Desktop Metal Inc (DM) Q1 2024 Earnings: Navigating Challenges with Strategic Cost Management

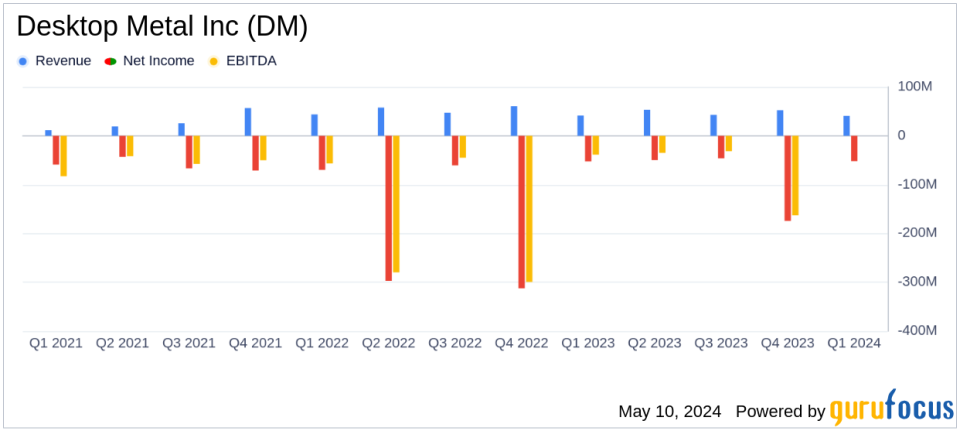

Revenue: Reported at $40.6 million, slightly below the estimate of $40.8 million.

Net Loss: Posted a net loss of $52.1 million, significantly above the estimated loss of $18.99 million.

Earnings Per Share (EPS): Recorded an EPS of -$0.16, falling short of the estimated -$0.06.

Operating Expenses: Total operating expenses were $47.2 million, a decrease from the previous year's $50.9 million, reflecting ongoing cost control measures.

Research and Development: R&D expenses amounted to $19.8 million, down from $23.1 million year-over-year, aligning with the company's strategic cost reductions.

Gross Loss: Reported a gross loss of $2.2 million, compared to a gross loss of $1.4 million in the same period last year.

Interest Expense: Interest expenses increased to $1.5 million from $0.8 million, indicating higher debt service costs.

On May 9, 2024, Desktop Metal Inc (NYSE:DM), a pioneer in the additive manufacturing industry, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company, known for its innovative 3D printing technologies, reported a quarterly revenue of $40.6 million, slightly below the analyst's expectation of $40.8 million, and a net loss of $52.1 million, which was significantly deeper than the anticipated $18.99 million.

Desktop Metal operates globally, providing advanced 3D printing solutions that cater to a diverse range of industries including automotive, consumer goods, and healthcare. Its products are distributed across key markets in the Americas, EMEA, and APAC, with the Americas being the largest revenue contributor.

Financial Performance and Operational Highlights

The first quarter saw Desktop Metal grappling with a challenging capital investment environment, which CEO Ric Fulop noted as a persistent headwind affecting overall demand. Despite these challenges, the company has successfully reduced its operating expenses for the ninth consecutive quarter. This strategic cost management is a critical component of their plan to achieve positive adjusted EBITDA in the latter half of 2024.

Revenue from product sales totaled $35.63 million, a slight decrease from $36.7 million in the previous year, while service revenues increased to $4.97 million from $4.62 million. The cost of sales, however, outpaced revenue, leading to a gross loss of $2.21 million compared to a loss of $1.36 million in Q1 2023. Operating expenses also saw a reduction, dropping from $50.95 million to $47.18 million year-over-year, reflecting the company's cost optimization efforts.

Balance Sheet and Cash Flow Insights

As of March 31, 2024, Desktop Metal's balance sheet showed $65.56 million in cash and cash equivalents, a decrease from $83.85 million at the end of 2023. Total assets stood at $412.03 million, down from $458.00 million at the previous year-end. The company's efforts to streamline operations and manage costs are evident in its reduced total liabilities, which slightly decreased from $216.35 million to $214.69 million.

The net cash used in operating activities was reported at $17.41 million, an improvement from the $37.35 million used in the same period last year. This indicates a more efficient management of operational cash flow despite the net loss.

Strategic Outlook and Investor Confidence

In his commentary, CEO Ric Fulop expressed confidence in the company's trajectory, emphasizing the strong demand for their production binder jet systems and the strategic cost reductions already underway. "We are continuing to see strong demand for our production binder jet systems that produce metal, sand, and ceramic parts, as well as a constructive environment for the value of Additive Manufacturing 2.0 systems," Fulop remarked.

"Looking ahead to the balance of 2024, we are confident in achieving positive adjusted EBITDA in the second half of 2024. Given our strategic cost-outs, we expect strong leverage as sales growth returns," stated Fulop.

Despite the current financial strain reflected in the net loss and cash flow challenges, Desktop Metal's reaffirmation of its full-year guidance and the strategic adjustments in play are pivotal. These efforts are aimed at steering the company towards profitability and sustainable growth, aligning with the broader industry's advancement towards more efficient and innovative manufacturing solutions.

For detailed financial figures and future projections, investors and stakeholders are encouraged to refer to the full 8-K filing and the upcoming conference call scheduled for discussing these results more comprehensively.

Explore the complete 8-K earnings release (here) from Desktop Metal Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance