Debts, disputes and a ‘shadow CEO’: The curious case of Truspine

Truspine Technologies has failed to take off since it floated nearly four years ago – and some are arguing this failure merits further investigation by City regulators. City A.M. takes a closer look at the firm’s labyrinthine history, uncovering a myriad of debts, disputes and detractors

Truspine Technologies’ chief executive Laurence Strauss resigned with immediate effect in May, making him one of many CEOs to come and go since the company was founded.

But people familiar with the medical tech company claim that most of these past CEOs were not really the ones calling the shots. Instead, they allege that a ‘shadow CEO’ has been running the show behind the scenes.

This, however, is just one of a plethora of issues that crops up in this company’s largely unsuccessful history.

A host of other problems at the firm including unpaid debts, misleading market statements and a tug of war over the intellectual property of the products it plans to create, raise serious questions about how this company has been run, and whether it will survive.

The company was ‘dead’

Truspine Technologies, which has its offices in Gatwick, is looking to develop unique spinal medical devices, and floated on London’s rival stock exchange Aquis back in 2020.

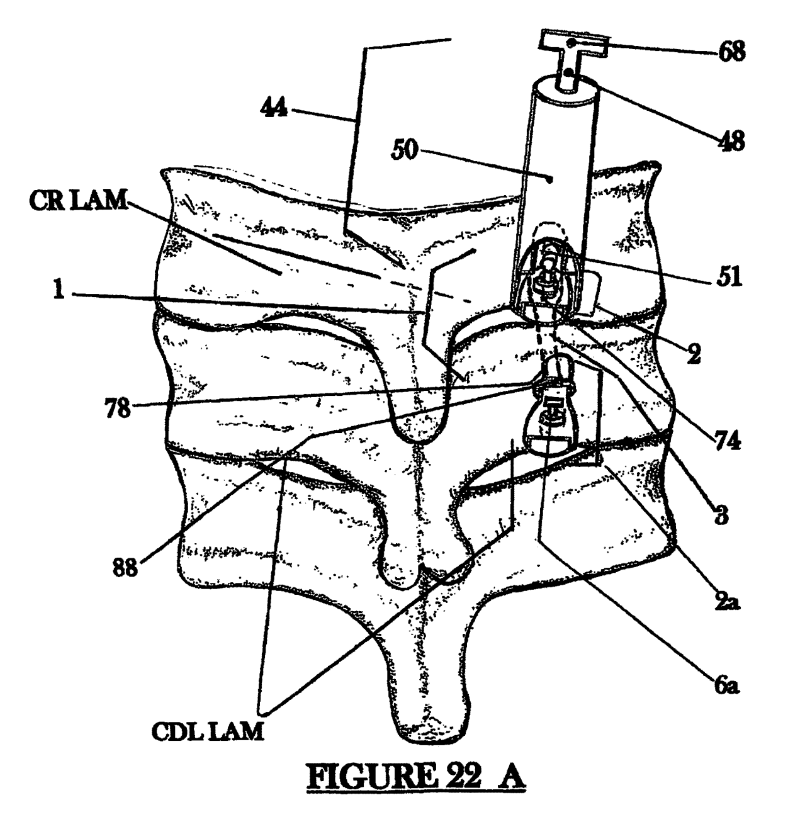

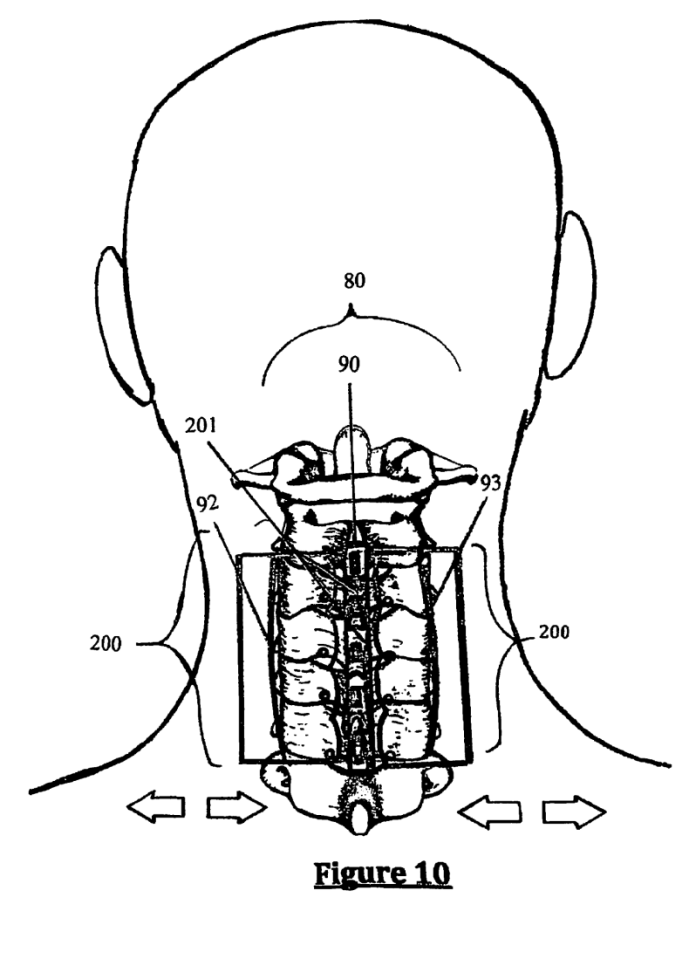

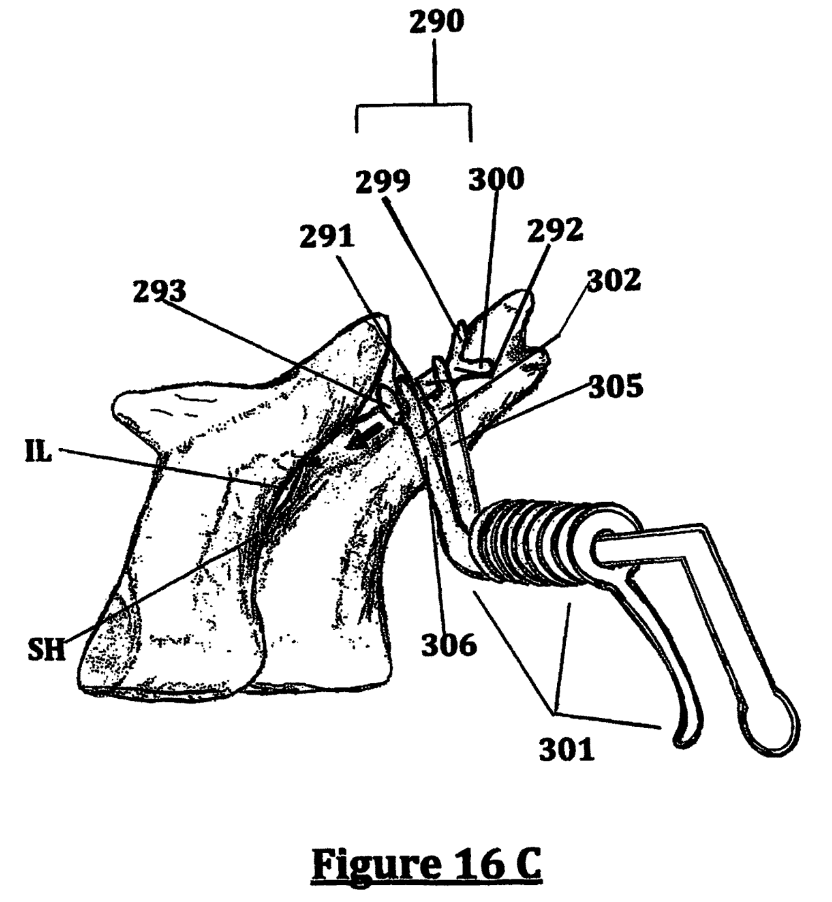

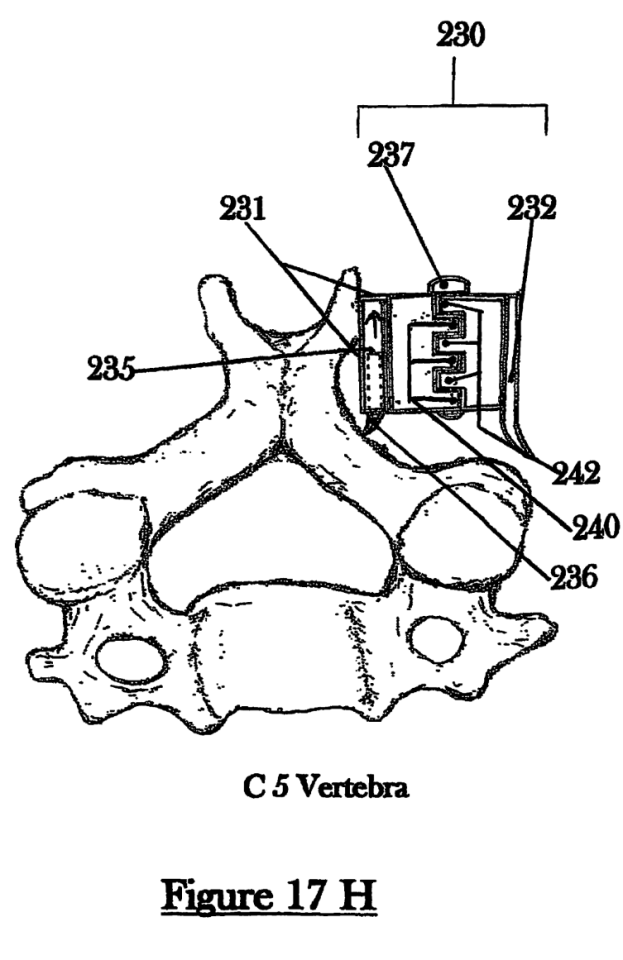

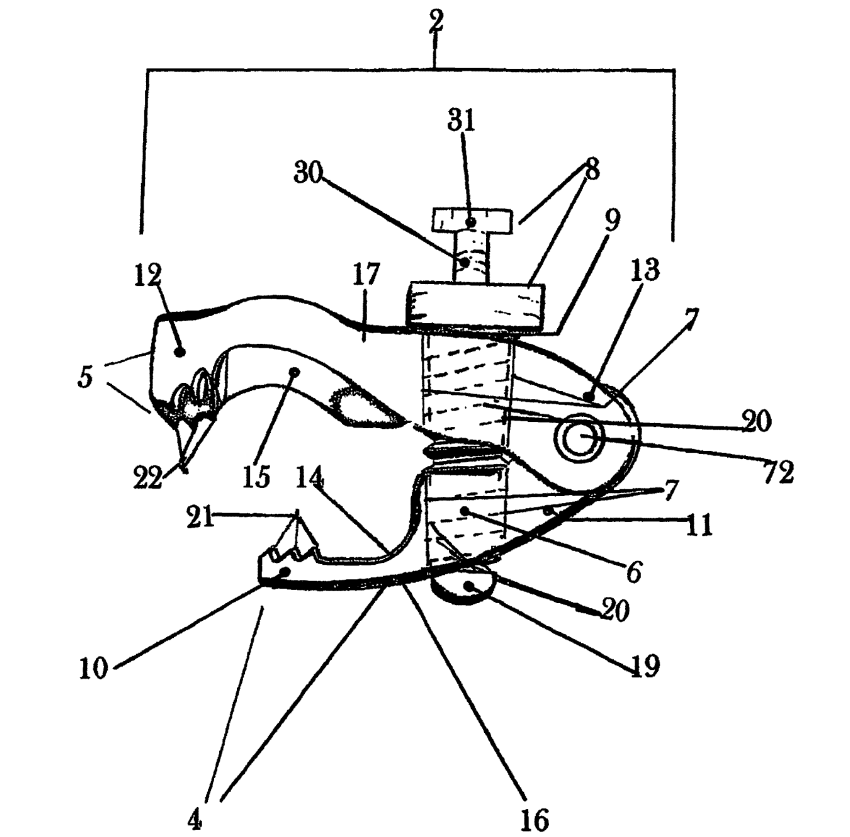

The company is aiming to break into the multibillion dollar spinal device market with three products – Cervi-Lok, Faci-Lok and Grasp Laminoplasty.

Truspine claims these devices, which were largely invented and designed by Professor Frank Boehm, will “revolutionise” the spinal stabilisation market.

But the firm has so far failed to produce any of these products or secure key approvals from the US Food and Drug Administration (FDA), and it has consistently run into financial difficulties since joining Aquis.

This sparked a campaign by angry investors last year to oust the company’s top brass, in particular the firm’s chief executive Strauss and chief financial officer Norman Lott, accusing the pair of mismanagement.

Strauss resigned last month soon after City A.M. reported on investors’ renewed bid to topple the C-suite figures.

But on his departure from the firm, even Struass didn’t have anything good to say about the company’s past, referring to Truspine as “dead” before he took the helm at the start of 2023, adding that it was “mired in so much bad publicity”.

So why has Truspine failed to properly take off, and, more importantly, who is to blame?

Fundraising fiasco

There were problems from the start.

While millions of pounds were raised in the run up to the company’s float on Aquis, not all of that money ended up in the firm’s accounts.

Buried in the company’s 79-page admission document is a shocking confession – nearly half a million pounds raised for the firm had gone missing.

The money was raised by a company called The Enduro Partnership, of which Shaun Smith was a director.

According to the admission document, Truspine “concluded that Enduro had been paying part of the subscription monies to the company, and retaining the other part of the subscription monies (totalling approximately £414,500)”.

“Over time, it became apparent to the company that the full amount would not be advanced by Enduro and the company terminated all relations with Enduro pursuant to a letter dated 18 June 2018,” it added.

What’s worse, is that Smith was also a former director of Truspine.

The unpaid amount was ultimately written off as a bad debt. City A.M. was unable to reach Shaun Smith for comment.

The firm was also owed nearly £100,000 at the time it floated by another sister firm called Euro SI. The firm’s chief financial officer Lott was a director at Euro SI, forcing the company to disclose the amount as it counted as a related party transaction. Euro SI eventually entered into liquidation in 2021, owing just over £40,000 to Truspine, according to Euro SI’s accounts.

Product development collapses

The firm’s management of its finances has been further called into question after it came to light that the company was not paying one of its key developers at the time it listed.

Truspine had hired medical equipment maker, Lincotek Medical, to start work on the developing the products, and, according to the company’s admission document, was described as one of two “key commercial partners”.

However, just before its first day of trading on Aquis on August 20, 2020, Lincotek emailed the then CEO Ian Roberts to tell Truspine it had ceased all work on the projects, after it failed to fully pay Lincotek for its latest tranche of work, estimated to be around $55,000.

“As we discussed in our team meeting yesterday with both the Lincotek and TrueSpine [sic] people present, Truspine has not come current on their financial obligations,” Lincotek’s Dan Triplett wrote in the email on August 11, seen by City A.M.

“To that end, and as discussed in the conference call yesterday, all engineering work will immediately cease on this project,” Triplett added.

It is unclear if Lincotek ever restarted work on the project. Lincotek did not respond to requests for comment.

A sudden shake-up

But upsets like this one didn’t stop after floating on Aquis.

The company decided to suddenly cancel its contract with an important consultant to the company in November 2020. Consultant Peter Houghton had worked closely with inventor Boehm and Truspine since 2016, and was even a director at Truspine for a period.

Houghton, however, resigned as a director “due to repeated failures associated with the mismanagement of Mr Shaun Smith”, but later returned to work for the company as a contractor, providing sales and marketing services after receiving assurances Smith would not be able to exert any influence over the firm.

Houghton is described in the company’s admission document as “a key consultant of the company”, adding that “his departure from the company may have a significant impact on the company’s ability to promote, market and sell the products commercially”.

On November 10, days after his contract was terminated, Houghton wrote a letter to the board in response to the company’s decision, warning about the situation with Lincotek and how the firm risked misleading investors.

“The board may or may not be aware but development for the Cervi-Lok has been indefinitely stopped and has been for months due to repeated breaches of contract, mainly non-payments, dating back to before July of this year. This pattern of late or nonpayment has unfortunately repeated itself time and again over the history of Truspine and Lincotek,” he wrote in the letter, seen by City A.M.

“Members of Truspine were warned repeatedly by Lincotek, myself and others that this ongoing delay had real time implications, such as resources being deployed and a dramatic shift in the timeline to the completion of the project,” he wrote.

“I could not understand nor receive any clear answers as to why a spine development company was not making development a priority,” Houghton added.

The company said in its admission document in August 2020 that it was seeking to obtain regulatory clearance from the FDA for its Cervi-Lok product “in Q1 2021” and it anticipated that “sales of Cervi-Lok will commence in Q2 2021”.

This was potentially misleading.

“By October the timeline to FDA clearance had been shifted to at least Q1 of 2022. I believe this was not disclosed during any of the recent public releases by Truspine. In my opinion, the timelines stated are in stark contrast to the information that I have been provided, and could potentially mislead both current and future investors.”

Peter Houghton, former Truspine director

“By October the timeline to FDA clearance had been shifted to at least Q1 of 2022. I believe this was not disclosed during any of the recent public releases by Truspine. In my opinion, the timelines stated are in stark contrast to the information that I have been provided, and could potentially mislead both current and future investors,” he added.

But there was another issue that he felt the board should investigate.

“I would offer researching Avtech Aviation & Engineering and its former CEO who is a current and longstanding consultant to Truspine,” and someone “who remains an integral part of every interaction I have ever had with the company”.

A ‘shadow CEO’

The man he was referring to is not listed as a director at the company and there is no mention of him on the company’s website.

His name is Michael Unwin.

People who have worked closely with the firm in the past have gone as far to describe him as the “shadow CEO” of Truspine.

“Nothing was done without Mike’s approval or involvement. He made that very clear,” Houghton told City A.M. “I met Mike many times. Mike and his assistant Sarah were involved in almost every meeting we had. He set them up and led the conversations.”

Todd Cramer, another former director at Truspine before it floated, said: “Unwin pulled all the strings”.

Cramer joined the firm in 2015, but eventually left in 2019 after he said he was “sidelined” by Unwin and hadn’t been paid properly.

“When I joined, he was very much a supporter of my work and ability, until I started asking questions about money, payments and daily operational issues. He always had a back room meeting with investors after we made presentations that were closed to the rest of us,” Cramer told City A.M.

“Mike Unwin was essentially the operating CEO of Truspine even though Ian Roberts was designated as such.”

Christopher Blank, Schmeiser Olsen & Watts

Christopher Blank, who was the company’s and Boehm’s intellectual property lawyer between 2016 and 2023, told City A.M.: “Mike Unwin was essentially the operating CEO of Truspine even though Ian Roberts was designated as such.”

Company documents seen by City A.M. show Unwin’s signature on the intellectual property sale agreement between Frank Boehm and Truspine, which was signed back in 2015.

Unwin was also involved with The Enduro Partnership – the company that failed to hand over money raised prior to Truspine’s admission to Aquis. Numerous emails and fundraising documents between 2015 and 2018, seen by City A.M., show Unwin’s involvement with the firm while at The Enduro Partnership.

Unwin was also the second largest shareholder in the now collapsed sister firm Euro SI, according to documents seen by City A.M., demonstrating his ties to the web of companies surrounding Truspine at this point in time.

Prior to his resignation last month, City A.M. asked former Truspine CEO Strauss, who joined the firm in 2023, about Unwin.

“I met him at the time of the fundraising, and I also met him after I joined the company, shortly after, which was when he used to have an office down the corridor from where Truspine’s offices are, and I went down to see him to tell him that he was still, apparently, registered as a consultant to the company,” Strauss told City A.M.

Strauss claimed, however, that he immediately cut his consultancy contract. “I ceased the relationship. I don’t need consultants of that sort of nature in the business.”

While Strauss said Unwin did not have any involvement in the business, he admitted that he still talked to Unwin. “As a shareholder, he rings me up from time to time and asks how things are going.”

Ian Roberts was contacted for comment.

Chequered pasts

But is Unwin’s involvement a problem? His track record prior to working on Truspine suggests it could be.

Prior to his involvement at Truspine, Unwin, was the CEO of another company, Avtech Aviation & Engineering, a UK company listed in Poland.

The Polish Financial Supervision Authority slapped Unwin with a fine of 150,000 polish zloty (around £30,000 at today’s rates) in 2014 for “disseminating false information about the development prospects and financial situation” of the firm. The regulator said the company misled the market about its financial health, saying the situation was stable when in fact it was struggling. It eventually went into liquidation.

Another senior Truspine figure also has ties to company’s punished by regulators.

Lott, the company’s long-term chief financial officer, was previously a director of African Land Limited, which offered investments in rice farm harvests in Sierra Leone. The FCA launched legal action against African Land, and others, arguing they had structured their investment schemes to try and avoid being regulated by the FCA. In February 2014, the High Court ruled that it was a collective investment scheme and was promoted and operated without FCA authorisation.

Lott resigned as a director of African Land Limited in July 2014 and was not named or criticised in the proceedings.

Debts pile up

The company has repeatedly struggled with its finances since joining Aquis.

In its final annual results for 2022, posted in September of that year, the company reported a loss before taxation of £941,000, increasing from the £651,000 loss it reported in 2021.

While the company has often repeated that it is “in a pre-revenue development phase and remains loss making”, it issued a more urgent statement a month later.

“The company’s financial position remains weak and the company has been urgently seeking alternative sources of finance as it is important that additional funding is secured in the near term in order to allow the company to continue operating.”

As it has scrambled for funding, its debts piled up, posing legal risks for the firm.

The extent of its debts were leaked online at the start of 2023. It owed over £440,000 to a very long list of creditors, according to a report by news site Share Prophets.

One party that had not been paid was US law firm Schmeiser Olsen & Watts.

Christopher Blank, Truspine and Boehm’s former IP lawyer and partner at the firm, confirmed to City A.M. that Truspine still hasn’t paid for services from August 2022 until it cut ties with Truspine in 2023.

Blank said that while promises were made “that money was being raised and payments would follow, these promises became unbelievable”.

Blank wrote a letter to Truspine on October 26 last year announcing that the law firm would no longer act for Truspine and demanded the company pay the $318,223 it was owed.

“Mike Unwin is acting as shadow CEO for Truspine”, which has been the case “from 2015 to the present day,” the letter, seen by City A.M., said. Blank did not disclose the letter to City A.M. but confirmed the details in it when asked.

“In nearly 40 years of practice, Truspine and its agents, directors, and officers have been the most difficult clients I have worked with.”

Christopher Blank, Schmeiser Olsen & Watts

“In nearly 40 years of practice, Truspine and its agents, directors, and officers have been the most difficult clients I have worked with,” he told City A.M.

Another person who has not been paid is Anthony Swoboda, who previously conducted sales and marketing services for Truspine.

After repeated non-payment, Swoboda served a statutory demand on the company in March of this year. The demand, seen by City A.M., seeks a total of $124,178.77 for unpaid invoices between 2022 and 2023.

“I am left with no choice,” Swoboda said in an email, with the demand attached, to the company’s board and directors. “I have a young family to provide for and the last 18 months have been extremely arduous to say the least,” citing the company’s “empty promises from prior, and current, executives” at the firm.

“Should this demand not be settled, I will pursue a winding up order through the courts.”

Houghton, when writing to the board in 2020, also said he was owed over $220,000 for unpaid consultancy fees. But he has since given up hope of being repaid.

“I hired a solicitor after my no cause termination and submitted a statutory demand which they disputed,” Houghton told City A.M. “He felt I would need to initiate proceedings in court but they had no money and I was not inclined to spend even more money or time on chasing an insolvent company.”

A crypto question

In its full-year accounts ending 29 March 2021, it showed that the company held £300,000 in Tether. Tether is a stablecoin and its value is pegged to the US dollar. Some people purchase Tether to facilitate crypto trading.

Truspine gradually sold down its Tether holdings between 2021 and 2023. How or why it came into possession of Tether is unclear from the company’s accounts.

Investors take action

With no products made, no clear FDA approval in sight, and its share price at rock bottom, investors, unsurprisingly, became agitated.

Some investors rallied to oust Strauss and Lott and other directors in a vote in May 2023, and replace them with Swoboda, Houghton and Cramer.

However, the vote to remove them was ultimately unsuccessful.

But these angry investors didn’t stop there. They took their complaints to multiple regulators and industry bodies.

Conservative MP Dominic Raab wrote to the head of the Financial Conduct Authority (FCA) Nikhil Rathi in October last year on behalf of one of the investors in Truspine to raise their concerns about the firm and others involved with it.

The FCA’s director of market oversight Clare Cole replied to Raab a month later.

“We will review the concerns about these different entities in the context of the relevant legislation and rules,” Cole said in a letter, seen by City A.M. “We will determine what, if any, action to take – and, in particular, whether it is appropriate for us to exercise any of our statutory powers, including whether we should open a formal investigation.”

A spokesperson for the FCA said it was unable to comment, adding that it does not confirm or deny whether any formal investigations are or aren’t taking place.

Misleading statements

Aquis, however, has taken action. The exchange hit the company with a £215,000 penalty, part suspended, in August last year after it found that Truspine misled investors at the start of 2023 about securing a loan, which had a charge over its assets.

“As a result of the failure to announce the charge at the time of entry into the loan, the market had a false impression of the company’s financial position and risk profile,” Aquis said.

“These events are indicative of a failure of fundamental procedures, systems, and controls in the governance of the company,” Aquis said, adding that the firm “has failed to act with integrity towards its shareholders”.

The charge has since been lifted.

A much bigger problem

The troubles at Truspine, however, have not been limited to its financial situation or how it has been governed. There have also been problems with who ultimately owns and controls the intellectual property of the products.

On April 5 last year, Truspine announced that it had terminated its consultancy agreement with J Lees S Consultants, which was the company by which inventor Boehm provided services to Truspine.

“The company notes that Mr Boehm has made various claims about the validity and ownership of the company’s IP,” Truspine said in a statement. “The company confirms that it continues to hold the IP in relation [to] the three non-invasive spine stabilisation products under development.”

Truspine later announced in October last year that this dispute had been “resolved”.

But former director Cramer said he doesn’t agree that the matter was sorted – especially since he is the joint inventor of Cervi-Lok. His name appears on the patent filed with the United States Patent and Trademark Office.

“All I can state is this: I am a 50 per cent owner and I have never been approached by anyone at any point to even discuss my ownership and a sale/purchase,” he told City A.M., adding that he wrote to the firm about the matter in May last year.

“Frank may or may not have assigned his holdings, and if he did, that is his portion, not mine,” Cramer said. “I have never nor will ever assign my rights to anyone else to act as an agent for me.”

In 2020, Truspine hoped to get regulatory clearance from the FDA for Cervi-Lok in the first quarter of 2021. In April 2022, it told the market it expects to file the application for clearance, known as a 501k submission, “prior to the end of Q2 2022”. It finally filed the application in July 2023. It has still not been approved by the FDA.

The firm posted another loss before taxation for the year ending 29 March 2023 of £853,000, decreasing slightly from £941,000 the previous year. For the six months to 30 September 2023, pre-tax losses were at £363,000.

Out from the shadows

City A.M. eventually managed to track down Unwin, who denied that he has long been the shadow CEO of Truspine.

“My association with Truspine has always been as a consultant and adviser from the start,” Unwin told City A.M.

Unwin claimed: “I did not have any power to make decisions, or be part of the formal decision making of the company, as would be necessary for me to be regarded as a shadow director, let alone ‘shadow CEO’.”

He said that his involvement with Truspine ended when Strauss terminated his contract with the firm in 2023. Unwin said, however, that he remained “an enthusiastic and supportive shareholder”, adding that, between him and his family, he holds roughly 2.5 per cent of the company’s stock.

While he confirmed working for The Enduro Partnership, he said he did not hold a management position in Shaun Smith’s company and has not spoken with him since 2018. He claimed that money was put into accounts under Smith’s control, but said it was ultimately “unclear” where the missing funds went.

He said that Copian Capital – his current firm, which was involved in the fundraising for Truspine, where Lott was also a former director – no longer has an office at the same building as Truspine, but it remains the company’s registered address.

A new chapter?

In March this year, a new chairman, Geoff Miller, entered the picture along with several new board members.

Aware of the simmering discontent that existed among shareholders, Miller almost immediately announced that the company’s new directors would “undertake a review of all of the actions by the company since IPO”.

Boehm, after having his consultancy contract cancelled last year, now appears to be re-engaging with the firm after Miller purchased nearly £40,000 of shares tied to Boehm.

“I am pleased that the company is engaging with the process of putting historical disputes behind it in a proactive manner, and I look forward to seeing the business develop in the months and years to come,” Boehm said in a Truspine statement last month.

Boehm said he was unable to comment when contacted by City A.M.

Truspine responds

Miller admits that the company has not been run well since it floated.

“Nobody is claiming that Truspine was well managed in the three years after admission.”

Geoff Miller, Truspine Technologies’ chairman

“Nobody is claiming that Truspine was well managed in the three years after admission,” Miller told City A.M. “The FDA application undoubtedly took longer than the company originally envisaged. This is not a problem unique to Truspine, and is in large part the reason for its poor share price performance.”

Truspine will no longer give a running commentary on the FDA application, and instead will only update the market when necessary, Miller said.

While he confirmed that the firm has a list of outstanding debts and issues to work through, there are some claims he disputed.

The company acquired its Tether holdings in one payment from an investor. He declined to name the investor. “There was no speculation in cryptocurrency,” he said, however, adding that the company has no intention of accepting cryptocurrency as payment again.

Miller said he had been in contact with both Houghton and Swoboda to resolve those disputes and debts. On the evening before this article was published, Truspine said Miller had signed a share deal with Houghton, which he confirmed, while Swoboda said that talks were taking place when he was contacted by City A.M.

Miller said Lincotek was ultimately paid what it was owed months late in October 2020 with funds from the IPO. Asked if there was any money outstanding that was owed to Lincotek, he replied: “I believe that there is, but I am waiting for Lincotek to confirm.”

“With respect to the IP, I have already said on the record several times that the IP, when the company was advised by Christopher Blank and Schmeiser Olsen & Watts on the IP, was not managed as well as it should have been,” he said. He declined to comment on the money owed to the law firm, and insisted that the IP of Cervi-Lok was not contested. “We and our advisers are comfortable that the public characterisation of the company’s IP position is accurate.”

“We have no comment to make on what the FCA may or may not wish to investigate, it is a matter for them,” Miller said, adding that he has written to Raab to get clarity on the concerns raised with the regulator.

While confirming Unwin’s involvement in setting up the firm, Miller was adamant that he “is not, nor has he, acted as a shadow director at any point”.

“He is a supportive shareholder, and for that we are grateful, but he is definitely not some form of eminence grise behind the scenes controlling anything.”

However, Miller said that any matters prior to becoming a quoted company, such as the missing funds, will not be looked at as part of the ongoing review because they were fully disclosed in the admission document and had been dealt with at the time.

“Trying to trace a guy who’s absconded with £400,000 pounds worth of other people’s money, when people tried to sort it out years ago, really isn’t going to is not going to be money well spent,” Miller said.

He added that there is no timeline on the review and no formal report detailing the review’s findings will be published. He said if the review throws up any issues that the market should know about, it will make an announcement.

“The claims of disgruntled ex-employees and service providers will, by their nature, be ill-informed… and partial, given their history with the company. The fact that they are coming to the fore now reflects the turnaround that the company is making and will continue to make.”

Geoff Miller, Truspine Technologies’ chairman

“The claims of disgruntled ex-employees and service providers will, by their nature, be ill-informed… and partial, given their history with the company. The fact that they are coming to the fore now reflects the turnaround that the company is making and will continue to make.”

Pointing fingers

Miller wouldn’t be drawn on who he thought was to blame for the company’s past, however.

“At the moment, we’ve got a situation we need to resolve, and in order to resolve that, what we need to do is we need to get everybody pulling in the same direction. Pointing fingers at one or two people who should have done different things in the past doesn’t help in terms of where we need to be.”

While Norman Lott was narrowly re-elected as CFO at the firm’s AGM last week, some shareholders remain unhappy with his continued role at the firm.

Marcus Nicholls, a retail shareholder who has invested £5,000, said the result was “not a shareholder mandate and proves serious concerns about Mr Lott’s past performance”.

But Miller said Lott was not to blame for the company’s past.

“I think where the company has failed has been in its business strategy, as opposed to its management of its financial reporting,” Miller said. “Whilst I accept that the management has been poor, I think it’s the operational side” that made mistakes, he said.

Despite the litany of issues the company has to work through, Miller still believes in the firm, which he said has “potentially extremely valuable IP”, adding that he has invested almost £350,000 of his own money over the past year, holding roughly nine per cent of the firm’s stock. “That aligns me with all other shareholders in a way that others sniping from the outside are not aligned.”

The company has said it is not immediately seeking a new chief executive, with Miller taking on many of the CEO responsibilities. But it is clear that Miller, and whoever becomes the next CEO, face a herculean task in turning the company around.

Yahoo Finance

Yahoo Finance