UK’s Cash-Strapped Councils Locked Out of Crucial Funding Source

(Bloomberg) -- Some of Britain’s most cash-strapped town halls are being locked out of a vital source of short-term funding, foreshadowing a major financial headache awaiting the UK government after the July 4 election.

Most Read from Bloomberg

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

Biden Struggles to Contain Pressure to Abandon Reelection Bid

The little-known £12 billion ($15.2 billion) inter-authority lending market — where local councils borrow from each other to meet everyday cash needs — is seizing up after a spate of high-profile bankruptcies caused unsettled confidence across the sector, according to five people familiar with the matter.

The opaque market accounts for almost all short-term borrowing by local government in the UK. Two councils with the most high-profile financial difficulties — Woking and Thurrock — say they now have to seek all of their loans elsewhere. Others are facing higher borrowing rates for the loans, as local authorities baulk at the potential reputational risk of lending to them.

The disruption is exacerbating a crisis that’s playing a major part in the British election, even though the political parties say little about how they would fix it. Many of the services provided by local councils, from social care and road maintenance to public libraries, have been scaled back dramatically due to a long-term funding squeeze that began after the global financial crisis.

That’s a major reason why polls make Keir Starmer’s opposition Labour Party close to a shoo-in to oust the Conservative Party from power for the first time in 14 years. The Tories’ silence on the issue makes sense given the council crisis emerged on their watch. Labour, which will most likely be charged with finding a solution, have said little beyond their manifesto pledge to provide local authorities with long-term funding certainty.

The Local Government Association has warned that councils face a £6.2 billion hole in their budgets in in the coming years after facing soaring costs and rising demand for services, such as social care and support for children. However, the thorny issue of council finances has been sidelined during the election campaign.

“One of the reasons neither the Conservative nor Labour parties have talked about it is because it’s so difficult,” said Tony Travers, a local government expert at the London School of Economics. “The current government has aimed the biggest reductions in public spending at the very part of the public sector which the public notices, outside its own front door every day.”

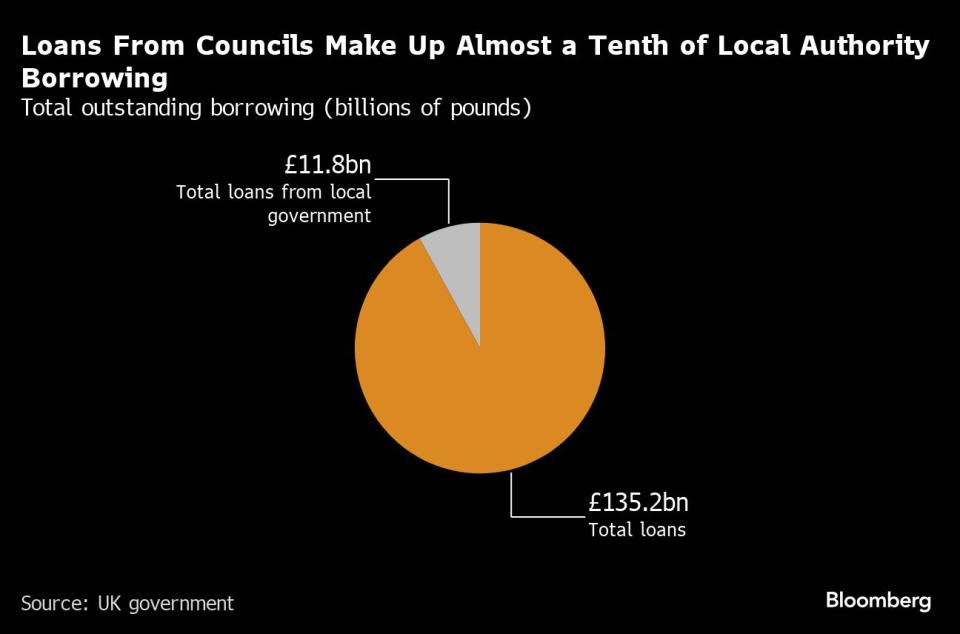

Last year, almost £12 billion of councils’ £135 billion in outstanding borrowing came from the inter-authority market, according to government figures.

But the market accounts for more than 90% of short-term council borrowing, making it a vital line of credit when revenue and spending are uneven throughout the year. Longer-term loans largely come from the central government.

On standard loans from the central government’s Public Works Loan Board, councils are charged borrowing rates of 100 basis points above gilt yields. However, they can get cheaper rates and shorter-term loans if they tap other authorities wanting to put their spare cash to use, according to people familiar with the market.

But some councils are reluctant to lend to other local authorities that have been caught up in high profile financial troubles in recent years, the people familiar with the matter said, after a number were forced to effectively declare bankruptcy or seek emergency support.

Councils in Birmingham, Nottingham and Woking effectively declared bankruptcy last year by issuing so-called section 114 notices. Many more local authorities warned they faced a similar fate, and several were granted special dispensation to sell assets and borrow to plug their funding black holes.

Thurrock council — which issued a 114 notice in 2022 — had relied heavily on the inter-authority when it ramped up debts of around £1.5 billion on a string of investments

Christian Wall, a director at PFM, the managed service provider of the UK Municipal Bonds Agency, said councils facing higher borrowing costs is a sign of stress in the market.

Wall said there’s been “a wobble in confidence that’s impacting borrowers” in the inter-council market.

To be sure, pressure on council budgets and the higher returns elsewhere after a rise in benchmark interest rates may also be restricting the amount being lent through this inter-authority market, according to the people.

But the net effect is that the councils in the most financial trouble are pushing into more expensive loans via the PWLB.

“There have been concerns about the absence of checks and balances on inter-borough lending, so it’s right that some are reticent to lend to financially unstable authorities,” said Jack Shaw, an affiliated researcher at the Bennett Institute. “However, that leaves those authorities at risk with fewer, more costlier options, further undermining their stability.”

Spokespeople for both Thurrock and Woking said both councils currently do all their borrowing via the PWLB.

While experts believe the actual risk of councils being unable to repay their borrowings to other local authorities is low, the loss of confidence still affects the ability and cost to finance themselves.

“There is a potential embarrassment if you lend millions of pounds to a council like Thurrock,” Wall said. “But all borrowers have repaid. The government stands behind local authorities. In credit terms, there’s very little risk.”

Most Read from Bloomberg Businessweek

China’s Investment Bankers Join the Communist Party as Morale (and Paychecks) Shrink

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance