Chancellor to overhaul £330bn coronavirus business loan scheme after backlash

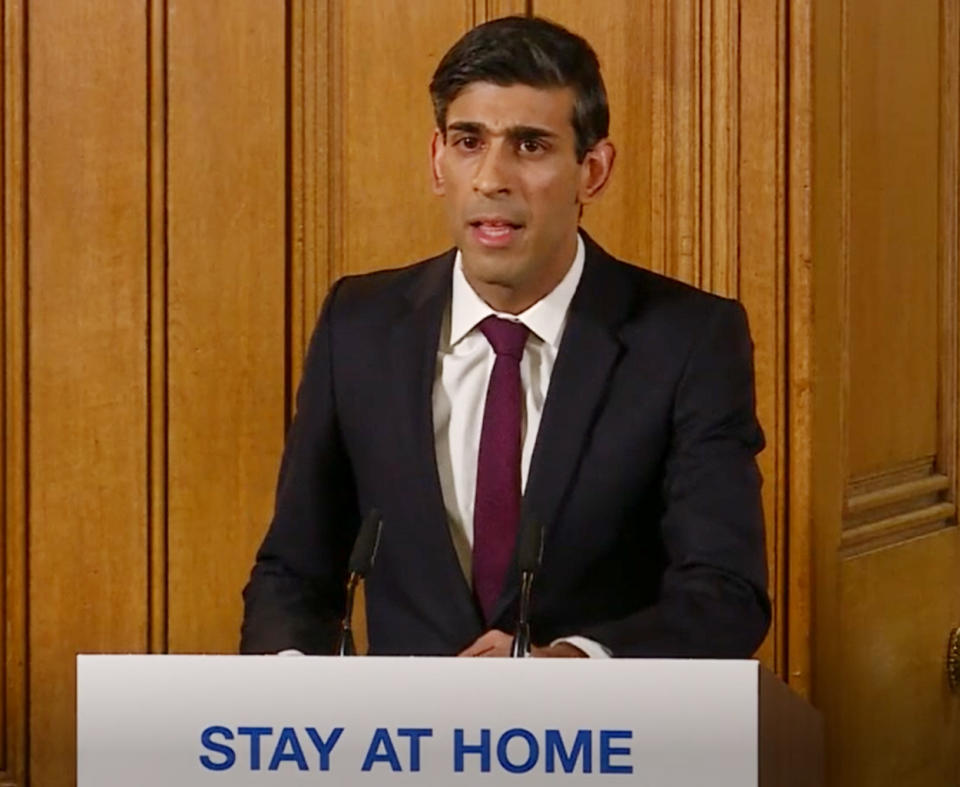

Chancellor Rishi Sunak is poised to overhaul the government’s £330bn support scheme for small businesses, following a backlash over how the scheme was being run and warnings that millions of firms could go bust without further action.

Sky News reported late on Wednesday that Sunak would announce changes to the Coronavirus Business Interruption Loan Scheme (CBILs) as soon as Friday.

The report came shortly after Business Secretary Alok Sharma said the Chancellor would make a further announcement on support for small businesses in the coming days.

Read more: Banks told to 'repay the favour' from 2008 with COVID-19 support

The CBIL scheme was announced just over two weeks ago and formed the centre piece of the government’s response to the economic fallout of COVID-19.

The Treasury promised to guarantee £330bn-worth of loans to small businesses to help them weather the current storm. Businesses could apply for loans of up to £5m, which are interest free for 12 months. The government promised to cover any losses on the loans made by banks up to 80% of the loan value.

The scheme was part of an “unprecedented” package of support for small businesses and was worth around 15% of UK GDP. However, the programme has met with almost constant criticism since its launch.

Around 40 financial institutions are doling out coronavirus support loans on behalf of the government but businesses say the banks are being too slow and in some cases profiteering.

Read more: UK releases 'unprecedented' financial measures worth 15% of GDP

Banks were criticised for asking for personal guarantees from business owners on loans above £250,000. The guarantees — meant to cover losses on the 20% of the loan not backed by the government — mean entrepreneurs could lose savings and investments if their firm went bust and they could not pay back the entire loan.

Some lender are also said to be charging interest rates hundreds of times higher than the Bank of England’s 0.1% base rate. Labour MP Chris Bryant said last week he was aware of banks charging interest rates of between 7% and 12%.

Business owners are also frustrated with the speed at which banks are moving, with loan applications taking too long and money being offered in 45 days in some cases.

Richard Burge, chief executive of London Chamber of Commerce and Industry, said on Thursday: “The government money simply isn’t flowing fast enough down the chain.”

Read more: Banks under fire over personal guarantees on coronavirus loans

Sky News said Sunak is planning to remove the requirement for banks to asses applicants for standard loans before looking at the government scheme. The idea is that this should speed up the process.

The Chancellor is also said to be in talks to get the banks to agree to a limit the interest rates charged on these loans after the 12-month interest free period expires.

A spokesperson for UK Finance, the banking industry body, said: “This is a new scheme delivered at pace and there will be issues that need to be addressed.

“That is why we have been working closely with government since implementation to ensure the scheme can operate in the best way possible to get money to viable businesses that need it as quickly as possible.”

The changes come as business groups warn millions of companies could go under unless the governments can get cheap financings to firms faster.

“Millions of fantastic small firms are facing collapse,” Mike Cherry, chairman of the Federation of Small Businesses (FSB), said on Wednesday night. “They were promised interest free, fee free, government-backed support from banks. Many of them are in urgent need of it today, and it’s not being made available.”

The Corporate Finance Network said on Wednesday that almost a fifth of small companies could run out of cash by the beginning of May, putting 4 million jobs at risk. A separate survey by the British Chamber of Commerce (BCC) found almost two thirds of small and medium-sized businesses only had enough cash to survive for three months.

The Treasury, the Bank of England, and the Financial Conduct Authority (FCA) wrote to banks last week saying their “priority” should be to “maintain and extend lending” to small businesses.

Business Secretary Alok Sharma said on Wednesday that banks should “repay the favour” from 2008 by supporting the economy and warned it was “unacceptable” for any bank to refuse financing to a viable business.

The UK Finance spokesperson said: “Lenders are working hard to get financing to all viable businesses who need it as quickly as possible, whether through the Coronavirus Business Interruption Loan Scheme if the business is eligible or by providing additional financial support through normal commercial arrangements where appropriate.”

Watch the latest videos from Yahoo UK

Yahoo Finance

Yahoo Finance