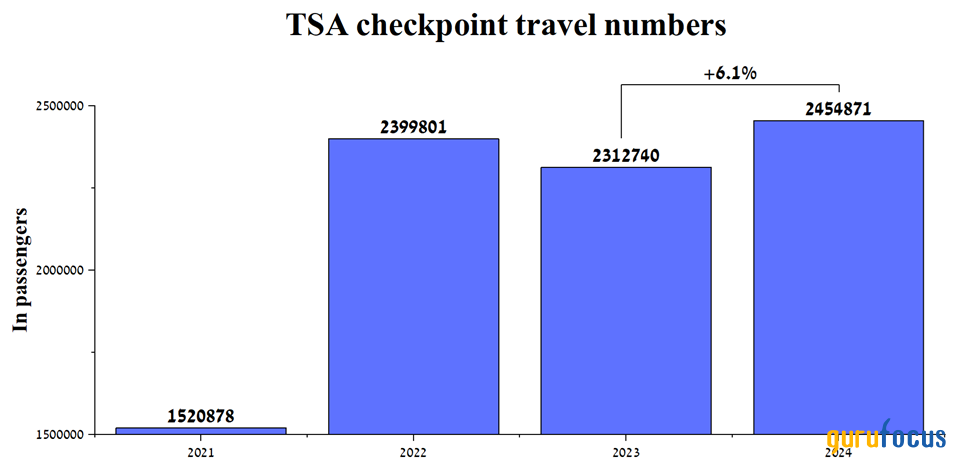

Key factors driving ongoing revenue growth include the recent surge in U.S. consumer spending and the start of the holiday season, which will boost domestic and international air travel starting in June. According to the Transportation Security Administration, the total number of passengers reached about 2.45 million on May 15, continuing the positive trend that began after the end of the acute phase of the Covid-19 pandemic.

Source: Transportation Security Administration.

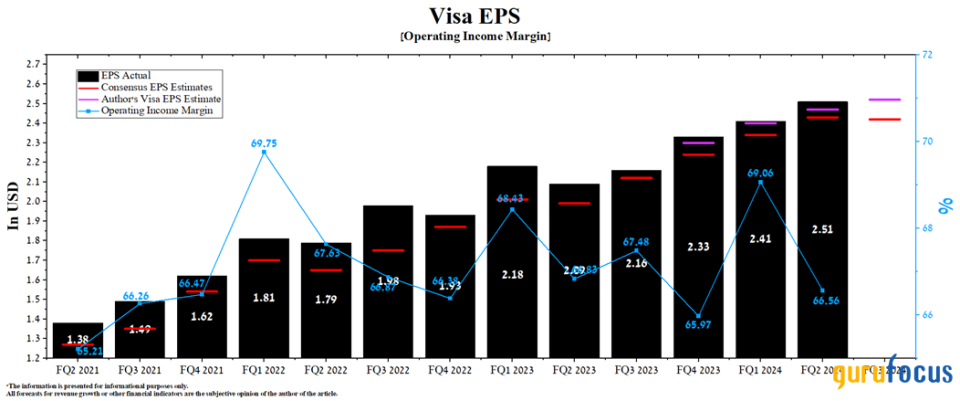

Visa's operating income margin was 66.56% for the three months ended March 31, down slightly year over year due to a 61% increase in general and administrative expenses. On the other hand, we expect this financial metric will remain stable in 2024 and increase to 68.40% by 2025, thanks to the faster pace of global economic recovery, the growing popularity of cryptocurrencies and their integration into Visa's products.

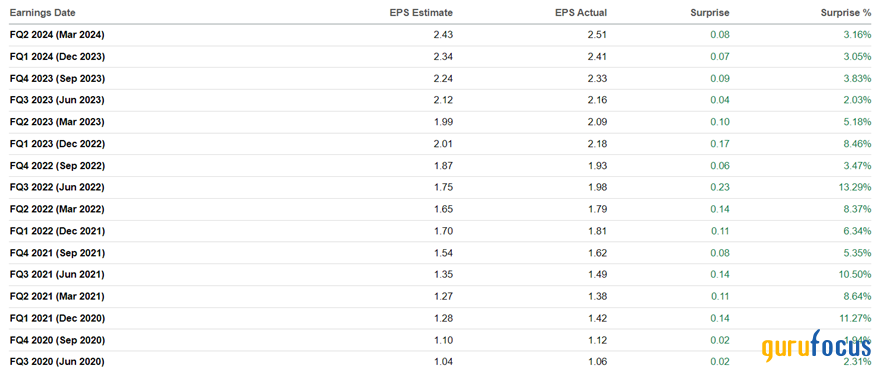

The company's earnings per share for the second quarter of fiscal 2024 reached $2.51, not only increasing relative to previous quarters but, more importantly, beating analysts' consensus estimates by 8 cents, mainly due to continued strong business activity in the United States, Germany and France.

Source: Author's elaboration, based on GuruFocus data.

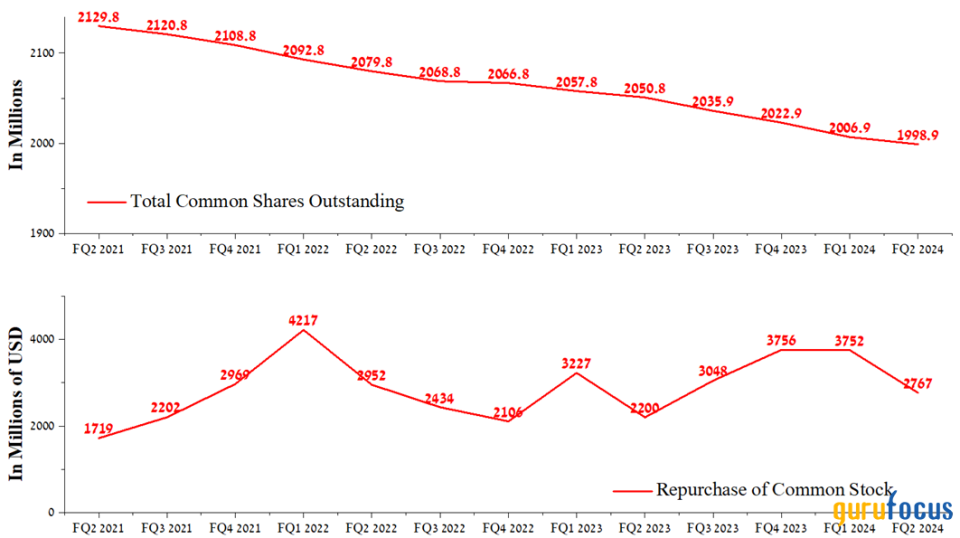

Meanwhile, analysts forecast financial metric to be in the range of $2.34 to $2.49 in the third quarter. However, we expect its earnings per share to modestly exceed the high end of this range, reaching $2.52, thanks to management's active use of its share repurchase program, as well as growth in debit and credit card payments volume.

Source: Author's elaboration, based on GuruFocus data.

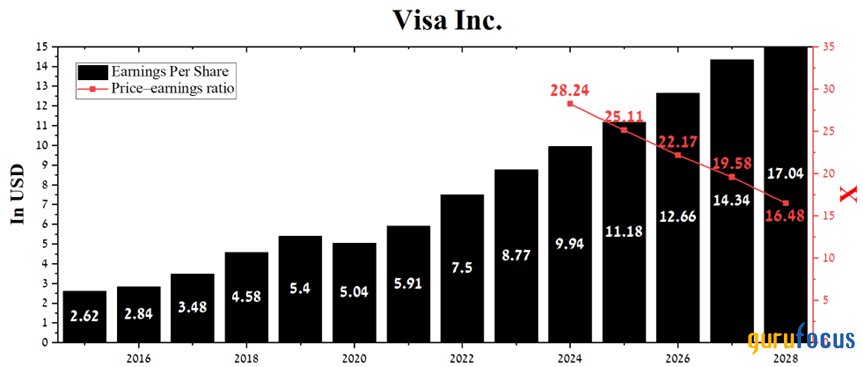

Further, the company's trailing 12-month non-GAAP price-earnings ratio is 29.90, indicating it is trading at a premium to the sector. However, Visa is a growth stock with a strong balance sheet, demonstrating relatively high revenue growth rates, including due to the increase in the volume of non-cash transactions worldwide.

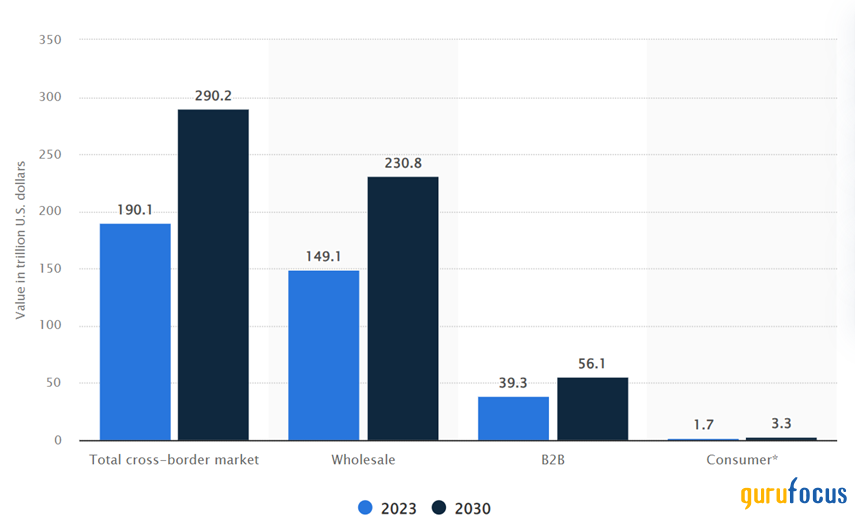

According to Statista, the global cross-border payments market will grow from $190.10 trillion to $290.20 trillion in 2030, including due to reaching new markets.

Source: Statista.

More globally, driven by its strong operating profit growth rate, as well as management's use of free cash flow to repurchase shares, Visa's price-earnings ratio is expected to decline to 16.50 by 2028, which we estimate is an attractive value for long-term investors looking for attractive assets in the financial sector.

Source: Author's elaboration, based on GuruFocus data.

According to GuruFocus, Wall Street analysts' price targets range from $265 to $340, suggesting an upside of about 13.60% from the current share price of $273.

Source: GuruFocus.

Conclusion

In recent months, we have seen an increase in U.S. consumer spending, which, while investor concerns about a global recession have eased, is fueling growth in Visa's payment volumes and transactions processed.

The company's financial position continues to improve even in the face of increased inflation in the U.S. and Europe, thanks to the launch of new products developed using advanced technologies such as artificial intelligence and blockchain. In addition, we believe the growing popularity of digital currencies in the world, caused by rising prices for them, will ultimately have a positive effect on increasing demand for the company's crypto solutions.

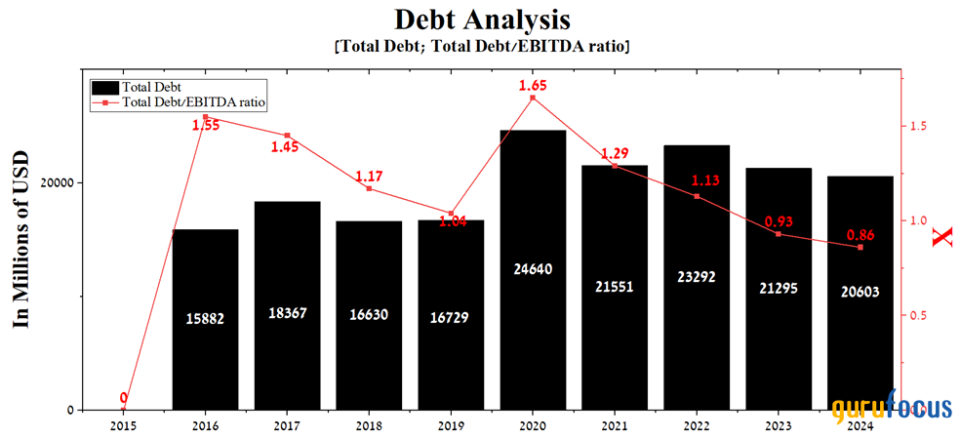

Further, thanks to Visa's year-over-year free cash flow growth, its total debt-Ebitda ratio fell from 1.65 to 0.86, indicating it will not have difficulty repaying senior notes maturing between 2025 and 2050.

Source: Author's elaboration, based on GuruFocus data.

We continue our analytics coverage of Visa with an "outperform" rating for the next 12 months.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance