Digital bank for 'mass affluent' set to launch later this year

A new digital-only bank backed by City of London veterans and targeting the UK’s “mass affluent” is set to launch within months.

Monument Bank is in the late stages of securing a banking licence and expects to launch later this year. The startup bank will target customers with a net worth of between £250,000 ($316,140) and £5m, a segment of the market its founders say is underserved.

“I actually experienced the pain myself,” Mintoo Bhandari, Monument’s chief executive and cofounder, told Yahoo Finance UK. “It was absolutely brutal.

“We were getting the call centre run around constantly, the [relationship manager] we had originally kept getting changed, the relationship was all one way. They really didn’t appreciate and respect our time. All the demands were on us as clients rather than on the bank.”

READ MORE: Starling Bank seeks £35m in new competition funding: 'We're a safe pair of hands'

Monument estimates that there are around 3.5 million “mass affluent” people in Britain with a combined £200bn in cash between them. Potential clients include bankers, lawyers, property developers, and doctors.

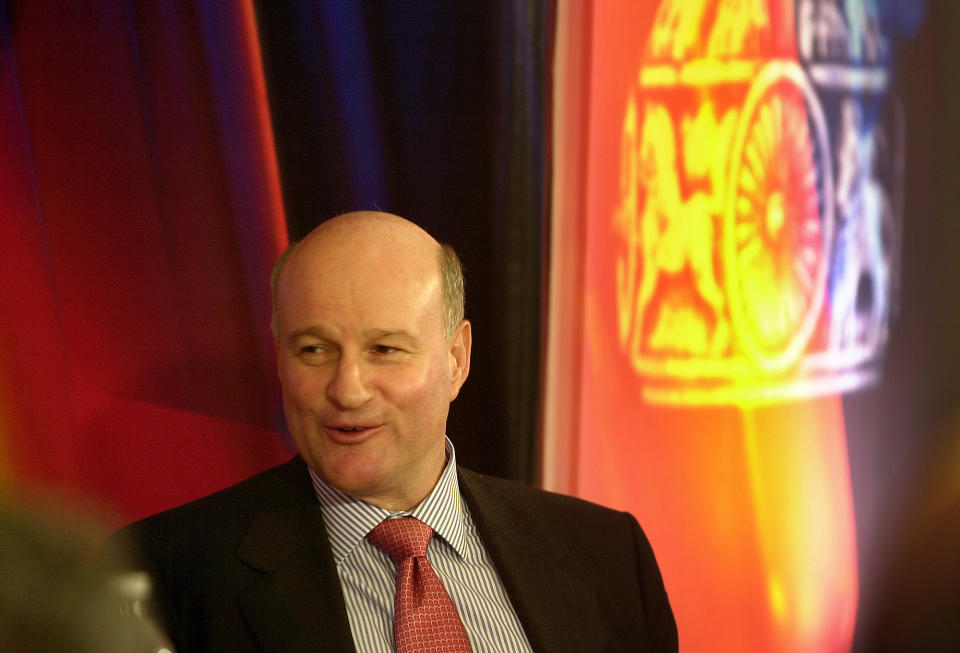

Bhandari is a former managing director at US investment giant Apollo Global and is one of a number of high finance veterans associated with the project.

Monument is chaired by Niall Booker, a veteran HSBC banker who rescued The Co-Op Bank from the brink of collapse in 2013 after being drafted in as chief executive. Others on the management team at Monument have held senior roles at Barclays and UBS.

The project has drawn funding from City of London veterans including former Panmure Gordon chief executive Ian Axe and London property developer Chris Murray.

Monument has raised £10m in ‘seed funding’ so far. The bank takes its name from the Monument to the Great Fire of London in London, which is colloquially known as simply Monument.

Monument Bank’s app will allow customers to video call and chat with relationship managers, as well as apply for buy-to-let property loans entirely digitally. Customers can also track their net worth and source advice on things like property law and inheritance.

Read more: Starling CEO Anne Boden on Bounce Back loans and growing during COVID-19 pandemic

“A decade ago it would have cost billions to deliver the technology solutions that we can deliver for single digit millions,” Bhandari said.

“We can democratise service that’s available to the Ultra High Net Worth community and the way we can do that is because of the collapse in technology cost.”

Multiple digital-first, app-only banks have launched in the UK in recent years but most have targeted ordinary current account holders or businesses. Monument claims to be the first digital challenger in the “mass affluent” space.

When it launches, Monument will go head-to-head with the likes of HSBC (HSBA.L) and Barclays (BARC.L), which have traditionally dominated the market.

Wasim Khouri, Monument’s chief strategy officer, said the startup was not perturbed at the prospect of competing with these giants.

“It actually costs so much more to modernise your technology than build it from scratch,” Khouri said. “What we’re able to do is combine this modern technology with exceptional client service.”

Khouri compared big bank’s IT systems to a “spaghetti of integration” and said Monument’s systems were more “Lego-like”, combining “best in class” cloud services.

Read more: RBS abandons Monzo-challenger Bó

Bhandari said RBS’s recent decision to shut its digital challenger bank Bo was a “good example” of how big banks lack the “culture to build these things”.

Monument has been in development for 18 months and currently has 12 full-time staff. Bhandari said he was not fazed at the prospect of launching a new bank in the midst of a pandemic.

“I think the evolution of digital has gone from a 5 or 10 year cycle to a three month cycle,” he said. “People are saying: oh I don’t know if I would do a million pound transaction on my phone. Now, people are saying: actually I would really love that.”

Yahoo Finance

Yahoo Finance