Discover Three Chinese Dividend Stocks With Yields Up To 6.4%

Amidst a backdrop of global economic fluctuations, Chinese stocks have shown resilience, though concerns about slowing growth persist. In this environment, dividend stocks may offer investors a blend of income and potential for long-term value appreciation, making them an attractive consideration in the current market scenario.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Lao Feng Xiang (SHSE:600612) | 3.27% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.64% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 4.09% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.58% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.69% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.01% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.34% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.63% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.64% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.78% | ★★★★★★ |

Click here to see the full list of 241 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

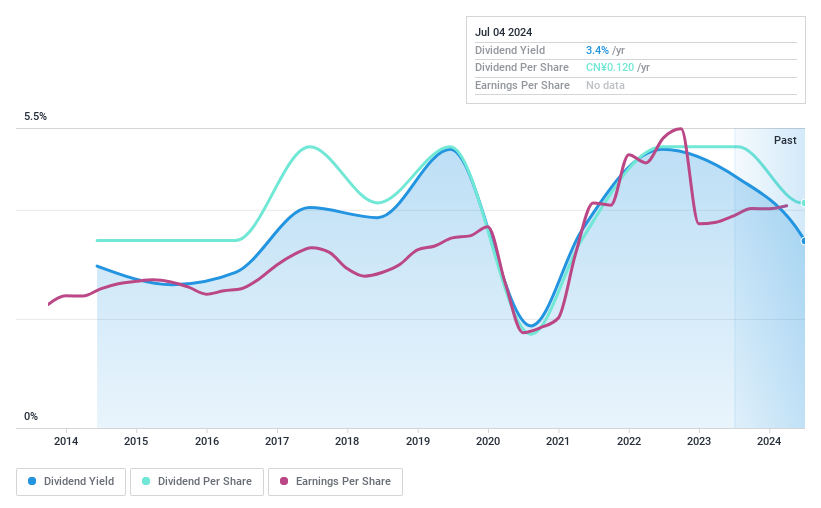

Fujian Expressway DevelopmentLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fujian Expressway Development Co., Ltd. specializes in the investment, construction, toll collection, maintenance, and management of expressways in China with a market capitalization of CN¥9.61 billion.

Operations: Fujian Expressway Development Co., Ltd. primarily generates its revenue through the investment, construction, operation, and tolling of expressways across China.

Dividend Yield: 3.4%

Fujian Expressway Development Co.,Ltd has shown consistent growth in revenue and net income, with recent quarterly earnings increasing to CNY 747.22 million and CNY 243.94 million respectively. Despite a historical volatility in dividend payments, the company maintains a low payout ratio of 36%, ensuring dividends are well-covered by earnings. Its dividend yield stands at 3.43%, higher than the market average of 2.54%. However, its dividend track record has been unstable over the past decade, reflecting some risk for dividend-focused investors.

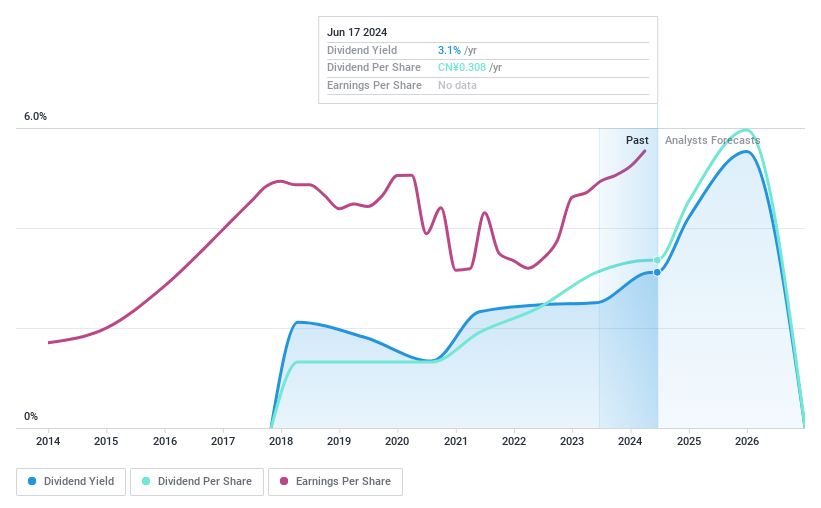

Shanghai Daimay Automotive Interior

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Daimay Automotive Interior Co., Ltd specializes in researching, developing, producing, and selling passenger car components for OEMs and automakers both domestically and internationally, with a market capitalization of approximately CN¥17.01 billion.

Operations: Shanghai Daimay Automotive Interior Co., Ltd generates its revenues primarily through the production and sale of passenger car components to OEMs and automakers across global markets.

Dividend Yield: 3%

Shanghai Daimay Automotive Interior Co., Ltd maintains a dividend yield of 2.99%, ranking in the top 25% within the Chinese market. The company's dividends are well-supported by both earnings and cash flows, with payout ratios at 74% and 71.5% respectively. Despite its robust coverage, Shanghai Daimay's dividend history is relatively short at six years, with a record that includes some instability. Earnings have seen modest growth historically but are projected to increase significantly by 20.62% annually. Upcoming corporate events include an Annual General Meeting on May 20, 2024, and a stock split scheduled for June 3, 2024.

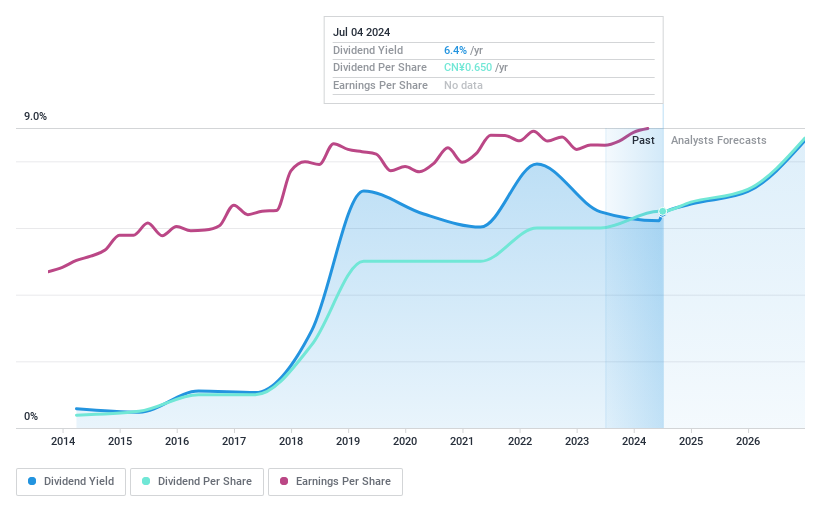

Shenzhen Fuanna Bedding and FurnishingLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shenzhen Fuanna Bedding and Furnishing Co., Ltd. operates in the design, production, and sales of textile home furnishings and related products, serving both domestic and international markets with a market capitalization of approximately CN¥8.44 billion.

Operations: Shenzhen Fuanna Bedding and Furnishing Co., Ltd. generates its revenue primarily from the design, production, and sales of textile home furnishings and related products across both domestic and international markets.

Dividend Yield: 6.4%

Shenzhen Fuanna Bedding and Furnishing Co.,Ltd offers a dividend yield of 6.44%, placing it in the top quartile of Chinese dividend stocks. Despite this, its dividends are under pressure with a high payout ratio of 93% and only 85.5% coverage by cash flows, indicating potential sustainability issues. Recent increases in dividends, including a CNY 6.50 per 10 shares for 2023, reflect a commitment to maintaining shareholder returns amid growing earnings forecasts at an annual rate of 9.58%.

Seize The Opportunity

Take a closer look at our Top Dividend Stocks list of 241 companies by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600033 SHSE:603730 and SZSE:002327.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance