Did Changing Sentiment Drive Codemasters Group Holdings's (LON:CDM) Share Price Down By 11%?

It's understandable if you feel frustrated when a stock you own sees a lower share price. But sometimes broader market conditions have more of an impact on prices than the actual business performance. Over the year the Codemasters Group Holdings Plc (LON:CDM) share price fell 11%. However, that's better than the market's overall return of -25%. Codemasters Group Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. It's down 32% in about a month. However, we note the price may have been impacted by the broader market, which is down 32% in the same time period.

Check out our latest analysis for Codemasters Group Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Codemasters Group Holdings managed to increase earnings per share from a loss to a profit, over the last 12 months.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action. So it makes sense to check out some other factors.

Codemasters Group Holdings managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

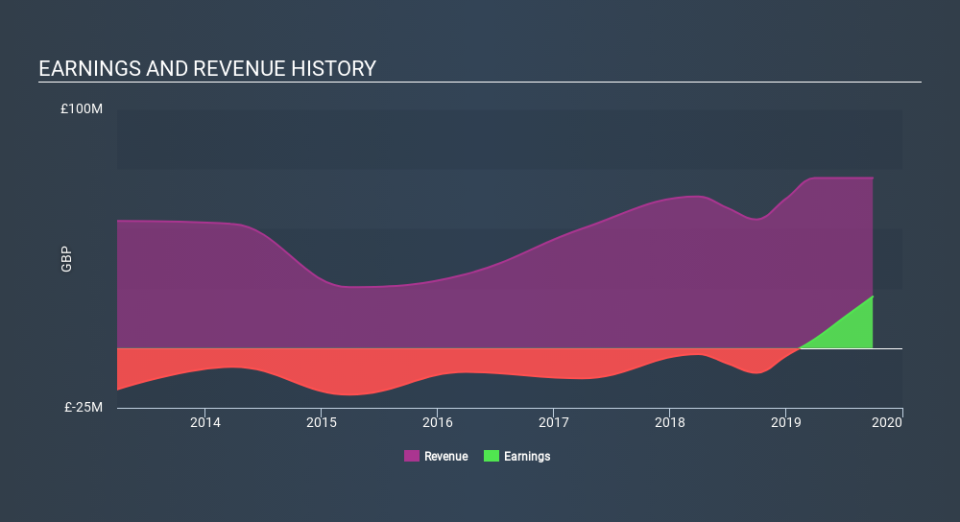

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Codemasters Group Holdings has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Codemasters Group Holdings will earn in the future (free profit forecasts).

A Different Perspective

Given that the broader market dropped 25% over the year, the fact that Codemasters Group Holdings shareholders were down 11% isn't so bad. However, the problem arose in the last three months, which saw the share price drop 26%. It's always a worry to see a share price decline like that, but at the same time, it is an unavoidable part of investing. In times of uncertainty we usually try to focus on the long term fundamental business metrics. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Codemasters Group Holdings is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance