DexCom (DXCM) Declines on Potential Competition for Stelo (revised)

Shares of DexCom DXCM lost almost 3% on Jun 3, probably due to concerns about a rise in competition for its recently approved Stelo as the FDA approved a competing product.

The FDA approval for Stelo in March 2024 looked promising as it was the first and only continuous glucose monitoring (CGM) device to receive approval for its over-the-counter (OTC) availability as a glucose biosensor. Stelo represents a significant opportunity as it can be used to get glucose insights directly on a smartphone without a prescription. The company planned the launch of Stelo this summer for use by people aged 18 years and above who are not on insulin therapy.

However, the FDA approval of Abbott’s ABT Lingo as an OTC glucose monitor should fuel potential competition for DexCom in this new category of over-the-counter CGM. Although Abbott is yet to announce its launch plan for Lingo in the United States, the product is already available in the United Kingdom since last year as a sensor for people who don’t have diabetes to track glucose spikes.

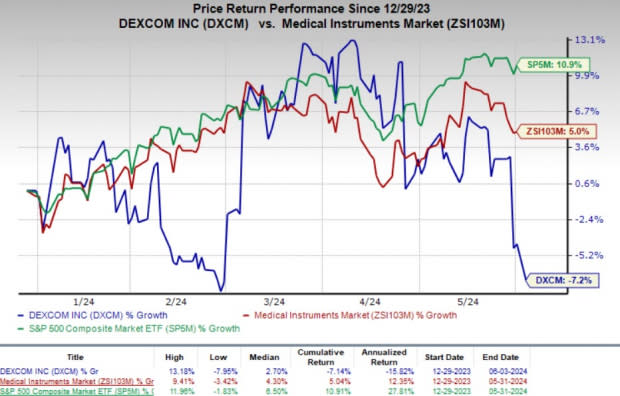

Price Performance

Shares of DexCom have lost 7.2% year to date against the industry’s 5% growth. The S&P 500 Index has risen 10.9% in the same time frame.

Image Source: Zacks Investment Research

More on the News

DexCom and Abbott already compete in the CGM device market with their respective sensors — G6 & G7 and Libre. However, all available CGM devices are currently available under prescription.

DexCom’s Stelo and Abbott’s Lingo are intended for people who do not have diabetes but track blood sugar spikes during the day, implying another competing field for the companies.

Meanwhile, the OTC availability for both devices should allow individuals to use a glucose monitor without prescription, thereby expanding the targeted population for CGM devices. A better commercialization plan and a strong sales team should help the companies to gain market share in this new segment.

Abbott has significantly higher resources with an extensive presence in healthcare product markets. This is expected to help the company gain an advantage over DexCom as commercialization of Stelo and Lingo begins this year. However, DexCom has significant success with its CGM devices in the United States, and a similar trend may follow in the OTC glucose sensor market amid competition from a larger device maker. The companies will likely provide updates on their OTC glucose sensors during their next earnings call.

Notable Developments

Last month, DexCom announced that Tandem Diabetes Care’s Mobi insulin pump with Control-IQ technology is now fully compatible with both its G7 and G6 CGM sensors. The connected system of CGM and insulin pump should help predict glucose levels 30 minutes in advance and automatically adjust insulin, if needed, to help prevent highs and lows.

In April, DexCom announced strong results during the first quarter. Impressive contributions from the Sensor segment and domestic and international revenue growth were the key catalysts. Moreover, the expansion of coverage for CGM systems during the quarter supported growth. This trend is likely to continue through 2024.

In March, DexCom introduced a new direct-to-Apple-Watch feature for its G7 CGM users. With the new feature, G7 is likely to be the first CGM device that can link to Apple Watch directly, negating the requirement of carrying around an iPhone. Dexcom intends a gradual launch of this feature for all iOS users worldwide by the end of second-quarter 2024.

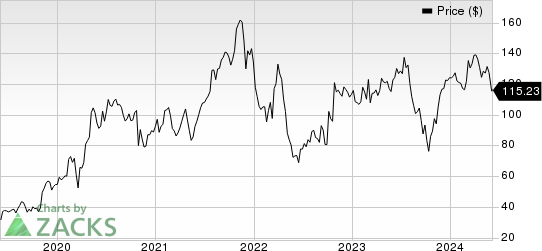

DexCom, Inc. Price

DexCom, Inc. price | DexCom, Inc. Quote

Zacks Rank & Stocks to Consider

DexCom currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN and Ecolab ECL.

Align Technology, currently carrying a Zacks Rank of 2 (Buy), reported first-quarter 2024 adjusted earnings per share (EPS) of $2.14, which beat the Zacks Consensus Estimate by 8.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $997.4 million outpaced the consensus mark by 2.6%.

Align Technology’s shares have lost 6.1% year to date against the industry’s 0.5% growth.

Ecolab has a long-term growth rate of 14.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 1.30%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 1.7%. Ecolab’s shares have risen 17.1% year to date against the industry’s 19.9% decline.

(NOTE: We are reissuing this article to correct a mistake. The original version, released earlier today, June 4, 2024, should no longer be relied upon.)

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance