Coronavirus: Chinese economy suffers biggest downturn since 1970s

China faces a drawn-out struggle to revive an economy that suffered its biggest contraction since possibly the mid-1960s after millions of people were told to stay home to fight coronavirus.

The world’s second-largest economy shrank by 6.8% from a year earlier in the quarter ending in March after factories, offices and shopping centres were closed to contain the outbreak, official data showed. Consumer spending, which supplied 80% of last year’s growth, and factory activity were weaker than expected.

China, where the pandemic began in December, is the first major economy to start to recover after the ruling Communist Party declared the virus under control. Factories were allowed to reopen last month, but cinemas and other businesses that employ millions of people are still closed.

There are signs that after an “initial bounce” as controls ended, “the recovery in activity has since slowed to a crawl”, said Julian Evans-Pritchard of Capital Economics in a report.

“China is in for a drawn-out recovery,” he said.

The last contraction this big was 5.8% in 1967 during the upheavals of the Cultural Revolution, according to Iris Pang of ING.

Forecasters earlier said China might rebound as early as this month, but they say a sharp “V-shaped” recovery looks increasingly unlikely as negative export, retail sales and other data pile up.

Instead, they expect a gradual crawl back to growth in low single digits in the coming quarters. For the full year, forecasters including UBS, Nomura and Oxford Economics expect little to no growth.

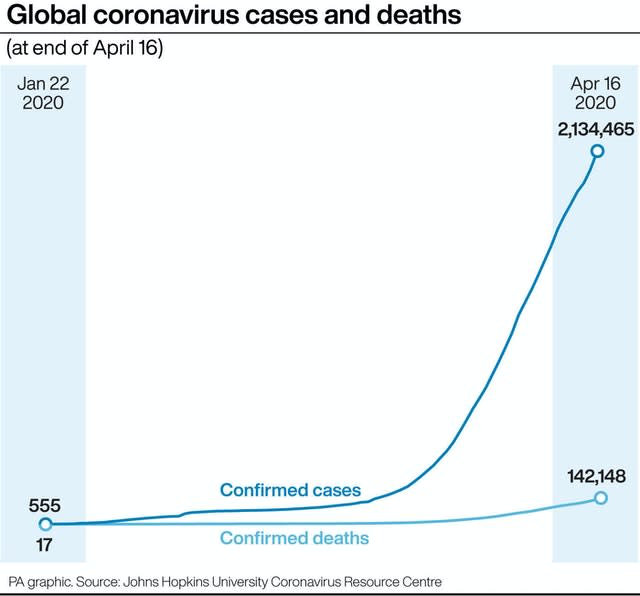

In total, China has reported 4,632 deaths after the total for Wuhan, the city of 11 million people at the centre of the outbreak, was revised upwards on Friday. The mainland has announced 82,367 cases.

Retail sales fell 19% from a year earlier in the first quarter. That improved in March, the final month of the quarter, to a decline of 15.8%, but consumers, jittery about possible job losses, are reluctant to spend despite government efforts to lure them back to shops and car showrooms.

That is a blow to car makers and other companies that hope China will power the world economy out of its most painful slump since the 1930s.

The economy had already been squeezed by a tariff war with President Donald Trump over Beijing’s technology ambitions and trade surplus. Last year’s growth sank to a multi-decade low of 6.1%.

Exports fell 6.6% in March from a year earlier, an improvement over the double-digit plunge in January and February, but forecasters say demand is bound to slump in America and Europe as anti-virus controls keep shoppers at home.

Investment in factories, property and other fixed assets, the other major growth driver, sank 16.1%.

Car sales sank 48.4% from a year earlier in March. That was better than February’s record 81.7% plunge but is on top of a two-year decline that is squeezing global and Chinese firms in the industry’s biggest global market.

Yahoo Finance

Yahoo Finance