Director William Waterman Sells 10,000 Shares of Kirby Corp (KEX)

On May 15, 2024, Director William Waterman sold 10,000 shares of Kirby Corp (NYSE:KEX) as reported in a recent SEC Filing. The transaction occurred at a price of $114.51 per share.

Kirby Corp, headquartered in Houston, Texas, operates in the marine transportation and diesel engine services industries. The company is the premier tank barge operator in the United States, transporting bulk liquid products throughout the Mississippi River System, on the Gulf Intracoastal Waterway, coastwise along all three United States coasts, and in Alaska and Hawaii. Kirby also services and remanufactures diesel engines and related parts, including the supply of spare parts, for marine and power generation applications.

The sale by the insider has adjusted his holdings in the company, reflecting a significant transaction in the context of his trading activities over the past year. Over the last 12 months, the insider has sold a total of 10,000 shares and has not purchased any shares.

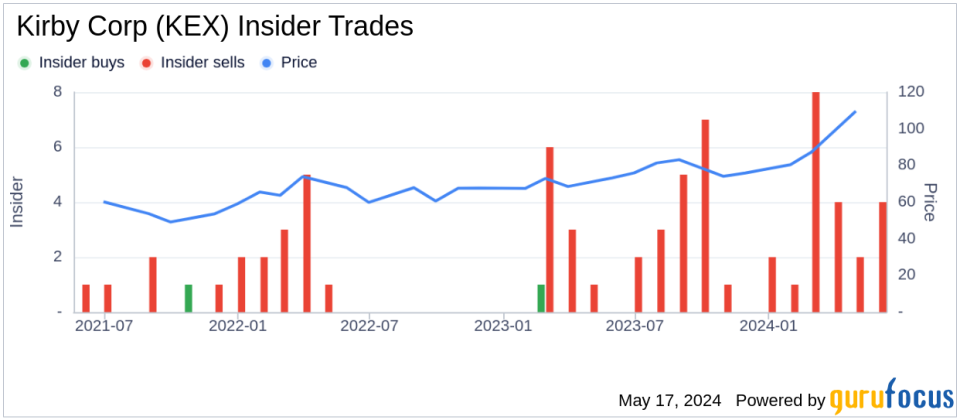

The broader insider transaction trend at Kirby Corp shows a pattern of sales, with 39 insider sells recorded over the past year and no insider buys during the same period. This could suggest a consensus among insiders about the stock's valuation or future prospects.

As of the date of the insider's recent transaction, Kirby Corp had a market cap of approximately $6.73 billion. The stock's price-earnings ratio stood at 27.28, which is above both the industry median of 14.62 and the company's historical median.

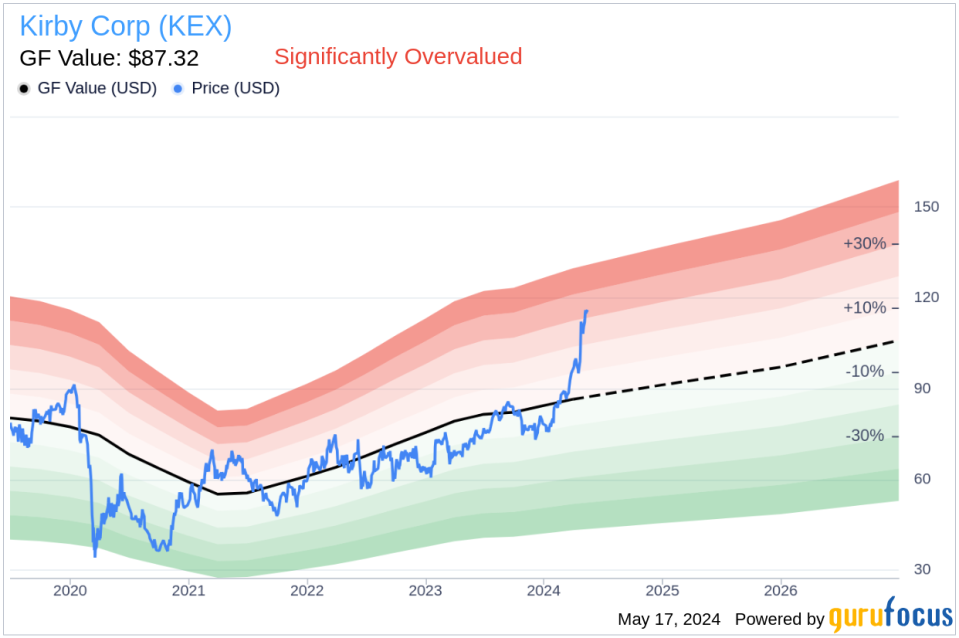

According to the GF Value, the intrinsic value estimate for Kirby Corp is $87.32 per share, making the stock significantly overvalued with a price-to-GF-Value ratio of 1.31 at the trading price of $114.51.

The valuation metrics and insider trading patterns provide critical data points for investors considering the stock's current position and future trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance