Director Peter Kim Acquires 25,000 Shares of Entrada Therapeutics Inc (TRDA)

On May 14, 2024, Peter Kim, Director at Entrada Therapeutics Inc (NASDAQ:TRDA), purchased 25,000 shares of the company, as reported in a recent SEC Filing. The transaction occurred at a price of $14.59 per share, totaling $364,750.

Entrada Therapeutics Inc (NASDAQ:TRDA) focuses on the development of therapies for neuromuscular diseases. The company's innovative approach aims to deliver transformative treatments to patients in need.

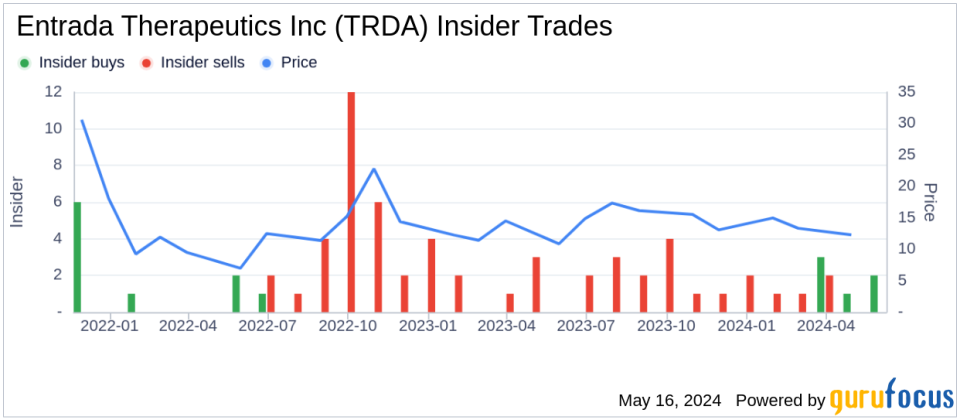

Over the past year, the insider has purchased a total of 45,368 shares and has not sold any shares. This recent acquisition follows a trend observed over the past year at Entrada Therapeutics Inc, where there have been six insider buys and 19 insider sells.

The shares of Entrada Therapeutics Inc were trading at $14.59 on the day of the transaction, giving the company a market cap of $504.697 million. The price-earnings ratio of the stock stands at 23.73, which is lower than the industry median of 28.295.

This insider purchase might indicate a positive outlook on the company's future performance by the insider. Investors often look at insider transactions to gain insights into potential future performance based on the actions of company executives and directors.

For more detailed valuation metrics such as price-sales ratio, price-book ratio, and price-to-free cash flow, visit the respective links.

For a deeper analysis, investors might also consider the GF Value of the stock to determine its fair value based on historical trading prices, earnings, and growth rates.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance