Did Nuformix's (LON:NFX) Share Price Deserve to Gain 58%?

Some Nuformix plc (LON:NFX) shareholders are probably rather concerned to see the share price fall 52% over the last three months. But that doesn't change the reality that over twelve months the stock has done really well. After all, the share price is up a market-beating 58% in that time.

Check out our latest analysis for Nuformix

With just UK£535,000 worth of revenue in twelve months, we don't think the market considers Nuformix to have proven its business plan. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Nuformix will significantly advance the business plan before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Nuformix investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

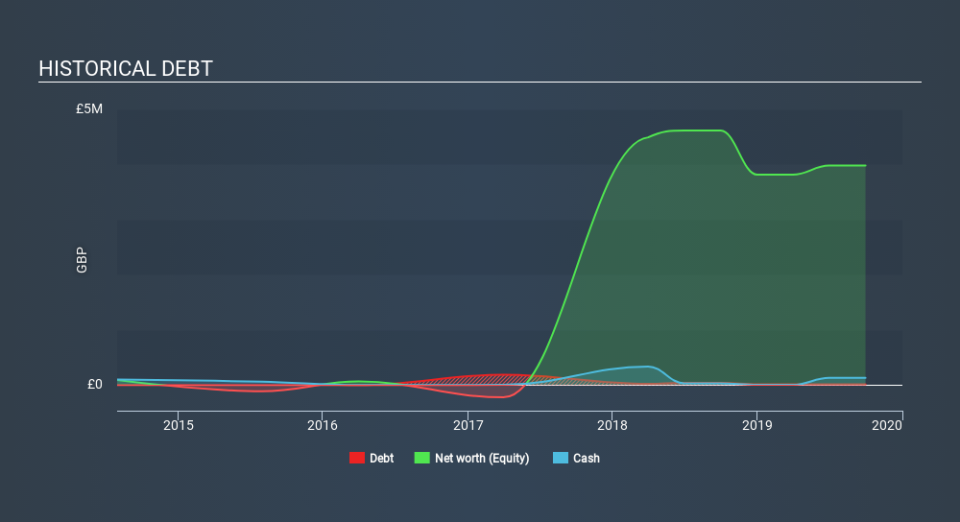

Our data indicates that Nuformix had UK£438k more in total liabilities than it had cash, when it last reported in September 2019. That puts it in the highest risk category, according to our analysis. So the fact that the stock is up 120% in the last year shows that high risks can lead to high rewards, sometimes. It's clear more than a few people believe in the potential. You can see in the image below, how Nuformix's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. However you can take a look at whether insiders have been buying up shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's nice to see that Nuformix shareholders have gained 58% over the last year. Unfortunately the share price is down 52% over the last quarter. Shorter term share price moves often don't signify much about the business itself. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 6 warning signs with Nuformix (at least 3 which are potentially serious) , and understanding them should be part of your investment process.

Of course Nuformix may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance