Death of cash helps boost tax revenue by £12bn

The death of cash has raked in an extra £12bn for Jeremy Hunt as card and digital payments make it harder for people to dodge tax.

Richard Hughes, chairman of the Office for Budget Responsibility (OBR), said the shift away from notes and coins had proven lucrative for the taxman because it was now harder to avoid value added tax (VAT).

He said: “The death of cash has been very good for VAT receipts. The fact that people are no longer using cash has reduced the VAT gap dramatically,” referring to the difference between the amount of revenue expected and the amount of tax actually collected.

The OBR said the VAT “tax gap” has fallen from the equivalent of 0.8pc of GDP in 2005-06 to 0.3pc in 2021-22. In cash terms, it has boosted tax income by £12.1bn.

Cash was used for fewer than one-in-five transactions in 2022, according to the British Retail Consortium (BRC), down from more than half a decade ago.

Typically notes and coins are used for smaller purchases. The value of transactions involving cash is just a tenth of the total, the BRC said.

By avoiding the anonymity of cash-in-hand transactions, card payments and digital transfers make it easier for the authorities to levy the 20pc transaction tax.

Mr Hughes told a Budget event at the Resolution Foundation think tank: “The Government’s efforts to crack down on tax avoidance have also boosted the tax to GDP ratio without raising anybody’s rate, so the Government deserves some credit on working harder to collect some peoples’ tax.

“The death of cash is making that easier as well.”

Mr Hunt, the Chancellor, announced plans to give HMRC more resources to chase taxes the state is owed in Wednesday’s Budget.

He said: “I will provide HMRC with the resources they need to ensure everyone pays the tax they owe leading to an increase in revenue collected of over £4.5bn across the forecast period.”

There are currently £81.3bn worth of banknotes in circulation, according to the Bank of England, up by 44pc from £56.2bn in 2014.

Figures from the OBR also indicated that taxpayers face a £104.2bn bill to cover losses linked to the Bank of England’s money-printing programme amid warnings that a jump in interest rates could push up the cost by a further £50bn.

The Bank hoovered up almost £900bn of UK debt during the pandemic and financial crisis in an effort to prop up the economy. The process is known as quantitative easing (QE).

At the time, it generated huge profits that were transferred to the Treasury as the Bank made more money on its holdings of UK gilts than the interest it paid on reserves held by commercial lenders.

This has reversed as interest rates have surged from their record lows. The Bank has also started actively selling some of its stockpile of gilts at a loss.

“Since Bank Rate and gilt yields rose from their record lows in the second half of 2022, the Bank of England’s Asset Purchase Facility (APF) has gone from making a profit to making a loss,” said the OBR. “Having transferred £123.9bn of cash profits to the Treasury between January 2013 and October 2022, a total of £49.4bn has been transferred from the Treasury to cover losses incurred by the APF since then.”

The OBR said its current estimate of the lifetime cost of quantitative tightening as the Bank continues to reduce its stockpile of debt was £21.9bn lower than forecast in November as lower interest rates reduce the Bank’s costs.

It said the estimate was highly sensitive to changes in interest rates. If interest rates average 3.4pc in the coming year instead of the 4.4pc it was currently predicting, the lifetime cost would fall to £46.6bn, according to the OBR. By contrast, if interest rates averaged 5.4pc for the whole year, the lifetime cost would soar to £156.9bn.

The OBR cautioned that these estimates for the cost of QE were far from comprehensive because money printing “supported the economy, asset prices, and financial markets at various points of stress over the past 15 years”.

Read the latest updates below.

08:08 PM GMT

That’s all for today...

Thanks for joining us on the Markets blog. We’ll be back in the morning before the London Stock Exchange opens to keep you informed of the latest business news.

07:58 PM GMT

Decline in face-to-face interviews has harmed hiring, warns recruiter

The post-pandemic decline in face-to-face job interviews is harming recruitment, a top consultancy has warned. Adam Mawardi reports:

Robert Walters said the rise of virtual vetting is denting the confidence of candidates wanting to switch jobs.

Toby Fowlston, the chief executive of Robert Walters, said the ability for employers to “look [job seekers] in the eye” is becoming more important as many seek reassurance about potential layoffs and cost-cutting.

He said: “It comes down to the confidence to know that they’re going into a secure environment, that they’re not going to be the first to be moved out if things get tougher.

“It’s a personal, human decision to move from one company to another. We should not commoditise that process.”

Businesses continue to rely on remote interviews over Zoom and Microsoft Teams, which many argue are quicker and easier than traditional face-to-face interviews.

Meanwhile, many younger Generation Z workers are reportedly refusing to come into the office for job interviews.

07:47 PM GMT

Novo Nordisk overtakes Tesla after positive drug trial news

Novo Nordisk on Thursday surpassed Tesla in market valuation after the maker of the popular weight-loss drug Wegovy announced positive early trial data for a highly anticipated new obesity drug.

Shares surged 9pc to record highs, shooting Novo Nordisk up in global rankings to the 12th most valuable company from 14 previously, after it told investors a Phase I trial of the pill version of experimental drug amycretin showed participants lost 13.1pc of their weight after 12 weeks.

That compares to a weight loss of about 6pc after 12 weeks and 15pc after 68 weeks in trials for Wegovy, its blockbuster obesity drug.

Investors welcomed the news as indicating Novo had more in its pipeline beyond its hugely successful Wegovy.

Novo’s shares have risen more than three-fold since June 2021 when it launched Wegovy in the United States, last year becoming Europe’s most valuable listed company, ahead of luxury goods group LVMH.

On Thursday, its market valuation reached $566bn, ahead of Tesla and Visa, according to LSEG data.

07:21 PM GMT

Official figures on jobs won’t give the Bank of England a reason to cut rates, say economists

New government figures on the labour market is unlikely to encourage the Bank of England to cut interest rates, a leading economics consultancy has said.

Pantheon Macroeconomics has issued a briefing saying:

The next round of official labour-market data, due on March 12, is unlikely to give the [Monetary Policy Committee] a strong reason to signal an imminent rate cut.

Redundancies remain low, unemployment likely held steady, and we look for another hefty month-to-month gain in wages. Ever since the pandemic, business surveys have signalled weaker jobs growth than the hard data ...

So far this year, the Insolvency Service has received 14pc fewer redundancy notifications than in 2023.

Meanwhile, the net balance of consumers expecting the unemployment rate to rise in GfK’s consumer confidence survey—one of the most reliable indicators of unemployment rate changes—points to stable unemployment ...

These data show firms held on to the workers they already had during last year’s minor recession, rather than letting them go unnecessarily.

Slower GDP growth instead showed up in vacancies, which fell 19.5pc in the second half of last year, on the basis of ONS data.

So, employment growth is unlikely to improve much as the economy picks up pace again in 2024, with firms hoarding labour.

07:14 PM GMT

Non-doms plot exodus in wake of Budget crackdown

Tax lawyers have been inundated with phone calls from non-doms planning to leave Britain after Jeremy Hunt announced a crackdown in the Budget. Charlotte Gifford, Eir Nolsøe and Tim Wallace have the details:

Members of the international elite attacked the Chancellor’s plan to scrap the tax status as “arrogant” and “short-termist” and began drawing up plans to move away within hours of the change being announced.

Christopher Groves, a partner at high-end international law firm Withers, said: “The phones started to ring yesterday as soon as the announcement came out. Lots of people are trying to work out what it means for them.”

Mr Groves said that one non-dom client, who is based in the UK with a large international business spread across Europe, instantly got in touch via WhatsApp.

In a message, the client said: “It’s really bad. Arrogant and short-termist and very damaging to the UK’s image as a good place for international wealth creators. How could anyone with serious wealth ever consider coming and putting down roots in the UK. So stupid.”

The client is in the process of expanding their international business in the UK but is questioning his choices.

Continue to read the full story...

06:52 PM GMT

David Cameron’s former business partner faces disqualification as director

An Australian businessman who once worked with David Cameron is at risk of disqualification as a director after the Government launched proceedings to strike him off. Matthew Field reports:

Lex Greensill is facing action from the Insolvency Service on behalf of Business Secretary Kemi Badenoch, who is seeking to bar him from running British companies.

Details of the claim have not yet been made public. A spokesman for Mr Greensill said he intended to fight the action.

Greensill was at one point valued at $3.5bn (£2.75bn), raising hundreds of millions of dollars from investors including Japan’s SoftBank, and employed Lord Cameron as a part-time adviser.

The specialist lender allowed businesses to pay their invoices early, effectively loaning them money. Its loans were then packaged up and sold to investors.

However, as the pandemic hit, the companies began defaulting on their loans. One of Greensill’s key insurers failed to renew its cover and it was unable to repay a loan of $140m (£109m) to Credit Suisse.

06:38 PM GMT

Bank of England money-printing policies will cost £104bn to unwind, says OBR

Taxpayers face a £100bn bill to cover losses linked to the Bank of England’s money-printing programme amid warnings that a jump in interest rates could push up the cost by a further £50bn. Our economics editor Szu Ping Chan has the details:

The Office for Budget Responsibility (OBR), the Government’s tax and spending watchdog, estimated that the lifetime cost of unwinding Threadneedle Street’s massive bond buying scheme currently stood at £104.2bn.

The Bank hoovered up almost £900bn of UK debt during the pandemic and financial crisis in an effort to prop up the economy. The process is known as quantitative easing (QE).

At the time, it generated huge profits that were transferred to the Treasury as the Bank made more money on its holdings of UK gilts than the interest it paid on reserves held by commercial lenders.

This has reversed as interest rates have surged from their record lows. The Bank has also started actively selling some of its stockpile of gilts at a loss.

“Since Bank Rate and gilt yields rose from their record lows in the second half of 2022, the Bank of England’s Asset Purchase Facility (APF) has gone from making a profit to making a loss,” said the OBR. “Having transferred £123.9bn of cash profits to the Treasury between January 2013 and October 2022, a total of £49.4bn has been transferred from the Treasury to cover losses incurred by the APF since then.”

The OBR said its current estimate of the lifetime cost of quantitative tightening as the Bank continues to reduce its stockpile of debt was £21.9bn lower than forecast in November as lower interest rates reduce the Bank’s costs.

It said the estimate was highly sensitive to changes in interest rates. If interest rates average 3.4pc in the coming year instead of the 4.4pc it was currently predicting, the lifetime cost would fall to £46.6bn, according to the OBR. By contrast, if interest rates averaged 5.4pc for the whole year, the lifetime cost would soar to £156.9bn.

The OBR cautioned that these estimates for the cost of QE were far from comprehensive because money printing “supported the economy, asset prices, and financial markets at various points of stress over the past 15 years”.

It added: “The wider economic and fiscal benefits of these interventions would need to be considered in any comprehensive assessment of the impact of QE.”

06:31 PM GMT

Darktrace boosted by hackers using ChatGPT

The rise of hackers using artificial intelligence systems such as ChatGPT has led to a leap in sales at the British cyber security company Darktrace as companies seek to fend off attacks. James Titcomb reports:

Darktrace, which defends companies from cyber attacks by detecting unusual activity on their IT networks, upgraded full-year sales and profit forecasts on Thursday.

This sent shares up by as much as 18pc before they closed 6pc up. Darktrace said it had observed a rise in “novel social engineering” attacks, which attempt to trick victims into clicking on malicious links or giving away information by manipulating them, driven by AI.

Revenues climbed by 27pc to $330.3m (£259m) in the six months to the end of December while profits soared, from $581,000 to $52.5m.

06:25 PM GMT

Selfridges tycoon files for insolvency

Selfridges tycoon Rene Benko has filed for insolvency following the implosion of his property empire Signa. Daniel Woolfson has the details:

In the latest chapter of Mr Benko’s downfall, the embattled businessman voluntarily filed for personal insolvency in Austria, four months after his business Signa collapsed.

Signa, which remains a shareholder in Selfridges, has been battling financial turmoil ever since higher interest rates piled pressure on multibillion-pound debt pile.

Mr Benko’s decision to file for insolvency, first reported by Bloomberg, comes after an Austrian lawyer alleged he failed to make financial commitments during Signa’s insolvency process.

After founding Signa in 1999, Mr Benko was ousted by the company’s shareholders in November after restructuring experts were brought in to oversee the business.

Signa’s portfolio includes stakes in London’s Selfridges, New York’s Chrysler Building and Berlin’s KaDeWe luxury department store.

However, Thai retailer Central Group seized majority control of Selfridges’ operating company in November by converting a €364m (£317m) loan into equity.

06:23 PM GMT

Virgin Money shares surge after takeover offer

Shares of Virgin Money UK rallied 35pc, their biggest percentage gain on record, after Nationwide Building Society agreed to buy the bank in a potential £2.9bn deal to create the country’s second-largest savings and mortgage provider.

The offer represented a premium of 38pc to Virgin Money’s Wednesday close.

Russ Mould, investment director at AJ Bell, said:

Nationwide is effectively pouncing on Virgin Money at a time when prospects are improving for its industry, albeit we’re still in a volatile period until the base rate starts to come down.

Data from mortgage lender Halifax showed British house prices rose for a fifth month in a row in February, echoing other signs of a recovery in the housing market.

Mr Mould added that the “bid premium is not overly generous and sits well below the 51pc average seen last year with UK-listed takeovers”, noting that there could be competing offers from other firms.

05:45 PM GMT

Packaging giants reach merger deal

Packaging giants Mondi and DS Smith have agreed to merge in an £5.1bn deal to create an European industry leader.

The FTSE 100 companies told investors yesterday afternoon that Mondi shareholders would own 54pc of the combined group, with current DS Smith shareholders receiving 46pc of Mondi.

They said DS Smith shareholders would effectively receive a 33pc premium on the value of their shares yesterday.

The companies believe the merger will bring “substantial” benefits including cost-savings and economies of scale.

Last month, Mondi paid out a special dividend to investors from the €775m (£663m) disposal of its Russian business. The company had been in Russia for more than two decades and the country accounted for around 20pc of the company’s underlying profits.

05:38 PM GMT

Death of cash helps boost tax revenue by £12bn

The death of cash has raked in an extra £12bn for Jeremy Hunt as card and digital payments make it harder for people to dodge tax, writes Tim Wallace.

Richard Hughes, chairman of the Office for Budget Responsibility (OBR), said the shift away from notes and coins had proven lucrative for the taxman because it was now harder to avoid value added tax (VAT).

He said: “The death of cash has been very good for VAT receipts. The fact that people are no longer using cash has reduced the VAT gap dramatically,” referring to the difference between the amount of revenue expected and the amount of tax actually collected.

The OBR said the VAT “tax gap” has fallen from the equivalent of 0.8pc of GDP in 2005-06 to 0.3pc in 2021-22. In cash terms, it has boosted tax income by £12.1bn.

Cash was used for fewer than one-in-five transactions in 2022, according to the British Retail Consortium (BRC), down from more than half a decade ago.

Typically notes and coins are used for smaller purchases. The value of transactions involving cash is just a tenth of the total, the BRC said.

By avoiding the anonymity of cash-in-hand transactions, card payments and digital transfers make it easier for the authorities to levy the 20pc transaction tax.

Mr Hughes told a Budget event at the Resolution Foundation think tank:

The Government’s efforts to crack down on tax avoidance have also boosted the tax to GDP ratio without raising anybody’s rate, so the Government deserves some credit on working harder to collect some peoples’ tax.

The death of cash is making that easier as well.

Mr Hunt, the Chancellor, announced plans to give HMRC more resources to chase taxes the state is owed in Wednesday’s Budget.

He said:

I will provide HMRC with the resources they need to ensure everyone pays the tax they owe leading to an increase in revenue collected of over £4.5bn across the forecast period.

There are currently £81.3bn worth of banknotes in circulation, according to the Bank of England, up by 44pc from £56.2bn in 2014.

05:14 PM GMT

Plane parts maker’s profits take off despite supply chain problems

The owner of plane parts maker GKN Aerospace has unveiled a big jump in profits but warned that supply chain issues continue to constrain growth. Matt Oliver reports:

Melrose Industries today said adjusted profits rose from £62m to £331m in 2023, after sales leapt from £3bn to £3.4bn.

It comes after the company spun off its GKN Automotive and powdered metallurgy businesses into a new listed entity, Dowlais, last year.

Melrose, which used to go by the motto of “buy, sell, improve” and follow a private equity-style model, says it is now focused on being a “pure play” aerospace business.

Peter Dilnot, the company’s new chief executive who took over from departing veteran Simon Peckham this week, said the business had a plentiful order book as the global aviation sector continues to bounce back from the pandemic and governments spend more on defence.

However, he said that huge demand for parts since the pandemic was still limiting the rate at which plane makers and their suppliers can fulfil those orders.

Melrose, which now focuses on engine parts and structures for planes, is a supplier for virtually all major aircraft made by Airbus and Boeing, while providing components used in military craft such as western F-35 stealth jet fighters and Black Hawk helicopters.

05:06 PM GMT

Fed chair pushes back against idea that surge pricing causes inflation

US Fed chair Jerome Powell has pushed back against the idea that surge pricing will fuel inflation during questioning in the US Senate today.

Surge pricing is used in Britain by companies such as Uber to manage demand for its cabs, and some pubs are using it.

Mr Powell told the US Senate Banking Committee that it was part of commercial freedom:

The price mechanism is incredibly important in our economy. I think we need to give companies the freedom to do that as long as they’re not fixing prices or failing to disclose the nature of the price changes to the public ...

My understanding is that the idea is that in slow periods, prices actually go down.

04:58 PM GMT

Footsie closes up

The FTSE 100 closed up 0.17pc today. The biggest riser was Rentokil Inital, up 17.67pc after a strong set of results, followed by Anglo American, up 5.09pc. The biggest faller was Ladbrokes owner Entain, down 4.87pc, followed by HSBC, down 3.48pc.

Meanwhile, the FTSE 250 rose 0.57pc. The biggest riser was takeover candidate Virgin Money, up 34.99pc, followed by ITV, up 12.17pc. The biggest faller was investment manager Quilter, down 5.75pc, followed by insurance group Lancashire Holdings, down 4.40pc.

04:55 PM GMT

Wegovy manufacturer jumps 10pc on news it will target China

Novo Nordisk has said it expects Wegovy to be approved for sale in China this year and plans to soon launch the popular weight-loss drug in the largest Asian market with capped volumes.

The upcoming launch in China will initially focus on patients paying out-of-pocket for Wegovy, the head of Novo’s business in China, Christine Zhou Xiaping, told an investors.

Wegovy had its debut in Japan, its first Asian market, in February. The Danish drugmaker has launched the drug in eight countries since its debut in the United States in 2021.

The company is racing to increase supplies of the blockbuster drug to meet soaring demand but has had to cap volumes in most markets. Eli Lilly, which makes rival weight loss drugs, has said it expects demand to outpace supply in 2024.

Wegovy belongs to a class of drugs originally designed to treat type 2 diabetes, which have been shown to reduce food cravings and empty the stomach more slowly.

Novo Nordisk shares lept 10.2pc today.

04:29 PM GMT

Pest control giant surge 18pc as takeover pays off

Rentokil Initial shares have surged by more than 18pc today after the pest control and facilities management giant announced that pre-tax profits for 2023 had jumped 66.9pc.

The company, which delivered revenue growth of 44.7pc, has been expanding in the US after spending $6.7bn on pest control brand Terminix in a deal that completed in October 2022.

04:15 PM GMT

Fed chair tells Congress he needs more proof that inflation is cooling

Jerome Powell, chair of the US Federal Reserve, has doubled-down on his position on interest rates in testimony on Capitol Hill today, saying that the Fed’s next move on interest rates is likely to be a cut, but it first needs to see additional data showing inflation is cooling.

After getting criticism for waiting too long before raising interest rates when inflation was accelerating, Mr Powell faced questions from the US Senate banking committee about the possibility that it could be too late in cutting rates.

That would cause undue pain because high rates slow the economy.

“We’re well aware of that risk, of course,” Mr Powell said. He said if conditions continue as expected, including a strong job market and cooling inflation, cuts will come later this year. Cutting rates too early could risk a reacceleration of inflation.

It’s a key point on Wall Street because cuts to rates would release pressure on the economy and the financial system.

After shelving earlier forecasts for cuts to begin in March, traders now see June as the likeliest starting point.

The Fed’s main interest rate is at its highest level since 2001.

04:03 PM GMT

House prices bounce back faster than expected

House prices have risen for the fifth month in a row, according to the latest figures from the Halifax House Price Index, as they bounce back faster than expected thanks to falling interest rates.

The average house rose by 0.4pc in February, or 1.7pc over the past year, raising the typical UK home to £291,699.

The biggest rises over the last year have been in Northern Ireland, where average prices have jumped 5pc, while homes in Eastern England dropped by 0.8pc.

Kim Kinnaird of Halifax said: “The average price tag of a home is now only around £1,800 off the peak seen in June 2022. While it is encouraging that we’ve seen growth in recent months, what happens next remains uncertain.”

03:33 PM GMT

Handing over

That’s enough Budget reaction for me for one day - Alex Singleton will make sure you’re kept up to speed into the evening.

Jeremy Hunt announced a plan to improve productivity in the NHS during his Budget speech.

I wonder if he was hoping to inspire the kind of output produced by this bakery deliveryman riding his bicycle along the al-Darb al-Ahmar district in Cairo this week.

03:23 PM GMT

Everything wrong with the Great British Isa

The Chancellor is committed to getting savers to invest more in British companies - but his British Isa plan may not be the answer.

Our money reporter Madeleine Ross analyses the scheme:

The Budget on Wednesday reflected Jeremy Hunt’s commitment by introducing a raft of measures focused on ensuring Britons do precisely that.

Reforms will make it easier for pension funds to invest in British companies. Jeremy Hunt also confirmed that defined contribution and local authority pensions will have to declare the breakdown of their asset allocations internationally.

But the key policy is that savers will be given an extra £5,000 annual Isa allowance if they invest in British stocks.

Read what the scheme means for you.

02:57 PM GMT

FTSE 250 nears one-year high as British Isa to inject £1.5bn

The FTSE 250 rose close to a one-year high following the Budget announcement of a British Isa designed to encourage investment into UK stocks.

London’s midcap index gained as much as 1.2pc today after analysts at Citi said the scheme could inject £1.5bn into UK equities.

The figure is considered relatively small, with the market cap of the FTSE 100 standing at £2 trillion.

However, it could have a little more impact on the FTSE 250, which has a market cap of about £353bn.

02:43 PM GMT

US stock markets rise amid rate cut hopes

Wall Street’s main indexes opened higher ahead of more commentary from Jerome Powell after the Federal Reserve chairman stuck to the script overnight by saying the central bank still expects to cut rates later this year.

The Dow Jones Industrial Average rose 123.25 points, or 0.3pc, at the open to 38,784.30.

The S&P 500 opened higher by 27.62 points, or 0.5pc, at 5,132.38, while the Nasdaq Composite gained 115.78 points, or 0.7pc, to 16,147.32 at the opening bell.

02:29 PM GMT

Badenoch: India election is not deadline for trade deal

Kemi Badenoch said she did not see a forthcoming election in India as a deadline for securing a trade agreement between the countries, saying it would be “challenging” to secure a deal by then but possible.

Britain and India have held stop-start talks over a Free Trade Agreement (FTA) for two years, and both countries are set to hold elections in 2024, which could complicate the timeline for negotiations.

Indian Prime Minister Narendra Modi is seeking to win a third term, with the official election campaign expected to begin in the coming weeks.

The Trade Secretary said at an event in Chatham House in London:

We can actually sign an agreement before the Indian election. I suspect that that is not necessarily going to be the case because I don’t want to use any election as a deadline.

It is possible that we can sign, but I’m not using it as a deadline.

02:17 PM GMT

Lagarde: ECB not ‘not sufficiently confident’ to start cutting rates

The European Central Bank is not yet “sufficiently confident” on progress being made on reducing inflation towards its two-percent target, president Christine Lagarde said, after policymakers froze interest rates again.

She told a press conference: “We are making good progress towards our inflation target.... but we are not sufficiently confident.”

She added: “We will know a lot more in June”.

Many analysts expect the ECB to start cutting rates that month.

02:05 PM GMT

Bonds rally as hopes raise for eurozone interest rate cuts

Eurozone government bond yields extended their fall after the European Central Bank revised down its inflation and economic growth projections, opening the way for rate cuts later this year.

The ECB estimates for inflation excluding energy and food have also been revised down, and average 2.6pc for 2024, 2.1pc for 2025 and 2pc for 2026.

Bond yields have risen in 2024 - with the German 10-year yield up around 30 basis points - as investors have reined in expectations for rapid and steep interest rate cuts, with economic data coming in stronger than expected and central bankers sticking to a tough line on inflation.

However, Germany’s 10-year bond yield, the benchmark borrowing cost for the euro zone, was last down seven basis points (bps) at 2.26pc.

The UK’s benchmark 10-year gilts yield has fallen three basis points to 3.96pc.

President Christine @Lagarde introduces the economic growth outlook for the euro area pic.twitter.com/M6r3VRDo5H

— European Central Bank (@ecb) March 7, 2024

02:01 PM GMT

Telegraph readers: Everything is broken

Telegraph readers said the “fruits of years of ineffectual government are starting to show” after warnings that Britain faces a £60bn black hole in the public finances, according to Wall Street bank Citi.

Take a look through what some of your fellow readers have said about the assessment that the OBR has been “too optimistic” in its interpretation of the UK’s growth prospects:

01:54 PM GMT

Lagarde: Eurozone economy ‘remains weak’

ECB president Christine Lagarde said the eurozone’s economy “remains weak,” as she delivered her press conference after holding interest rates at their record highs of 4pc.

However, she predicted that: “As inflation falls and wages continue to grow, real incomes will rebound, supporting growth.”

She said: “Governments should continue to hold back energy support measures to allow the disinflation process to continue.”

01:50 PM GMT

Money markets increase bets on eurozone interest rate cuts

Traders are ramping up bets on interest rate cuts by the European Central Bank after it revised lower its predictions for economic growth this year.

Money markets are now forecasting that interest rates could fall by a full percentage point by the end of the year to 3pc.

Meanwhile, the US took another step closer to a so-called “soft landing” for its economy as new figures showed American applications for jobless benefits were unchanged last week as the labour market continues to show strength in the face of elevated interest rates.

Unemployment claims for the week ending March 2 were 217,000, matching the previous week’s revised level, figures from the Labor Department showed.

The four-week average of claims, a less volatile measure, fell by 750 from the previous week to 212,250.

Weekly unemployment claims are broadly viewed as representative of the number of US layoffs in a given week.

They have remained at historically low levels since the pandemic purge of millions of jobs in the spring of 2020.

Claims:

1/ Y/Y continuing claims the lowest they've been since March 2023.

Base effects continue to drop out as last year's (small) burst of layoffs fades into the rear view mirror. pic.twitter.com/HWfquiAb5Y— Guy Berger (@EconBerger) March 7, 2024

01:36 PM GMT

Eurozone to grow less than expected this year, says ECB

The European Central Bank has forecast that the eurozone’s economy would grow more slowly this year than previously predicted before picking up in 2025.

The economy is expected to expand 0.6pc in 2024, before growing 1.5pc in 2025 and 1.6pc in 2026, “supported initially by consumption and later also by investment”.

Previously, the ECB expected growth to come in at 0.8pc for 2024 and 1.5pc for both 2025 and 2026.

🇪🇺 ECB on hold, staff projections revised lower as expected, including core back to 2% by 2026.

Broken record but a forward-leading central bank with a tight policy stance, forecasting inflation back at target in 2025, should cut rates now as real rates move higher. pic.twitter.com/QgqibzDLHG— Frederik Ducrozet (@fwred) March 7, 2024

01:29 PM GMT

Sunak declines to explain how to pay for abolishing NI

The Prime Minister declined to explain how he would pay for his proposal to abolish employee contributions to national insurance.

Rishi Sunak told broadcasters:

I think what people can see from me, I think they trust me on these things, is that I will always do this responsibly.

We funded our current tax cuts responsibly, borrowing hasn’t increased, we are still on track to meet our fiscal rules that have our debt falling.

We have also made sure that we keep investing in our public services, especially the NHS which received even more funding yesterday which was welcomed by the NHS CEO.

And that’s what you get when you stick to a plan. We can invest in the NHS, we can cut people’s taxes and we can continue to have our debt on a falling trajectory.

01:26 PM GMT

ECB holds interest rates as ‘price pressure remain high’

The European Central Bank (ECB) left its key interest rate at a record high as it waits for more confirmation that inflation is under control for good — even as high borrowing costs drag on the stalled economy.

Central banks around the world are trying to judge whether inflation has been tamed to the point that they can start cutting rates — making it cheaper for consumers and businesses to borrow, spend and invest.

The ECB said in a statement: “Although most measures of underlying inflation have eased further, domestic price pressures remain high, in part owing to strong growth in wages.”

01:15 PM GMT

Eurozone interest rates held at 4pc

The European Central Bank has left interest rates unchanged at 4pc, where they have been since September as the eurozone battles against inflation.

01:09 PM GMT

Pound rises as ECB prepares to announce interest rate hold

The pound has edged up after the Chancellor’s Budget tax cuts - but it is expected to remain steady against the euro as the European Central Bank prepares to make its next interest rate decision in the next few minutes.

Sterling rose 0.1pc to $1.27 having earlier hit its highest against the dollar in around a month, and nudged into positive territory against the euro, rising 0.2pc to 85p.

The firmness in sterling was less a product of Jeremy Hunt’s Budget more that of a decline in the dollar after US Federal Reserve chairman Jerome Powell told Congress that interest rate cuts in the US will “likely be appropriate” later this year “if the economy evolves broadly as expected”.

Meanwhile, the European Central Bank is expected to hold interest rates steady at their record highs of 4pc.

12:53 PM GMT

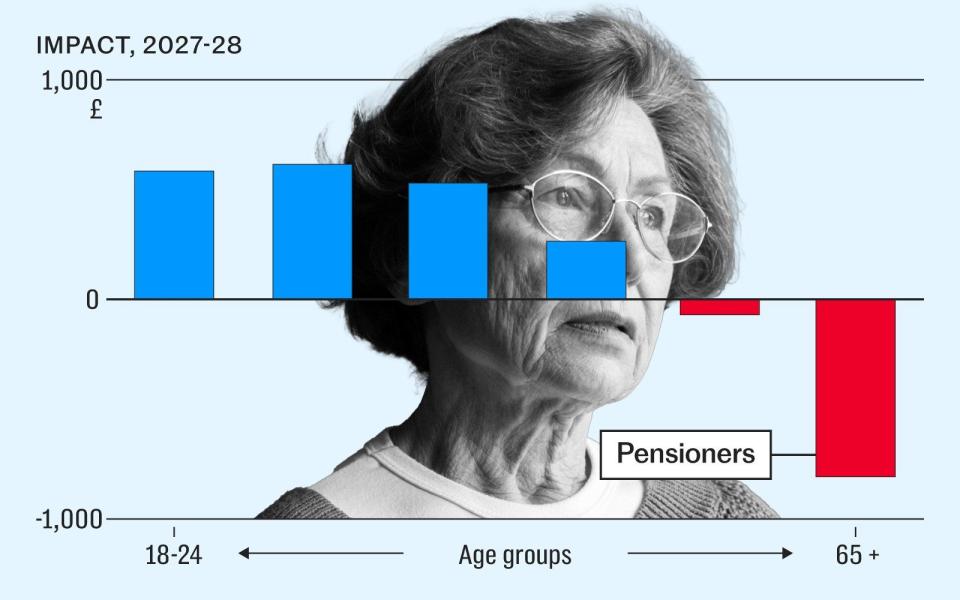

Pensioners suffer biggest losses from Tory tax raid as Hunt boosts millennials

Pensioners and high earners are the biggest losers from Jeremy Hunt and Rishi Sunak’s stealth tax raids as state spending on millennials is prioritised over baby boomers.

Our economics editor Szu Ping Chan has the details:

The Resolution Foundation and the Institute for Fiscal Studies (IFS) both said the elderly would be worse off at the end of this Parliament than they were at the start as a freeze on tax thresholds drags them into paying income tax.

In analysis published after Wednesday’s Budget, the Resolution Foundation warned that eight million retirees faced an average £1,000 hit to their incomes as a result of a six-year freeze on income tax thresholds.

Paul Johnson, director of the Institute for Fiscal Studies (IFS), said pensioners paying higher tax rates faced an even bigger hit of £3,000 as a result of policies announced in this Parliament. He added that “well over” 60pc of pensioners were now subject to income tax.

These charts show how pensioners will suffer the worst hit.

12:29 PM GMT

Gold price hits new record high

Gold has hit a new record peak after Federal Reserve boss Jerome Powell indicated US interest rates would start to come down this year.

The spot price of the yellow metal spiked to a new all-time peak at $2,161.48 per ounce to extend its record-breaking run.

It comes after Mr Powell told the House Financial Services Committee in Congress:

If the economy evolves broadly as expected, it will likely be appropriate to begin dialling back policy restraint at some point this year.

But the economic outlook is uncertain, and ongoing progress toward our two percent inflation objective is not assured.

12:13 PM GMT

Hunt tax raid puts net zero project at risk of collapse

A pioneering net zero project is at risk of collapse after its key investor threatened to pull out because of Jeremy Hunt’s North Sea windfall tax.

Our energy editor Jonathan Leake has the details:

Harbour Energy said that the Viking carbon capture scheme is increasingly unviable because of the Chancellor’s tax raid.

The company, which is the biggest oil and gas producer in British waters, faced an effective tax rate of 95pc as the UK’s windfall levy took $565m (£443m) out of its 2023 earnings – leaving a profit of just $32m.

Mr Hunt announced in the Budget on Wednesday that the tax would be extended for an extra year until 2029, triggering a backlash from the industry and senior Scottish Tories.

Read why Harbour’s chief executive, Linda Cook, said the levy had impacted the company’s ability to invest in Viking.

11:57 AM GMT

Chancellor won’t banish National Insurance, says IFS boss

Jeremy Hunt’s suggestion that the Government will abolish National Insurance would cost £40bn and will not happen, a prominent think tank boss has said.

The Chancellor revealed an ambition to abolish National Insurance for workers as a centrepiece of the Conservative re-election bid.

In his Budget speech on Wednesday,, Mr Hunt criticised “double taxation” by income tax and NI, vowing to “end this unfairness” as he cut the levy by 2p.

However, Paul Johnson, the director of the IFS think tank, has cast doubts on the feasibility of the plan as his organisation delivered is analysis of the Chancellor’s speech.

He said:

Talk of abolishing National Insurance does not look realistic.

Of course, the Chancellor is only talking about the part paid by employees (and the self-employed), not the much bigger part paid by employers.

But this pledge to cut taxes by more than £40bn goes in the same bucket as pledges to increase defence spending – not worth the paper it’s written on unless accompanied by some sense of how it will be afforded.

He added that he also thinks the Chancellor will not raise fuel duties again, which has not happened in 15 years, and that he would not withdraw child benefit on basis of joint income, which is “practically hard and creates losers”.

Things chancellor said yesterday I don't think will happen:

- abolish NICs (cost >£40bn)

- get defence spending to 2.5% GDP (cost>£10bn)

- raise fuel duties (not happened in 15 years)

- withdraw child benefit on basis of joint income (practically hard and creates losers)— Paul Johnson (@PJTheEconomist) March 7, 2024

11:54 AM GMT

Recruitment firms cut jobs as economies struggle

Recruitment companies Page Group and Robert Walters both said they had reduced the number of people they put into work last year as they dealt with tougher labour markets.

Robert Walters said that its headcount was down 9pc to 3,980 at the end of December, while Page’s reduced by 15.7pc to 7,859.

Robert Walters said that its net fee income dipped 10pc to £386.8m in 2023, as its pre-tax profit fell 63pc to £20.8m in the same period.

In the UK its net fee income sank 18pc while in London it plummeted 29pc as the financial services and technology sectors retrenched.

The company was also struggling elsewhere in the world.

“In 2023 we saw the anticipated bounce-back in the Chinese economy fail to materialise, and consolidation of a sharply rising interest rate cycle across many countries, with a resultant cooling in global labour markets,” it said.

Robert Walters shares have gained 2.9pc today while Page Group was little changed.

11:44 AM GMT

Non-dom tax changes risk revenues for Treasury, warns IFS

Jeremy Hunt’s reforms to non-dom tax status has created high uncertainty about potential revenues for the Treasury in the future, the IFS has warned.

However, the economic think tank praised the Chancellor’s reforms, saying that it is a “much more sensible basis for taxation”.

From April 2025, the tax regime will be based on residence rather than whether high-earners claim to be domiciled in another country, meaning they will have to pay UK taxes on foreign income and gains after four years of living in Britain.

However, IFS deputy director Helen Miller warned that rich foreigners “might be less likely to come” to the UK once the changes are introduced, creating a risk to tax revenues.

She added it is unclear what tax revenues the reforms will generate as HMRC “don’t know how much offshore income and gains people have”.

The new residence regime for non-doms will be based on residence, rather than domicile, a more objective basis for tax.

@HelenMillerIFS presents on the changes to non-doms:

Watch live: https://t.co/qJDiN3q18W pic.twitter.com/ECVWNAlG9f— Institute for Fiscal Studies (@TheIFS) March 7, 2024

11:27 AM GMT

Starmer: Government stole Labour’s non-dom policy

Sir Keir Starmer said it was “humiliating” for the Government to have stolen Labour’s non-dom tax policy, and accused ministers of having learned “absolutely nothing” since Liz Truss’s mini-Budget disaster.

Speaking during a visit to a construction site in the City of London, the Labour leader told broadcasters:

How humiliating was that for the Government yesterday?

We’ve argued for years that they should get rid of the non-dom tax status, they’ve resisted that. And now, completely out of ideas, the only decent policy they’ve got is the one that they’ve lifted from us.

Obviously we will keep our commitment to the NHS, so important it is. We’ll go through all of the numbers and we’ll be absolutely clear nothing in our manifesto will be unfunded and uncosted. That is an iron rule for the Labour Party.

Contrast that with the Government, where, yesterday, at the end of the Budget, the Chancellor made a staggering £46 billion unfunded commitment to abolish national insurance.

That’s bigger than Liz Truss’s commitment, so they’ve learned absolutely nothing.

He said the “overall story of the Budget was, as ever, Government give with one hand and take much more with the other”.

11:15 AM GMT

Britain faces ‘depressing’ drop in public sector investment

Investment by Britain’s public sector is set to fall sharply after the next election, according to the IFS.

It predicts that net public sector investment will drop by more than 25pc - the equivalent of £18bn - over the next five years.

Depressing for 3 reasons.

- Public sector investment is low in UK;

- It is due to be cut sharply (whoever wins the election);

- levels are completely unstable, up and down, making planning hard, and one reason why infrastructure projects more expensive in UK than elsewhere. https://t.co/O5CKzuy6Up— Paul Johnson (@PJTheEconomist) March 7, 2024

11:02 AM GMT

Chancellor ‘barely meeting’ fiscal rules, warns IFS

The national debt will inch down by the tiniest of margins, the IFS think tank has warned, as it analyses Jeremy Hunt’s Spring Budget:

The Chancellor is barely meeting his target to have debt falling in the fifth year of the forecast.

It is set to fall by the tiniest of margins between 2027/28 and 2028/29. pic.twitter.com/iMJ0t6uWut— Institute for Fiscal Studies (@TheIFS) March 7, 2024

10:55 AM GMT

Tax burden to hit highest level since the Second World War

The Resolution Foundation also held its post-Budget analysis this morning, in which it highlighted how taxes have gone up during this Parliament at the fastest pace since the Second World War:

...tax cuts in this election year are on course to be followed by £19bn of tax rises after polling today. That's perfectly normal - what's unusual is those tax rises having already been announced pic.twitter.com/ScN3JYAx3p

— Torsten Bell (@TorstenBell) March 7, 2024

10:48 AM GMT

Living standards suffered ‘terrible decade,’ says IFS

A stark graph from the IFS showing how GDP per head - considered a key indicator of living standards - has grown at just 0.5pc per year since 2007, compared to 2.5pc before the global financial crisis:

It's been another terrible decade for economic growth.

Real GDP per capita grew on average by just 0.5% per year between 2007 and 2019, and is forecast to stay at this pace until 2028.

Isabel Stockton presents IFS analysis of the #Budget2024: [THREAD] pic.twitter.com/iEWNFQ0BYl— Institute for Fiscal Studies (@TheIFS) March 7, 2024

However, the think tank has improved its outlook for household incomes in the coming years following the Budget:

Real household disposable income is not forecast to return to pre-pandemic levels before the election this year.

Though the outlook has improved since November 2023's forecast, it means that people will on average be worse off at the end of this parliament then at the start. pic.twitter.com/i0tr0NfOdE— Institute for Fiscal Studies (@TheIFS) March 7, 2024

10:30 AM GMT

Paying down national debt could be most difficult in 80 years, warns IFS

Both the Tories and Labour are maintaining a “conspiracy of silence” about the challenge of reducing debt after the election, a leading think tank has warned.

Our economics reporter Melissa Lawford has the latest:

IFS director Paul Johnson has warned that reducing the national debt in the next parliament could be harder than at any point in 80 years because of high debt interest payments and low economic growth.

In the opening remarks of his post-Spring Budget analysis, he said pensioners are “substantial net losers” - with higher rate taxpayers due to be £3,000 a year worse off by 2027.

Despite the Chancellor’s National Insurance cuts, tax revenues will have risen by a record amount as a share of national income over this parliament.

He said the pledge to scrap NI is “not worth the paper it’s written on” without a plan for how to pay for it.

Mr Johnson also questioned the costing of the actual tax cuts. He said: “We got some immediate, definite, tax cuts part paid for by a smorgasbord of future, uncertain tax rises.”

He added: “Government and opposition are joining in a conspiracy of silence in not acknowledging the scale of the choices and trade-offs that will face us after the election. They, and we, could be in for a rude awakening when those choices become unavoidable.”

10:22 AM GMT

ITV profits more than halve amid advertising slump

ITV’s profits have more than halved as the broadcaster battles a slump in advertising revenues.

James Titcomb and James Warrington have the details:

The company reported full-year profits of £193m for 2023, down from £501m in 2022, as advertising income dropped by 8pc.

Following the results, ITV said it would cut costs faster than previously expected, completing a £150m savings plan a year earlier than planned.

It said it would also conduct a further restructuring programme to save another £50m a year.

Chief executive Dame Carolyn McCall said last year that the company was going through the worst advertising downturn since the financial crisis.

09:46 AM GMT

Household tax bill is £4,000 higher

Households are paying an extra £4,000 in tax a year compared to the start of this Parliament in 2019, according to a think tank, writes Tim Wallace.

James Smith at Resolution Foundation said:

Taxes are very much going up, the tax take overall is still very high, the rise over the parliament is equivalent to nearly £4,000 per household.

This is a big change in taxes.

09:43 AM GMT

Britain faces £60bn black hole, claim City bankers

The UK’s spending watchdog has been “too optimistic” with its growth projections for the British economy, leaving the Government with a £60bn black hole in the public finances, according to a Wall Street bank.

Analysts at Citi said that the Office for Budget Responsibility (OBR) had over estimated Britain’s potential productivity - a measure of economic performance - over its forecast period.

They have warned that while the OBR predicts British output will rise by about 0.9pc year-on-year, which is about double the level seen since the pandemic.

Citi thinks a more realistic measure of productivity would be 0.5pc as the economy is likely to face “supply shocks” in the years ahead.

It fears fiscal forecasts are £30bn to £35bn worse than the OBR’s latest predictions and that the cuts to public spending penciled in are also “undeliverable,” meaning the Government will realistically need to spend another £20bn to £25bn than what is already planned.

Citi said that in total it means forecasts are “offside” by £50bn to £60bn.

In a note to clients, the bank warned “we think is post-Covid fiscal headwinds are only just beginning”.

09:32 AM GMT

Real wages will not hit pre-2008 levels until 2026, warns think tank

Jeremy Hunt’s Budget giveaway has been funded by “fiscal fiction” public spending cuts, according to the Resolution Foundation.

James Smith, research director at the think tank, told a press conference that “big cuts to public spending” are coming after the general election. He said:

The Government are pencilling overall day-to-day spending numbers beyond the end of the spending review, from 2025-26 onwards.

And if you take out what the Government has said it will guarantee in terms of health, defence, education, then you end up with those unprotected departments.... with really, really big cuts.

So this is something like three quarters of the intensity of the the cuts that we got from 2010 and it’s getting on for £20bn. So you can think of tax cuts, the £20bn national insurance giveaway that we’ve had since autumn has been essentially funded by these fiscal fiction spending cuts that are pencilled in.

On living standards, he said: “We don’t get back to the pre-2008 level of real wages until 2026. So that’s nearly two lost decades of real wage growth. So that’s an incredibly bleak backdrop in terms of living standards.

“If you look at overall income, this is going to be the first Parliament, which we have comparable income data for, where income is actually falling in real household disposable income terms.”

09:20 AM GMT

M&S confirms departure of co-chief executive

Marks & Spencer has confirmed co-chief executive Katie Bickerstaffe will retire from the retailer in July after just over two years in the role.

The high street giant said Ms Bickerstaffe will leave after the group’s annual general meeting to “pursue her board career” with plans to take other roles in company boardrooms.

She was appointed co-chief executive in March 2022, reporting to chief executive Stuart Machin but with responsibility for overseeing areas such as data, digital and technology.

The group said in January that Rachel Higham will be joining M&S from marketing giant WPP in the new financial year to take over leadership of data and technology and will sit on the executive committee.

Ms Bickerstaffe joined M&S in 2018 as a non-executive director before moving into an executive role in 2020, then becoming co-chief operating officer alongside Mr Machin in 2021 before taking on the co-chief executive role in 2022.

08:58 AM GMT

Hunt clashes with BBC over ‘unworthy’ portrayal of economy

Jeremy Hunt clashed with Radio 4 Today programme presenter Amol Rajan as he accused the broadcaster of giving a characterisation of the economy which is “unworthy of the BBC”.

Mr Rajan said he was stating facts when the Chancellor objected after being told: “We’ve seen seven quarters of GDP per head that’s been revised downwards. We’re hooked on foreign labour. The birth rate is collapsing. Many public services are creaking. Councils are going bust. Those are facts.”

Mr Hunt replied: “I think the characterisation that you’ve just given of the British economy is unworthy of the BBC.”

As the two spoke over one another, Mr Rajan said: “The BBC is an organisation with tens of thousands of people who do lots of different things.”

Mr Hunt added: “I’m afraid I don’t share your pessimism.”

08:47 AM GMT

UK markets lack direction amid hopes for British Isa

UK stock markets were mixed amid weak performances by financial and mining stocks but optimism about the impact of a British Isa.

The blue-chip FTSE 100 was down 0.3pc, while the midcap FTSE 250 rose by 0.2pc amid renewed excitement about domestically-focused stocks.

Banks declined by 2.4pc amid weak performances by HSBC and Standard Chartered, while base metal miners shed as much as 1.1pc as Rio Tinto traded ex-dividend.

Aerospace supplier Melrose fell 4.6pc to the bottom of the FTSE 100 despite beating annual profit view for 2023.

Meanwhile, Entain dropped 3.9pc after the gambling group said that some regulatory measures in the UK and Netherlands would hurt its profit forecast for the current financial year.

On the flip side, Virgin Money UK jumped 36.2pc to the top of the FTSE 250 after Nationwide Building Society agreed to potentially buy the lender in a deal valued at about £2.9bn.

Rentokil Initial surged 13.1pc to the top of the FTSE 100 after the pest control firm reported a 50pc jump in annual profit.

Investors will also focus on the European Central Bank’s interest rate decision later in the day, where it is largely expected to keep its policy rates unchanged.

08:31 AM GMT

Hunt accused on BBC of being ‘fiscal drag queen’

Jeremy Hunt insisted the Conservatives are the party that want to bring taxes back down after being accused of being a “fiscal drag queen” who is causing people’s taxes to go up.

The Chancellor admitted he had been forced to put up taxes as a result of the pandemic and the war in Ukraine.

Asked on BBC Radio 4’s Today programme by presenter Amol Rajan whether he is the “fiscal drag queen of British politics,” he said:

Taxes did have to go up. The choice now is do we want them to stay high or do we start to bring them down?

I happen to believe if you look around the world, the fastest growing economies are the ones in North America and Asia which tend to have lower tax rates.

So I want to make a start on bringing down taxes. I have never said I can bring them down all in one go.

He admitted someone on the average wage will see their taxes go up in the coming year by more than £200 but added that the National Insurance cut would save them £900.

He added: “Does that take taxes back down to before the pandemic? No, but it is a start.”

08:13 AM GMT

British Isa adds ‘damaging complexity,’ warns investment boss

The British Isa will not achieve its aims to boost UK-listed companies and will instead add “complexity” to the Isa savings market, an investment company boss has warned.

AJ Bell chief executive Michael Summersgill said he is “not a fan” of the plan, which will give savers an extra £5,000 allowance in their Isas to invest exclusively in British stocks.

Mr Summersgill told BBC Radio 4’s Today programme:

The aim of the product, which is to increase investment into UK businesses, is clearly a good one.

This product will not achieve those aims.

In fact, it adds damaging complexity to the Isa regime.

He said the maximum the Chancellor could hope for through the scheme would be an extra injection of £4bn into UK listed companies, which he said is 0.2pc of the £2 trillion stock market.

He said: “It is a rounding error and it adds complexity into the Isa regime, which is what really concerns me.”

08:09 AM GMT

UK markets mixed at the open

Domestically-focused stocks in London rose again as markets opened after a rally caused by the announcement of a British Isa designed to increase investment in UK listed companies.

The FTSE 100 fell 0.3pc to 7,659.84 but the midcap FTSE 250 - which gained 1.1pc on Wednesday - rose by 0.1pc to 19,495.43.

08:00 AM GMT

Hunt: We have done a lot to support people on low incomes

Jeremy Hunt has insisted he has done “a lot of things” to support people on low incomes amid accusations that people earning less than £15,000 will be worse off in the coming years under his Budget.

He told BBC Breakfast:

I chose in the Autumn Statement to increase benefits for people on low incomes in work and out of work by more than double the rate of inflation.

I increased the local housing allowance, which is about £800, to 1.6m people on low incomes.

Yesterday I extended the household support fund.

We have done a lot of things to make sure we support people on low incomes.

07:50 AM GMT

Reeves: Hunt must show how he is paying for NI cut

Chancellor Jeremy Hunt needs to explain “where the money is going to come from” to abolish National Insurance, Rachel Reeves has said.

The shadow chancellor told BBC Breakfast:

Yesterday, at the end of the Budget, the Chancellor started floating this idea that he was going to get rid of National Insurance altogether.

Well, that would cost £46 billion. And I would like to know where that money is going to come from, because I just wouldn’t make a promise like that without being able to say where the money is going to come from.

I think it is incumbent on politicians to be honest about the trade offs that have to be made.

07:36 AM GMT

Hunt ‘not pretending’ he has brought down taxes as fiscal drag hits workers

Jeremy Hunt conceded he was “not pretending” he had brought “all those taxes down” when asked about fiscal drag, whereby people are pulled into higher rates while thresholds are frozen.

The Chancellor also said removing National Insurance altogether would be a “huge job” and suggested it would not happen “any time soon” but that he wants to “end the unfairness” of the system.

He told Times Radio:

Freezing the thresholds is one of the ways in which taxes have gone up in order to pay for the jobs we protected during Covid, to help... families paying their electricity over last winter, all those other very important things.

And I’m not pretending that I brought all those taxes down in one go. We can’t afford to do that. It wouldn’t be responsible to do that. But do I want to carry on bringing them down, as I did yesterday, as I did in the autumn statement? Yes, I do.

Asked whether he was planning another fiscal event before the election, Mr Hunt said: “No, but if there’s an autumn election which is the working assumption then theoretically it would be possible to have one.

“But you know, that’s a decision that’s above my pay grade.”

07:34 AM GMT

Hunt brushes off accusations of shunning pensioners

Jeremy Hunt insisted that the Government has done an “enormous amount for pensioners” and “really prioritised pensioners” amid criticism over the decision to cut National Insurance rather than income tax in the spring Budget.

The Chancellor said that ultimately growing the economy will help increase the state pension.

He told Sky News: “We’ve done an enormous amount for pensioners. This Government introduced the triple lock... we have really prioritised pensioners.”

07:32 AM GMT

Nationwide ‘wholly committed’ to building society model with Virgin Money deal

Virgin Money is the UK’s sixth largest lender and a takeover by Nationwide would create a combined group with total assets of approximately £366.3bn.

Nationwide said it “remains wholly committed” to being a building society (it is the UK’s largest) and a modern mutual.

Bosses said Virgin Money’s £9bn of existing business lending balances and ‘Business Current Account’ would enable Nationwide to broaden its business banking offering and diversify its sources of funding.

Kevin Parry, the Nationwide chairman, said:

A combination with Virgin Money would accelerate Nationwide’s strategy and create a stronger, and more diverse, modern mutual.

The combination would increase Nationwide’s scale and financial strength, put us in a stronger position to continue to provide Fairer Share Payments to eligible Nationwide members, and offer rates for mortgages and savings that are, on average, better than the market average.

David Bennett, the chairman of Virgin Money UK, added that the deal offered “attractive value for our shareholders”.

07:24 AM GMT

Nationwide agrees take over of Virgin Money in £2.9bn deal

High street lender Virgin Money has agreed to a takeover by Nationwide Building Society in a deal worth around £2.9bn, the companies have announced.

Virgin Money shareholders will be paid 220p per share under the deal, which represents a 38pc premium on the lender’s closing price on Wednesday.

07:13 AM GMT

House prices rise for fifth month straight amid more affordable mortgages

House prices are just £1,800 off their record highs after rising for a fifth month in a row in February as falling mortgage rates increased the number of potential buyers, according to an industry survey.

Property values increased by 0.4pc last month when compared to January, according to the Halifax house price index.

However, bosses raised concerns about the outlook for prices after the recent uptick in mortgage rates as the Bank of England is expected to keep interest rates high for longer.

The survey found that average house prices increased to £291,699, around £1,000 more than last month.

Compared to the same month last year, property prices grew by 1.7pc, which was slower than the 2.3pc annual growth recorded in January.

Kim Kinnaird, the director of Halifax Mortgages, said:

While it is encouraging that we’ve seen growth in recent months, what happens next remains uncertain.

Although lower mortgage rates, alongside expectations of Bank of England interest rate cuts this year, should help buyer confidence in the short term, the downward trend on rates is showing signs of fading.

07:13 AM GMT

Hunt’s tax cuts should have been ‘more punchy’, says ex-Bank economist

The Budget could have been “a bit more punchy,” according to a former chief economist at the Bank of England, who fears Jeremy Hunt was held back by the memory of the Liz Truss crisis.

Andrew Haldane said he could not remember many statements by Chancellors that had “fewer white rabbits” pulled out of the hat to impress voters.

Jeremy Hunt announced a 2p cut in National Insurance, although his flagship policy had already been heavily trailed in the media.

He was asked if Mr Hunt had been forced to reassure people in the wake of the Liz Truss mini-Budget, which triggered a crisis in bond markets after the announcement of £45bn of unfunded tax cuts.

Mr Haldane told the BBC that the Chancellor could not have pushed things last year but added: “We’re just about getting far enough away from the Truss Budget to think that financial markets have regained their poise, and therefore something that tells a good story about growth, even if it were at the expense of a bit more borrowing, would be accepted. It would even be welcomed.”

07:06 AM GMT

Good morning

Thanks for joining me. Jeremy Hunt has been accused of failing to spread “fairy dust” on his Budget by a former chief economist at the Bank of England.

Andrew Haldane said that the chaos caused by the Truss mini-Budget was now far enough away in the past for the Chancellor to have tried to have focused more on increasing growth “even if it were at the expense of a bit more borrowing”.

Five things to start your day

1) Revealed: the winners and losers of Jeremy Hunt’s Budget | Telegraph Money outlines whether the Chancellor has left you better or worse off

2) US investor targets Britain’s ‘nuclear triangle’ for mini-nuke factory | Export of reactors built in the UK could be worth £4bn annually

3) Time is running out for Tories to secure trade deal with India, warns billionaire Modi ally | Tycoon Sunil Mittal says Labour are waiting in the wings as elections loom

4) John Lewis unveils record pay rise amid job cuts backlash | Retailer plans to slash redundancy packages to free up cash for wage increases

5) AstraZeneca to build £450m vaccine hub in Liverpool in boost for UK | Move comes as rival pharma giant GSK sounds alarm over soaring cost of operating in UK

What happened overnight

Asian shares were trading mixed, after Wall Street recovered some losses from the day before after the Federal Reserve chairman’s comments that interest rates will likely fall this year.

Japan’s benchmark Nikkei 225 momentarily reached a record high in early trading but slipped later to finish at 39,598.71, down 1.2pc.

Australia’s S&P/ASX 200 rose nearly 0.4pc to 7,763.70. South Korea’s Kospi added 0.2pc to 2,645.62.

Hong Kong’s Hang Seng shed 1pc to 16,269.12, while the Shanghai Composite declined 0.3pc to 3,031.72.

Jerome Powell, the Federal Reserve chairman, said again that cuts to interest rates may be coming this year, but that the Fed needs more data showing inflation is cooling before it will act.

The S&P 500 rose 26.11 points, or 0.5pc, to 5,104.76. The benchmark index fell 1pc a day prior.

The Dow Jones Industrial Average rose 75.86 points, or 0.2pc, to 38,661.05. The Nasdaq composite rose 91.95, or 0.6pc, to 16,031.54.

Yahoo Finance

Yahoo Finance