CyberArk (CYBR) Q3 Earnings and Revenues Beat Estimates

CyberArk Software CYBR reported non-GAAP loss of 6 cents for third-quarter 2022. The figure was narrower than the Zacks Consensus Estimate of a loss of 20 cents per share. The bottom line was flat year over year.

For third-quarter 2022, the leading Identity Security solution provider reported revenues of $153 million, beating the consensus mark of $151.2 million. The top line witnessed a year-over-year improvement of 26%. Markedly, 84% of quarterly revenues were recurring in nature, which surged 44% year over year to $129 million.

Annual Recurring Revenues (“ARR”) increased 49% to $512 million. The maintenance portion, representing 41.2% of total ARR, increased 2.4% year over year to $211 million. The subscription portion, which accounted for 58.8% of the total ARR, soared 117% year over year to $301 million. This upside was primarily driven by a record number of software-as-a-service solutions bookings and strong demand for on-premises subscription offerings.

CyberArk’s subscription transition has been witnessing strong momentum, with a rapidly growing base of recurring revenues. Subscription bookings made up 87% of the license bookings in the quarter, which was higher than 72% in the year-ago quarter.

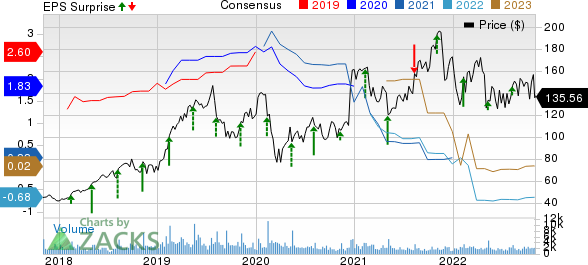

CyberArk Software Ltd. Price, Consensus and EPS Surprise

CyberArk Software Ltd. price-consensus-eps-surprise-chart | CyberArk Software Ltd. Quote

Quarter Details

Segment-wise, Subscription revenues (49% of total revenues) were $74 million, up 110% from the year-ago quarter.

Maintenance and professional services revenues (41.8% of total revenues) remained flat at $64 million.

Perpetual license revenues (9.2% of total revenues) plunged 39.1% to $14 million at the close of this quarter.

The signing of new logos across all industries highlighted a steady increase in new businesses. The new business pipeline is encouraging.

During the third quarter, CyberArk added around 230 new customers.

Operating Details

CyberArk’s non-GAAP gross profit increased 22.9% year over year to $126 million.

Non-GAAP operating expenses escalated 27% year over year to $130 million. This was primarily due to 27.4%, 29.7% and 13.1% year-over-year increases in R&D, S&M and G&A expenses, respectively, from the year-earlier reported figures. S&M expenses comprised almost 57% of the total quarterly operating expenses.

The company’s non-GAAP operating loss was $4 million at the end of third-quarter 2022, against a non-GAAP operating income of $0.13 million a year ago.

Balance Sheet

CyberArk ended the July-September quarter with cash and cash equivalents, marketable securities and short-term deposits of $949.5 billion.

As of Sep 30, 2022, total deferred revenues were $376 million, up 34% year over year.

During the third quarter, CyberArk used operating cash flow worth $18.5 million and free cash flow worth $13.9 million. In the first nine months of 2022, the company generated $29.2 million in operating cash flow and $20.4 million in free cash flow.

Guidance

For the fourth quarter of 2022, CyberArk expects revenues between $169.9 million and $176.9 million. It projects to post non-GAAP earnings per share in the range of 7-20 cents.

Non-GAAP operating earnings are estimated between $2 million and $8 million.

For full-year 2022, CyberArk now expects revenues to be in the range of $592.5-$599.5 million compared to the prior estimate of $589-$601 million. The company now projects non-GAAP loss to be 54-39 cents per share compared with the previously estimated range of 82-57 cents per share.

Non-GAAP operating loss for full-year 2022 is estimated in the $24.5-$18.5 million band.

Zacks Rank & Other Key Picks

CyberArk currently carries a Zacks Rank #2 (Buy). Shares of CYBR have declined 25.4% in the past year.

Some other top-ranked stocks from the broader Computer and Technology sector are Okta OKTA, Zscaler ZS and Digi International DGII. While Okta and Zscaler flaunt a Zacks Rank #1 (Strong Buy), Digi International carries a Zacks Rank #2. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Okta's third-quarter fiscal 2023 loss has been revised a penny downward to 31 cents per share over the past 60 days. For fiscal 2022, loss estimates have improved by 3 cents to 72 cents per share in the past 30 days.

OKTA’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, the average surprise being 45.5%. Shares of the company have declined 80.1% in the past year.

The Zacks Consensus Estimate for Zscaler's first-quarter fiscal 2023 earnings has been revised a penny north to 21 cents per share over the past 60 days. For fiscal 2023, earnings estimates have moved north by a penny to $1.18 per share in the past 30 days.

ZS' earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 28.6%. Shares of the company have declined 58.4% in the past year.

The Zacks Consensus Estimate for Digi’s fourth-quarter fiscal 2022 earnings has increased by 2 cents to 42 cents per share over the past 90 days. For fiscal 2022, earnings estimates have moved 1.2% down to $1.61 per share in the past 60 days.

DGII's earnings beat the Zacks Consensus Estimate in all the preceding four quarters, the average surprise being 28.6%. Shares of the company have improved 62.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Digi International Inc. (DGII) : Free Stock Analysis Report

CyberArk Software Ltd. (CYBR) : Free Stock Analysis Report

Okta, Inc. (OKTA) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance