The demise of British Airways? From computer failures to the end of free food, how it stopped being the world's favourite airline

In 1989, bosses at British Airways were so confident that they could make the audacious claim in the carrier’s advertisements that it was “The World’s Favourite Airline”.

Twenty-eight years later, however, and BA’s standing with air travellers has fallen far short of that bold slogan.

This bank holiday the UK’s flag carrier was plunged into turmoil after a worldwide computer systems meltdown sparked chaos across the airline’s network.The travel plans of thousands of customers have been thrown into disarray by the IT failure, which has led to passengers flying without their luggage and others being stranded at airports around the world.

The disruption will also deal a financial blow to BA, which is now owned by International Airlines Group (IAG), the FTSE 100 giant behind Ireland’s Aer Lingus and Spanish carrier Iberia. Under EU rules, passengers are likely to be able to claim compensation for the mayhem and the airline is also obliged to provide refreshments for delayed passengers.

When American carrier Delta Air Lines was rocked by a similar computer failure last August that forced it to cancel about 2,300 flights, it suffered a $100m hit to revenues.

Aside from the financial cost, the turmoil will also add to a growing list of controversies that have dogged BA in recent years.

Cost cuts

In January BA scrapped free food and drink for its economy passengers on short-haul routes and replaced the service with a range of Marks & Spencer snacks and sandwiches that passengers have to pay for instead.

The move, which sparked anger among passengers, was the latest in a series of cost cuts and changes that BA bosses have made as they battle fast-growing budget airlines such as Ryanair and easyJet. Lured by its cost price fares, Ryanair flew 117m passengers last year, making it Europe’s biggest airline.

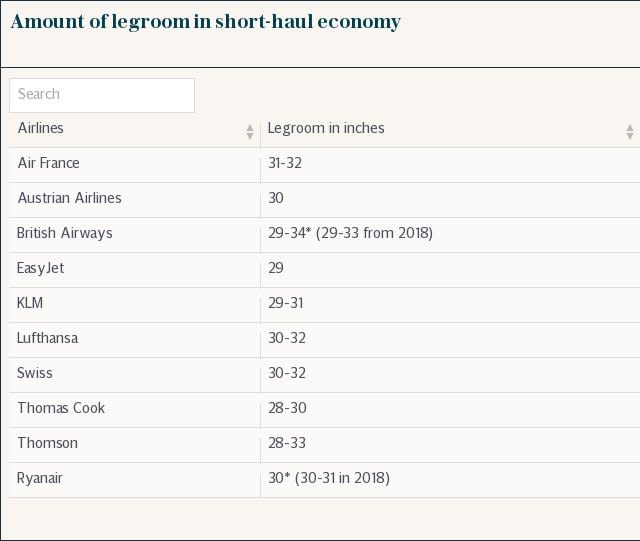

In 2009, BA abandoned free meals on some short haul flights and reduced the range of alcoholic drinks on offer. Meanwhile, in March it emerged that it was adding an extra two rows of seats into its Airbus A320 and A321 aircraft, reducing passengers’ legroom from 30 inches to 29 inches.

The move means that travellers on the planes now have the same amount of space as on an easyJet flight and one inch less than Ryanair. BA justified the overhaul by saying it allowed the carrier to offer the cheaper fares, which helps it compete with its budget rivals.

Other recent cost cuts have included axing fresh flowers in first-class toilets.

While unpopular with passengers and at odds with BA’s premium image, slashing overheads has become ingrained in its culture ever since Willie Walsh took charge of the airline in 2005. Mr Walsh, who is now chief executive of parent company IAG, earned the nickname “Slasher Willie” even before he joined BA, after cutting about 2,500 jobs at Aer Lingus.

Alex Cruz, the Spanish businessman who took the helm at BA for IAG a year ago, is driving the renewed focus on costs at the airline and, like Mr Walsh, he has plenty of experience in the area. He was previously the boss of Vueling, the budget Spanish airline that IAG took control of four years ago.

Heathrow chaos

The fiasco surrounding the opening of Heathrow’s Terminal 5 nine years ago cost BA about £16m, raised questions over whether Mr Walsh could lose his job, and dealt a blow to the airline’s reputation.

The £4.3bn facility, which was built for BA, got off to a disastrous start in March 2008 when about 500 flights cancelled and some 23,000 bags misplaced.

In a grilling by MPs on the Commons transport select committee, Mr Walsh admitted that the turmoil was caused by BA staffs’ lack of familiarity with the new terminal.

He also conceded that BA executives had been aware of the problems before the facility’s chaotic debut and that it had been airline’s decision to press ahead with the opening despite the lack of employee training.

“My regret is we did compromise on the test programme,” he told MPs. “We did this with our eyes open. We knew it was a risk, it was a calculated risk, and it was a risk I decided to take.”

Brexit shockwaves

Like other UK airlines, BA’s owner IAG was rattled by the surprise vote to leave the EU in last June’s referendum.

Just hours after the referendum result, IAG shocked the City by warning investors that profits would not rise as much as expected. The pound’s slump against the euro after the vote has hurt the company because it generates most of its revenues in sterling but reports its results in the European currency.

IAG has since trimmed back its growth plans and in the months after the referendum reported that it had seen more muted demand from business travellers because of the uncertainty caused by Brexit.

Nevertheless, despite the turbulence caused by the Brexit vote and passengers’ disgruntlement with cut-backs, IAG’s finances remain robust.

Helped by Mr Walsh’s focus on costs, adjusted operating profits climbed 8.6pc to €2.54bn last year. BA may have long since dropped its motto that it is the world’s favourite carrier, but profits at its parent company are still flying high.

Yahoo Finance

Yahoo Finance