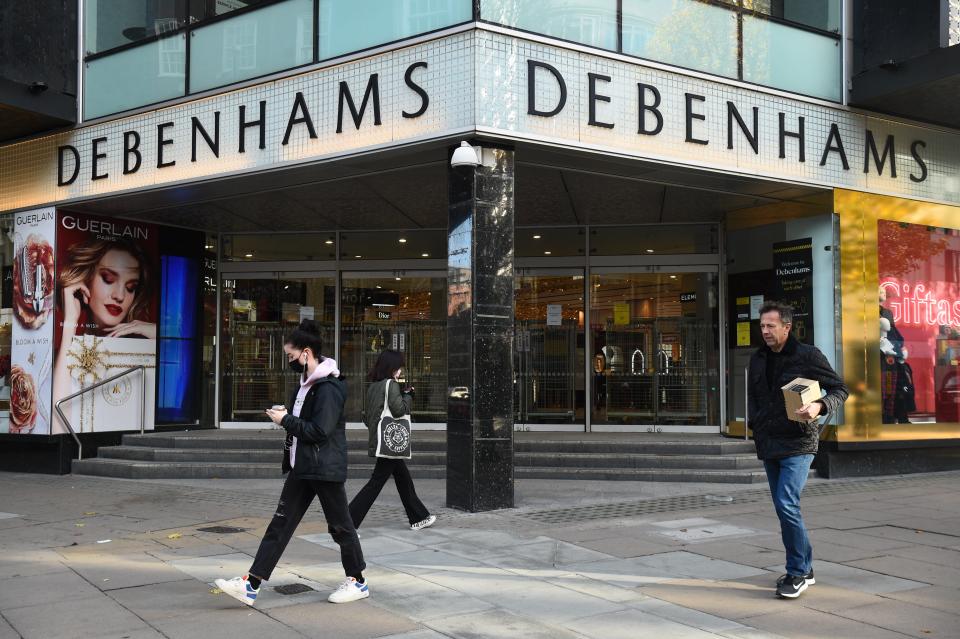

Debenhams store closures: Landlords impacted by the department store chain leaving the high street

Debenhams will not reopen its Oxford Street branch

(PA)In another horrible day for the high street, of which there have been plenty recently, it has emerged that Debenhams will close all of its UK shops.

The move sadly could result in the loss of around 12,000 jobs, and it will also leave more vacant sites in town centres.

Landlords, including a number of listed firms, are now looking at what they might do with the large stores when they become empty.

Melanie Leech, chief executive of the British Property Federation, said: “This leaves a huge gap in our town centres, and significant investment from the commercial property sector will be required to fill it.”

The Evening Standard has looked the Debenhams estate, and what might happen to it…

Debenhams to leave the high street

Online fashion retailer Boohoo has bought the intellectual property assets of the department store group Debenhams from administrators, but the sale does not include shops or stock.

Debenhams was already in the process of closing down, after administrators last year failed to secure a rescue deal for the struggling firm. However, it had been hoped some parts of the company may be sold that would safeguard some jobs and stores.

Earlier this month it was announced that six sites would not reopen from lockdown.

There are 116 branches that are set to reopen once lockdowns ease to get rid of stock, before then closing.

Listed landlords left with empty stores

There are a number of landlords that let space to Debenhams, and of these a number are listed firms.

These include British Land, Capital & Regional, Hammerson and Landsec. These firms respectively have six, three, two and two Debenhams stores in their property portfolios.

Building owners were prepared for closures

Property sources say that building owners thought a last minute rescue deal for the entire Debenhams business, or the majority of it, was highly unlikely. Landlords have been looking at various options for the space.

Interest for some of the sites has come from other commercial property tenants, including gym operators, grocers and other retailers that would want to take part of the space rather than the entire stores.

It is likely some landlords will look at a change of use for sites.

Another headache for landlords

While some landlords with Debenhams in prime sites could quickly line up new occupiers, particularly once lockdown lifts, there will be others that find themselves with much less occupier interest.

Facing the prospect of empty stores comes on top of other headwinds. Many companies have seen rental income during the pandemic. Numerous businesses, particularly in retail and hospitality, have not able to pay rent after lockdown stopped them from trading.

Property owners have also faced a number of tenants seeking rent cuts or store closures via the CVA model.

A recent report from property agent Savills said the UK currently has 142 million square feet of vacant retail space, equivalent to 12.6% of all retail units, as widespread store closures continue to impact the sector.

Business rates

Retailers were given a business rates holiday at the start of the pandemic to help the high street ride out the virus crisis.

Property agency Altus Group estimates that helped Debenhams save around £50 million for the current financial year to the end of March. But the rates holiday will finish this year.

Altus says: “Landlords do not have to pay business rates on empty buildings for 3 months. But, after this time, most landlords must pay full business rates although some properties can get extended empty property relief like industrial premises.”

That could mean another cost property owners have to face if stores are not quickly re-let.

What has happened to previous Debenhams sites?

Previous Debenhams branches have been used by other retailers and some have become beauty halls. In addition, one site in Leicester is set to become flats.

Most recently, plans were unveiled to create a entertainment venue at a former Debenhams in Wandsworth. The revamped site will comprise a e-karting area, ping pong and pool tables, bowling lanes and a cocktail bar.

More store closures

With a number of high street chains struggling with online competition and lockdowns forcing them to temporarily close shops, it is likely landlords will see other retailers exiting sites in 2021.

Property firms will have to work hard to entice new entrants to town centres that can encourage shoppers to go out when lockdown rules ease.

Read More

Boohoo buys Debenhams for £55m and becomes a market for other brands

The online fashion retailers benefiting from lockdown clothing demand

Landlords to be hit by collapse of Topshop owner Arcadia

All Jaeger shops to close permanently, as stores not part of M&S deal

Debenhams Oxford Street flagship among branches that won’t reopen

Pets At Home reveals plans for up to 20 high street shops in London

Primark loses £1bn of sales but pledges: we will be back

Dixons Carphone sees online sales soar, but shops remain important

Yahoo Finance

Yahoo Finance