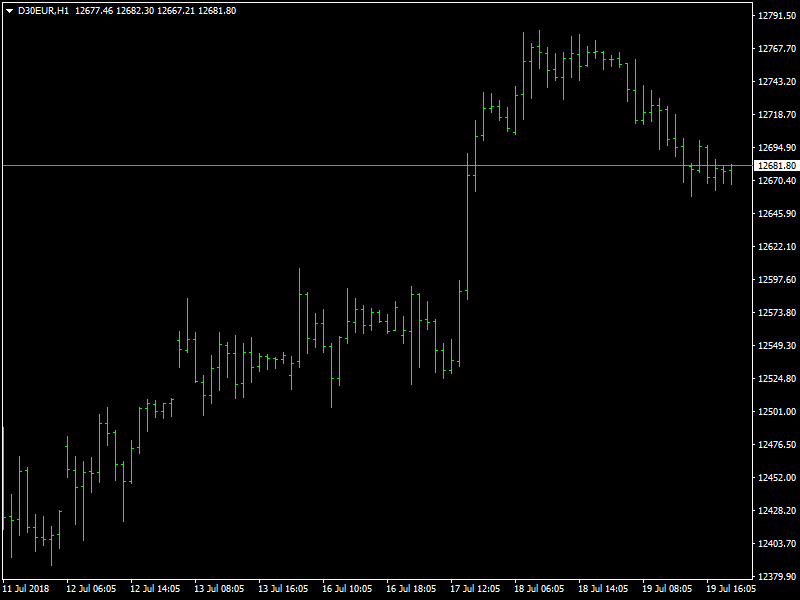

DAX Index Forecast – DAX Takes Some Rest

The DAX closed lower yesterday but considering the fact that the index has been bullish and rising for much of the week, it is only natural for the markets to take a rest and consolidate the gains that it has made over the last few days. The index closed the day above the 12600 region which is still above the strong resistance turned support at the 12500 region which should continue to give confidence to the bulls.

DAX Consolidates

The index does not have much by way of fundamentals or economic data to go by for the past few days and it has been driven mainly by the way that the major global indices have been moving during this period. The threat of the trade war continues to have a diminishing effect on the markets and it could well be that, it would be forgotten in due course of time did someone from the US or China begins to rattle the sabre once again. Till that time, the market is likely to be driven by the fundamentals and with the US-first policy followed by the current government, it is likely that the US stock indices would continue to remain strong.

This is likely to keep the DAX buoyant along with the fact that there still isnt any sign of the QE being tapered or wound down in due course of time by the ECB. This is also a time when the markets are slow due to the lack of any major fundamental or economic news and so we can safely expect some consolidation to happen with some buoyancy bound to be in the markets for the short term.

Looking ahead to the rest of the day, we do not have any major news from Germany or the Eurozone but we believe that the index would open the day on the backfoot as many of the major markets in Asia have taken the cue from the close of the US stock indices and are trading in a weak manner. We could see the DAX pick up later in the day which should help it to remain buoyant as it heads into the weekend.

This article was originally posted on FX Empire

More From FXEMPIRE:

What are ILP’s (Initial Loan Procurements) and How Does it Work?

Gold Price Futures (GC) Technical Analysis – Trading on Weak Side of Long-Term Fib Level at $1250.00

Trump Wants a Strong US Dollar but Not Too Strong; Trade War Escalates

AUD/USD Forex Technical Analysis – Move Through .7484 Changes Minor Trend to Up

Stocks Lower as Trump Threatens to Go All in on Tariffs Against China

Yahoo Finance

Yahoo Finance