Debt Mountains of G-7 Will Mean High-Rate Headaches, Scope Says

(Bloomberg) -- Indebted Group of Seven countries face increasing budget pressures from persistently high interest rates in the post-pandemic era, according to Scope Ratings.

Most Read from Bloomberg

Biden’s Fourth of July Shrouded by Pressure to Drop 2024 Bid

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

Newsom Shocks California Politics by Scrapping Crime Measure

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

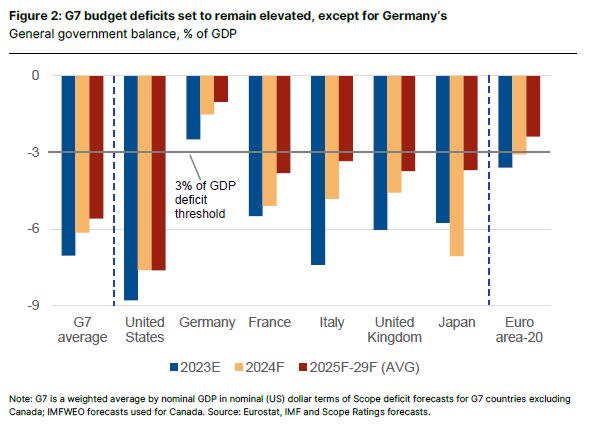

The credit-assessment company released a report Thursday warning that US and other nations in the club of advanced economies have returned to a trajectory of rising borrowing that they’ll struggle to reverse.

“The change of the outlook for rates to stay higher for longer changes things,” analyst Dennis Shen said. “Rising debt-to-GDP not only raises questions over long-run debt sustainability but also limits governments’ near-term budgetary headroom.”

The US will lead the increase in borrowing, along with the group’s European members aside from Germany, Scope said, adding that fiscal rules in many countries won’t be adequate to prevent public finances from bloating further.

Just this week, US Federal Reserve Chair Jerome Powell acknowledged once again his country’s challenge in that regard. “The level of debt that we have is not unsustainable, the path that we’re on is unsustainable — that’s completely non-controversial,” he told the European Central Bank’s annual retreat in the Portuguese town of Sintra.

Scope specified that France, Italy, the UK and the US all need better fiscal frameworks and to fix their public finances. Regarding the French situation, in advance of Sunday’s election runoff, it said rising debt there could stoke more investor unease after a “material” widening in the country’s bond spread over German equivalents.

“A new government needs to continue cooperative relations with France’s neighbors and the European Union and pursue coherent fiscal consolidation,” Shen said. “The spread could easily widen more if the sustainability of French debt is called into question.”

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance