Crest Nicholson to close London office and build more 'flat pack' houses as costs bite

Housebuilder Crest Nicholson is feeling the pinch of rising construction costs and a slower housing market, prompting it to close its Central London office and expand production of so-called "flatpack" housing structures.

In its half-year results, Crest Nicholson said that it expects its margins to be around 18pc for the full year compared with 20.3pc last year - and at the lower end of its 18pc to 20pc range - due to the “generally flat” pricing environment.

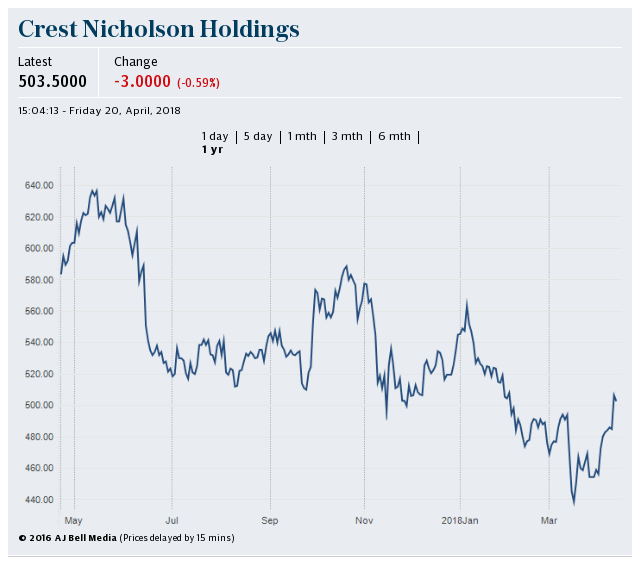

Shares in the FTSE 250 housebuilder fell more than 7pc in morning trade.

Patrick Bergin, chief executive, said he expected the operating margins to be flat next year, with an improvement from 2020 and beyond. He said that a shortage of skilled labour in the construction sector because of an ageing workforce was one factor driving up costs, which could be further affected by Brexit.

"We're preparing also for a world where, even if the Brexit solution is to allow reasonably free flow of people with work in the UK, that just the net reduction in attractiveness might limit the number of EU workers coming to work here."

Crest Nicholson hopes to offset rising labour costs by manufacturing the light steel gauge inner walls of its houses offsite and delivering them "flatpack" to sites, rather than using traditional breeze blocks. The company expects 10pc of its output next year to use an element of offsite manufacturing.

"If we can prove that model - and we believe we can - then I would probably expect to step that up in 10pc increments over the first few years so that, actually, fairly quickly, you get to 20pc, 30pc of your output coming through this way and maybe ultimately 50pc to 60pc," Mr Bergin said.

"What you end up with is a house that looks and feels very traditional but the offsite manufacturing has enabled you to erect it at a far greater speed and enabled you to work concurrently on both the inside and the outside so that you're less beholden to bricklayers and scaffolders."

While a traditional house takes eight to 10 weeks to get to the point of putting the roof on, the prototypes using prefabricated walls can reach that stage within seven days, although at scale it may take longer than that. As the panels come with the windows and doors prefixed, that means that they are weathertight as soon as the roof is completed.

The company is also looking to get support from the Government's Homes England programme for this type of manufacturing, Mr Bergin said.

Surrey-based Crest Nicholson is also seeking to cut costs by closing its Central London office serving the capital, which has been a "difficult place to trade" amid house price pressure and high land prices, Mr Bergin said.

Instead, the housebuilder will focus on the home counties, with a new office in Kent planned. Consultations with the 50 members of staff at its Central London office have already begun and the company hopes to move many to the new Kent office. The company plans to have completed the transition by October.

Crest Nicholson posted pre-tax profit of £74.8m for the six months to April 30, down from £76.2m during the same period last year. Revenue for the period was £473.8m, up 13pc from £419.7m the previous year.

Forward sales were £568.2m in mid-June, up 5pc compared with the previous year, while forward sales including year-to-date completions were 12pc ahead of the same period last year.

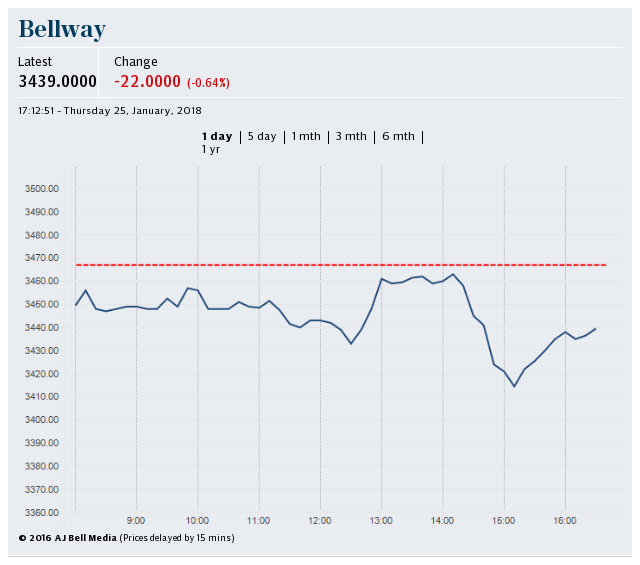

Elsewhere, rival housebuilder Bellway said in a trading update that it was seeing a “firm” pricing environment, with modest, single-digit price rises at some of its sites.

However, it said that there was less demand for large or higher-priced homes in expensive areas and it was therefore cutting prices in some of those areas.

The company, which is also in the FTSE 250, said it expected an operating margin of about 22pc in the year to July 31.

The value of its order book at June 3 was 7.8pc ahead of the previous year, at £1.7bn, comprising 6,144 homes.

Bellway shares fell 2.7pc in morning trade to £33.16.

Yahoo Finance

Yahoo Finance