Discover 3 Growth Stocks On Chinese Exchanges With Up To 38% Insider Ownership

Amid a backdrop of fluctuating global markets, China's stock indices have shown mixed responses to recent economic stimuli and sector-specific developments. As investors navigate these uncertain waters, companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's explore several standout options from the results in the screener.

Asian Star Anchor Chain Jiangsu

Simply Wall St Growth Rating: ★★★★★☆

Overview: Asian Star Anchor Chain Co., Ltd. Jiangsu operates globally in the production and sale of anchor chains, marine mooring chains, and related accessories, with a market capitalization of CN¥7.35 billion.

Operations: The company generates revenue primarily from the global production and sales of anchor chains and marine mooring chains.

Insider Ownership: 38.5%

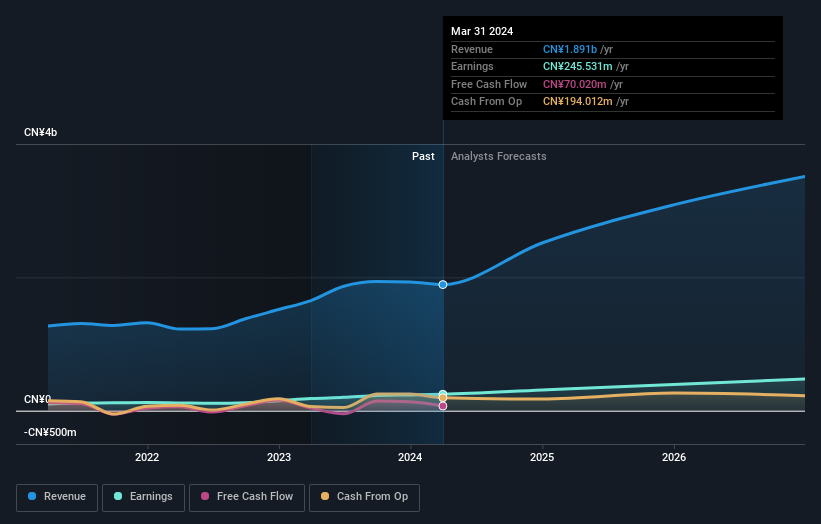

Asian Star Anchor Chain Jiangsu has demonstrated robust financial performance, with a significant 35.3% earnings growth over the past year and an expected annual profit growth of 23.5%, outpacing the Chinese market average. Despite challenges in dividend coverage, the company's revenue is projected to grow at 22.1% annually, also above market trends. Analysts predict a potential price increase of 39.1%, suggesting confidence in its valuation, which currently stands 17.5% below estimated fair value.

Jiangsu Jibeier Pharmaceutical

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Jibeier Pharmaceutical Co., Ltd. is a pharmaceutical company involved in the research, development, production, and sale of chemical pharmaceutical preparations, Chinese medicine, and drugs, with a market capitalization of approximately CN¥4.55 billion.

Operations: The company generates revenue primarily through pharmaceutical manufacturing, totaling approximately CN¥889.82 million.

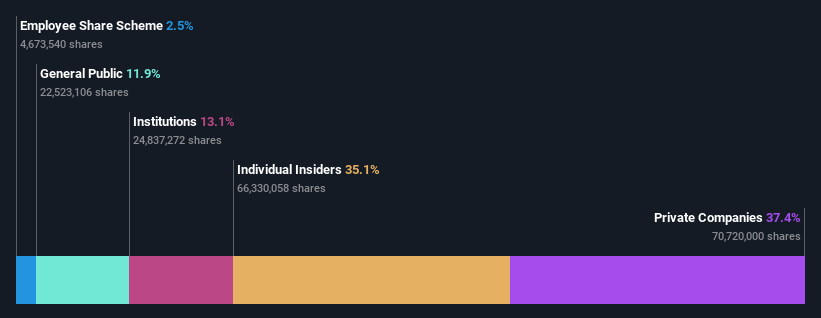

Insider Ownership: 35.1%

Jiangsu Jibeier Pharmaceutical is poised for growth with its revenue and earnings forecasted to expand by 20.8% and 21.24% per year, respectively, outpacing the Chinese market averages. Despite a lower projected Return on Equity of 14.6%, the company maintains competitive pricing with a Price-To-Earnings ratio of 19.5x, below the market average of 29.5x. Recent activities include a successful private placement and robust quarterly results, indicating active management and solid financial health without substantial insider selling or buying in recent months.

Jiangsu Canlon Building Materials

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Canlon Building Materials Co., Ltd. is a company specializing in the production and sale of waterproof building materials, with a market capitalization of approximately CN¥3.11 billion.

Operations: The revenue segments information for the company is not provided in the text.

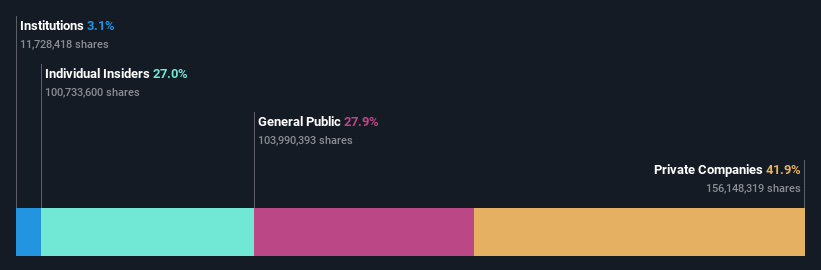

Insider Ownership: 27%

Jiangsu Canlon Building Materials has shown resilience with a significant recovery in annual revenues, reaching CNY 2.80 billion, up from previous losses. The company's earnings are expected to grow by 48.67% annually, positioning it for profitability within three years. Despite this growth, its dividend coverage remains weak due to modest cash flows and earnings. Recent share buybacks reflect confidence from management but debt concerns persist as operating cash flow does not adequately cover obligations.

Key Takeaways

Click through to start exploring the rest of the 395 Fast Growing Chinese Companies With High Insider Ownership now.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:601890 SHSE:688566 and SZSE:300715.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance