Crown Castle (CCI) Q2 FFO & Revenues Rise Y/Y, '18 View Up

Crown Castle International Corp.’s CCI second-quarter 2018 adjusted funds from operations (AFFO) per share of $1.31 compares favorably with the prior-year figure of $1.2. The Zacks Consensus Estimate for the reported quarter’s AFFO per share was pegged at $1.33.

Results reflect increase in site rental revenues. The company continues to benefit from its extensive tower portfolio, high demand for infrastructure and slew of fiber-operator buyouts. Also, the company raised its outlook for 2018.

Net revenues for the quarter amounted to $1.33 billion and marked year-over-year growth of 27.9%. Moreover, the reported figure came in line with the Zacks Consensus Estimate of $1.33 billion.

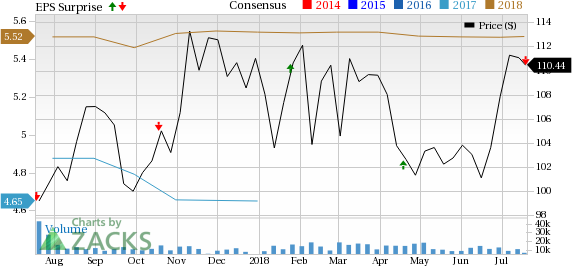

Crown Castle International Corporation Price, Consensus and EPS Surprise

Crown Castle International Corporation Price, Consensus and EPS Surprise | Crown Castle International Corporation Quote

Site rental revenues came in at $1,169 million, up 35% year over year that included organic growth, as well as contributions from acquisitions and other items. Particularly, site rental revenues in the April-June quarter recorded 8% growth, driven by strong new leasing activity, as well as contracted tenant escalations.

However, network service revenues came in at $161 million, down 4.7% year over year.

Operating Metrics

Quarterly operating income jumped 33% from the prior-year quarter to $345 million. Operating expenses also escalated 26.4% year over year to $985 million. Quarterly adjusted EBITDA was approximately $769 million, representing year-over-year increase of 30.6%.

Cash Flow and Liquidity

Crown Castle exited the second quarter with cash and cash equivalents of $206 million, down from $314 million reported at the end of 2017. Further, as of Jun 30, 2018, the company generated $1.1 billion of net cash from operating activities compared with $931 million reported in the year-ago period.

Also, debt and other long-term obligations aggregated approximately $15,844 million, down from $16,044 million at the end of 2017.

Dividend Payout

During the reported quarter, Crown Castle paid common stock dividend of $1.05 per common share, up approximately 11% from the year-earlier quarter.

Q3 Outlook

For third-quarter 2018, Crown Castle expects site rental revenues of $1,172-$1,182 million. Site Rental cost of operation is projected at $345-$355 million. Adjusted EBITDA is estimated in the range of $785-$795 million. Interest expense (inclusive of amortization) is estimated in the $156-$166 million range. Meanwhile, FFO is anticipated in the $490-$500 million band, while AFFO is projected at $568-$578 million.

2018 Outlook

Crown Castle raised its outlook for full-year 2018. The company expects site rental revenues of $4,673-$4,703 million, denoting a projected increase of $26 million at the mid-point from the previously-issued outlook. Adjusted EBITDA is anticipated in the band of $3,132-$3,162 million, reflecting an uptick of $27 million at the mid-point. In addition, AFFO is guided in the band of $2,263-$2,293 million, unchanged at the mid-point.

Our Take

Crown Castle is well poised to benefit from its unmatched portfolio of more than 40,000 towers and 60,000 route miles of high-capacity fiber in key U.S. markets. This has also enabled the company to enjoy higher demand from its customers. Further, amid increasing demand for infrastructure, the company has solid capacity to offer tower, small cells and fiber solutions. Lastly, healthy leasing activity, continued buyout of towers and growing demand for mobile broadband remain key positives.

Nevertheless, Crown Castle operates in a highly competitive wireless tower operator industry, with incumbents like American Tower Corp. AMT and SBA Communications Corp. SBAC.

Crown Castle currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We now look forward to the earnings release of Equity Residential EQR, which is scheduled for Jul 24.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (REIT) (AMT) : Free Stock Analysis Report

Crown Castle International Corporation (CCI) : Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance