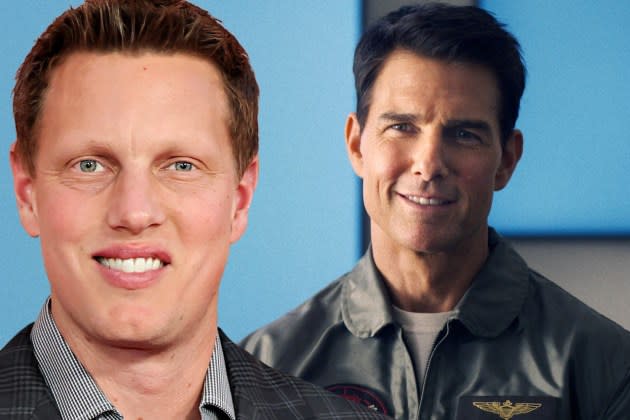

David Ellison Says Tom Cruise Supports Skydance-Paramount Merger, Calls Outreach From Hollywood “Remarkable And Humbling”

Skydance CEO David Ellison said Tom Cruise of Paramount’s Mission Impossible and Top Gun franchises “is supportive of the planned merger and that the “outreach that we have received from the entertainment community has been pretty remarkable and humbling.”

“I think there’s a great opportunity, the fact that we’ll have one of the first owned and operated studios, that will be that will be stable, that can think long term. That’s not just going to have to focus on tomorrow but can focus on several years from now. We really are going to take the long-term approach to this business. And it’s been it’s been really exciting, encouraging and humbling that the greatest filmmakers in the world and artists are supportive of this transaction,” he said today in an interview with CNBC.

More from Deadline

Skydance has made nine movies with Cruise, he said, calling the actor “one of the greatest, most talented artists in the world.”

Ellison also offered a peek into his family’s investment philosophy and how it informed the deal on his end, telling the network, “We’re really comfortable with businesses in transition.”

“I think if you look at the technological prowess we have on the family side, and the transition that Oracle just went through, that was a time period where … we bought more stock and emerged in that transition stronger than ever. Remember similar conversations around Tesla when we made that bet, obviously, as a family. And what we believe in here [with Paramount] is the ability to transition this business, to double down on our core competencies and invest in technology and actually create that media company of the future where art and technology can work hand in hand. And believe that when we come out of this, Paramount will definitively be winner.”

Ellison’s father is billionaire Oracle co-founder Larry Ellison, who is a backer of Skydance and its planned acquisition of and merger with Paramount in a two-step transaction.

Asked about Larry Ellison’s possible involvement in the New Paramount as it’s being called now — which everyone from Wall street to Hollywood is curious about — he said, “So obviously, you know, I’m running the company with Jeff Shell. But please understand, I’ve got an amazing relationship with my father. We talk every day.”

Pressed on that, he said there are some things “in this interim period I can’t speak to” and noted how Skydance and Oracle had partnered to create “studio in the could” — a cloud-based animation studio.

“It’s been an incredible privilege of being able to learn from him, and learn from other mentors like Steve Jobs and David Geffen.”

“What I really want to say is when you go back to Skydance 15 years ago, the core thesis of the founding, of the foundation of Skydance, was that this bridge was going to get built between Silicon Valley and Hollywood, and that that was going to create a tremendous amount of disruption. And Skydance is very much a pure play content engine that was the tip of the spear for that disruption, that believes in where entertainment is heading. And really, Paramount is a business that needs to follow suit and make that transformation and be able to meet this particular moment in time.”

Skydance and Shari Redstone, Paramount’s controlling shareholder, danced around a deal for months before coming to terms and announcing a proposed transaction Sunday night. That started the clock ticking on a 45-day “go shop” period for any other interested bidder to make a move. Otherwise, the deal is expected to fly past regulators and might close sooner than the nine months anticipated earlier this week.

“There could be a pathway here for this to be a lot tighter and quicker in the review process, but it’s not in our control,” said Gerry Cardinale of RedBird Capital, Skydance’s partner and investor in the deal, who appeared with Ellison on CNBC.

The deal calls for Skydance and backers including Larry Ellison and RedBird to acquire Shari Redstone’s family holding company National Amusements, which controls Paramount. The Skydance group will invest $1.5 billion in Paramount and merge with the storied company. Paramount is publicly traded and Skydance is offering to buy out all Class A voting shares for $23 each, and a chunk of non-voting Class B shares for $15.

Hollywood is happy that the historic backlot will be preserved, that private equity, which has been known to destroy value, won’t have free rein, and that Par’s new owner is passionate about the business. Paramount staff may be more apprehensive as Ellison outlined an unspecified but whopping $2 billion in cost savings, vs the $500 million in cuts identified this spring by the outgoing trio of CEOs — which is included in the total. Industry insiders have noted over the past year that Paramount’s already been cut pretty close to the bone over the years.

What’s mainly known of the merged company management-wise so far is that Ellison will be CEO and Jeff Shell president.

Best of Deadline

2024 Premiere Dates For New & Returning Series On Broadcast, Cable & Streaming

Which Emily Henry Books Are Becoming Movies? ‘Happy Place,’ ‘Book Lovers,’ Among Others

Sign up for Deadline's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo Finance

Yahoo Finance