DICK'S (DKS) Slides 11% in a Week: Is This a Buy Opportunity?

DICK’S Sporting Goods Inc. DKS has seen its shares slide a significant 11.5% in the past week, pushing it behind its industry peers and the broader S&P 500 index. The downside came after NIKE’s NKE commentary, on its Jun 26 earnings call, about the soft global demand for its lifestyle products and a challenging path ahead. NIKE’s lower-than-expected sales outlook for fiscal 2025 not only led its shares to slide significantly but also sent jitters across the sporting goods industry and its key retail partners — DICK’s and Foot Locker FL.

However, this looks like a temporary phase as the DICK’S stock has started showing some green shoots lately. The stock of the prominent sporting goods retailer rose about 1% yesterday to $200.13 after dropping as much as $197.13 on Jul 2. At the current price, the stock trades at a 17% discount to its 52-week high of $234.47 reached on Jun 20, 2024. This indicates that the stock has further upside potential from here.

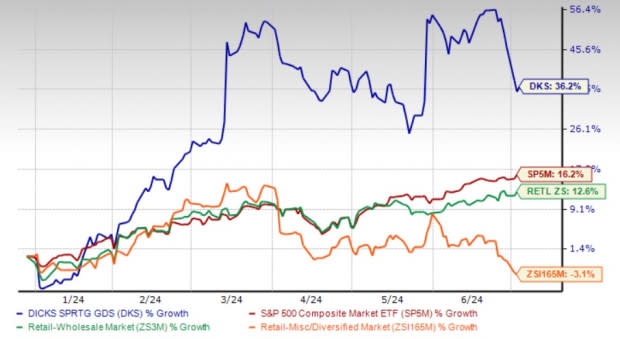

Despite the recent drop, DICK’S has garnered 36.2% year-to-date growth against the industry’s decline of 3.1%. The company also outperformed the broader Zacks Retail-Wholesale sector and the S&P 500's growth of 12.6% and 16.2%, respectively, in the same period.

Image Source: Zacks Investment Research

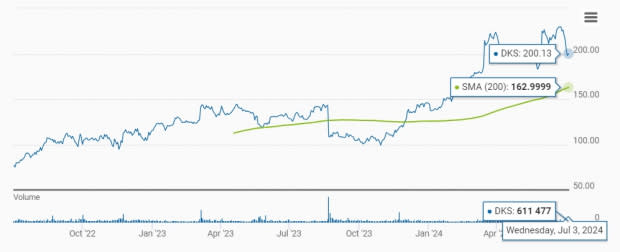

Additionally, DICK’S is currently trading above the 200-day moving average, indicating robust upward momentum and price stability. This technical strength reflects positive market perception and confidence in DICK’S financial health and prospects.

DICK’S Stock Trades Above 200-Day Average

Image Source: Zacks Investment Research

How investors should play DICK’S shares? Let’s decode.

DICK’S Long-Term Game Play

We expect the DKS stock to return to a growth trajectory, given its continuous investments to provide the best omni-channel athlete experience by redefining its stores and digital portals. It has been enhancing service levels at all its digital and store experiences to cater well to the athletes wherever they are.

The Pittsburgh-based retailer has been keen on offering exciting DICK’S store concepts to customers. The company’s various concept stores, including Dick’s Sporting Goods, Golf Galaxy, Public Lands and Going Going Gone, have been performing well.

Additionally, the latest concept stores like the 50,000 square feet “Next Generation” stores and the 100,000 square feet “DICK’S House of Sport” stores are the future of DICK’S. These immersive stores have been attracting customers through the unique experiences that they offer, such as climbing walls and golf bays. Through the expansion of these concepts, the company is poised to elevate omni-channel athlete engagement, and generate strong sales and profitability.

Investing in digital capabilities is vital to the company’s omni-channel success. GameChanger, its new premier live-streaming mobile sports app for youth sports, positions it well for long-term growth. Through the app, DKS is on track to explore the fast-growing, multibillion-dollar youth sports technology market, solidifying its position.

The company is well-placed as the go-to destination for sports in the United States due to its commitment to provide access to differentiated, on-trend products. It is optimistic about the product pipeline from its key brand partners and confident about its private brands, which resonate well with customers.

DICK’S continues to return value to its shareholders through its share repurchase program and dividend payments. The company is committed to sharing its profits with shareholders as evident from its long history of dividend payments. DKS currently has an annual dividend yield of 2.20% and a payout ratio of 34%. The company has a 5-year annualized dividend growth of 37.16%. Check DKS’s dividend history here.

Upward Estimate Trajectory

DICK’S expects fiscal 2024 earnings per share of $13.35-$13.75 compared with $12.91 a year ago. The Zacks Consensus Estimate for DKS’s fiscal 2024 and 2025 earnings per share rose 0.3% each in the last 30 days. The upward revision in earnings estimates indicates analysts’ increasing confidence in the stock.

Image Source: Zacks Investment Research

For fiscal 2024, the Zacks Consensus Estimate for DKS’s sales and EPS implies 1.8% and 6.6% year-over-year growth, respectively. The consensus mark for fiscal 2025 sales and earnings indicates 4.6% and 7% year-over-year growth, respectively.

Valuation

The company is currently trading at a discount than its industry on a forward 12-month P/E basis, making the stock an attractive pick for investors. DICK’S is trading currently at a forward 12-month P/E ratio of 14.13X, which is below the industry average of 15.79X and the S&P 500’s average of 21.59X.

Image Source: Zacks Investment Research

Conclusion

DICK’S continues to hold a market niche in the sporting industry, thanks to its robust strategies, including merchandising initiatives and store-related efforts. Management’s focus on creating a trend-right merchandise assortment, deepening relations with customers via marketing, and efficiently controlling expenses should drive sustained growth in the future.

The company's current price presents a compelling entry point for investors eager to invest in this profitable sporting goods stock. For those who already own the stock, stay invested for solid long-term prospects. DICK’S currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE): Free Stock Analysis Report

Foot Locker, Inc. (FL) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance