Credit investments aren't worth the risk right now, says bond giant PIMCO

PIMCO says that private credit investors are not being compensated enough for market risks.

Excess premium is falling as capital flows into too few opportunities, the bond giant said.

Private corporate credit is vulnerable to higher interest rates or an economic slowdown, the firm added.

Credit returns aren't enough to justify the risks investors are currently taking on, PIMCO said in a note on Wednesday.

According to the bond giant, borrowers need to offer higher compensation to lenders, given the market's rising vulnerability to today's macro-conditions.

What's more, less-liquid private credit is not offering high enough premiums for borrowers that lock in their investments.

"The compensation for providing liquidity is declining across both public and private credit markets as more capital chases too few opportunities," CIO of core strategies Mohit Mittal explained. "New investments are entering at potentially unattractive valuations, with corporate spreads across public and private credit markets near record lows."

For example, the excess premium received for investing in the private sector now stands below 100 basis points: that's not even half of what should be offered, PIMCO estimates.

By commiting money in these assets, investors are possibly losing out on opportunities elsewhere, and exposing themselves to the potential cash shortfall, Mittal said.

Meanwhile, some corners of private credit are susceptible to an increased macro uncertainty.

Among smaller firms with floating-rate debt, a cooling economy or sustained interest rate highs are rising risks, PIMCO said. While markets are betting on rate cuts to start this September, such projections have been delayed multiple times through 2024.

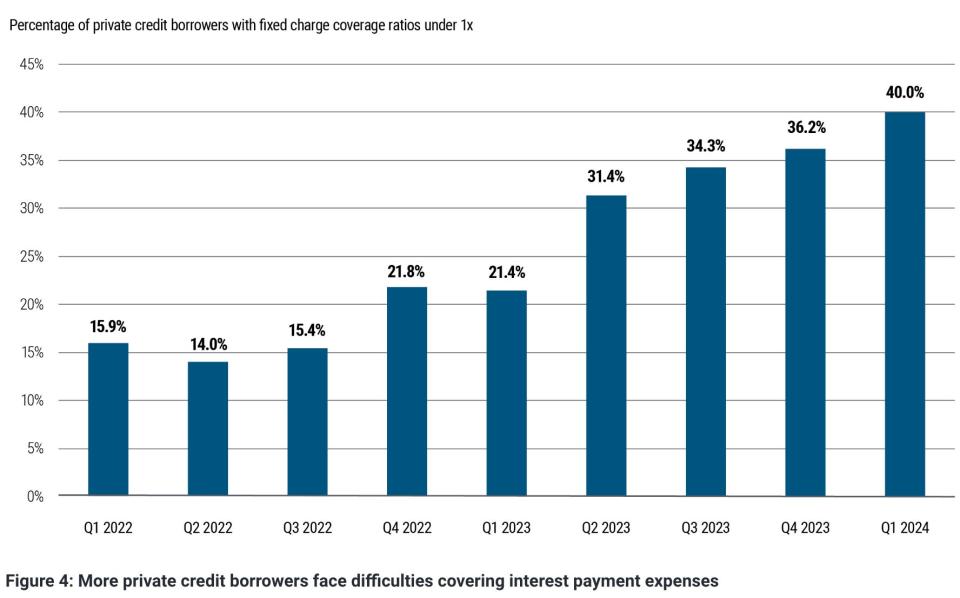

In fact, PIMCO found that higher rates are eroding the private sector's ability to cover interest rate expenses:

"40% of private credit borrowers (size weighted) are not producing enough cash flow to service all debt, taxes, and capital spending needs," it estimated. "If interest rates stay elevated for longer or economic growth slows, these borrowers would be more vulnerable to further increases in leverage, declining credit quality, and higher expected losses."

At the same time, corporate credit is heavily centered on vulnerable sectors, such as technology and health, PIMCO noted. These come with their own risks, such as exposure to an AI disruption.

In these conditions, there's "tremendous value" in public credit of high-quality and liquidity, Mittal suggested.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance