Distributed Antenna System (DAS) Global Market Report 2023: Rising Demand for Enhanced Network Coverage and Need to Eliminate Connectivity Gaps in Buildings Bolsters Growth

Global Distributed Antenna System Market

Dublin, March 10, 2023 (GLOBE NEWSWIRE) -- The "Distributed Antenna System (DAS) Market by Offering (Component, Services), Coverage (Indoor, Outdoor), Ownership Model, Vertical (Commercial, Public), User Facility Area, Frequency Protocol (Cellular, VHF/UHF), Network Type, Signal Sources and Region - Global Forecast to 2028" report has been added to ResearchAndMarkets.com's offering.

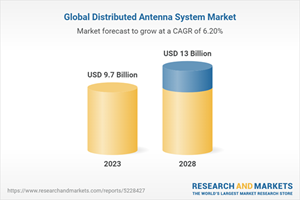

The DAS market is projected to grow from USD 9.7 billion in 2023 to USD 13.0 billion by 2028, registering a CAGR of 6.2% during the forecast period.

Some of the major factors that are driving the growth of the distributed antenna system (DAS) market include growing mobile data traffic, rising demand for extended network coverage and uninterrupted connectivity, and rising construction of buildings based on modern and sustainable concepts that necessitate DAS deployments.

However, the complexities involved in installing DAS will be a challenge for the market in the future. The major growth opportunities for the market players are increasing requirements for public safety connectivity and a rise in the number of commercial spaces, especially in the ASEAN region.

Market for neutral-host ownership to grow at higher CAGR during forecast period

The neutral-host qonership segment of the DAS market is expected to account for the largest market size and highest growth rate during the forecast period. In neutral-host models, the ownership shifts from carriers to building owners, DAS integrators, or third-party system/service providers. An independent, third-party host handles financial, legal, regulatory, and technical responsibilities, including the deployment, installation, and maintenance of the DAS system. The host who owns the system can lease system access to one or more operators. Hence, end users can benefit from a multicarrier DAS, while the host company receives exclusive rights to the system. This model is successful for deployments at large venues, such as stadiums, malls, and airports.

Healthcare commercial vertical held largest share of DAS market in 2023

In terms of market size, the healthcare vertical is expected to dominate the DAS market and is likely to witness significant growth during the forecast period. Hospitals use DAS to amplify and extend the coverage of outdoor cellular signals inside hospital buildings to ensure consistent mobile service. With the adoption of telemedicine and telehealth, as well as the increasing number of devices used within hospitals, they will require more bandwidth than current Wi-Fi and DAS infrastructure can provide. At present, DAS provide significant benefits to the healthcare vertical by providing ubiquitous cellular, and public safety communication coverage.

Asia Pacific to witness highest growth among other regions during forecast period

Asia Pacific is expected to dominate the DAS market during the forecast period Asia Pacific is one of the emerging markets for DAS components and services. The region has been segmented into China, India, Japan, South Korea, and Rest of Asia Pacific, which includes Australia, New Zealand, Singapore, and other Southeast Asian countries. The major drivers for the growth of the DAS market in Asia Pacific include the growing adoption of phones, rise in the number of internet users (1.2 billion users in 2021), increasing internet connectivity, growing network establishment, and rise in high bandwidth-intensive applications.

According to the GSMA Mobility report 2021, the global mobile data usage in Asia Pacific was 11.5 GB per subscriber per month in 2022. The region has become a global focal point for huge investments and business expansions. Asian markets encourage the development of 5G mobile technologies, with commercial deployments already implemented in South Korea, Japan, and China and ready to be deployed in India in the next few years.

Market Dynamics

Drivers

Growing Mobile Data Traffic

Rising Demand for Enhanced Network Coverage and Need to Eliminate Connectivity Gaps in Buildings

Growing Need for Strong and Reliable Cellular Connectivity for Internet of Things (IoT)

Growing Focus on Enhancing Spectrum Efficiency

Deployment of Distributed Antenna Systems in Buildings Based on Modern and Sustainable Concepts

Restraints

High Costs Associated with Das Network Deployment

Routing Backhauling Issue Associated with Das Networks

Opportunities

Growth in Requirement for Public Safety Connectivity

Increase in Commercial Spaces Across Association of Southeast Asian Nations

Use of Distributed Antenna System (Das) Technology in Citizens Broadband Radio Service (CBRS)

Challenges

Complexities Associated with Installation of Das

Upgradeability Issues of Existing Das Networks

Key Attributes:

Report Attribute | Details |

No. of Pages | 293 |

Forecast Period | 2023 - 2028 |

Estimated Market Value (USD) in 2023 | $9.7 Billion |

Forecasted Market Value (USD) by 2028 | $13 Billion |

Compound Annual Growth Rate | 6.2% |

Regions Covered | Global |

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

6 Distributed Antenna System Market, by Offering

6.1 Introduction

6.2 Component

6.2.1 Antenna Nodes/Radio Nodes

6.2.1.2.1 Fiberglass Antenna

6.2.1.2.2 Panel Antenna

6.2.1.2.3 Wall-Mount Antenna

6.2.1.2.4 Ceiling Antenna

6.2.1.2.5 Sector Antenna

6.2.1.2.6 Others

6.2.1.3 Antenna Nodes/Radio Nodes, by Technology

6.2.1.3.1 Standalone Das

6.2.1.3.2 Integrated Antenna

6.2.1.4 Antenna Nodes/Radio Nodes, by Coverage

6.2.1.4.1 Omni-Directional Antenna

6.2.1.4.2 Directional Antenna

6.2.1.5 Antenna Nodes/Radio Nodes, by Configuration

6.2.1.5.1 1X1 Antenna

6.2.1.5.2 2X2 Antenna

6.2.1.5.3 4X4 Antenna

6.2.1.5.4 Others

6.2.2 Head-End Units

6.2.3 Radio Units

6.2.4 Bidirectional Amplifiers (BDA)

6.2.5 Das/Point-Of-Interface (PoI) Trays

6.2.6 Others

6.3 Service

6.3.1 Pre-Sales Services

6.3.2 Installation Services

6.3.3 Post-Sales Services

7 Distributed Antenna System Market, by Coverage

7.1 Introduction

7.2 Indoor

7.2.2 Active

7.2.2.2 Analog

7.2.2.3 Digital

7.2.3 Passive

7.2.4 Hybrid

7.3 Outdoor

8 Distributed Antenna System (Das) Market, by Ownership Model

8.1 Introduction

8.2 Carrier Ownership

8.3 Neutral-Host Ownership

8.4 Enterprise Ownership

9 Distributed Antenna System (Das) Market, by User Facility Area

9.1 Introduction

9.2 >500 K Sq. Ft.

9.3 200-500 K Sq. Ft.

9.4 <200 K Sq. Ft.

10 Distributed Antenna System Market, by Vertical

10.1 Introduction

10.2 Commercial

10.3 Public Safety

11 Distributed Antenna System Market, by Frequency Protocol

11.1 Introduction

11.2 Cellular

11.3 Very High Frequency/Ultra-High Frequency (Vhf/Uhf)

11.4 Others

12 Distributed Antenna System Market, by Network Type

12.1 Introduction

12.2 Public Network

12.3 Private Long-Term Evolution (Lte)/Citizens Broadband Radio Service (Cbrs)

13 Distributed Antenna System Market, by Signal Source

13.1 Introduction

13.2 Off-Air Antennas (Repeaters)

13.3 On-Site Base Transceiver Station (Bts)

13.4 Small Cells

14 Distributed Antenna System Market, by Region

15 Competitive Landscape

16 Company Profiles

17 Appendix

Companies Mentioned

Advanced Rf Technologies, Inc.

Airplux Technologies Limited

American Tower

At&T

Betacom Inc.

Boingo Wireless, Inc.

Bti Wireless

Cellnex Telecom

Comba Telecom Systems Holdings Ltd.

Commscope

Connectivity Wireless

Corning Incorporated

Dali Wireless

Galtronics

Harris Communications

Huber+Suhner

Jma Wireless

Kathrein Broadcast Gmbh

Pbe Group

Solid

Veridas Technologies

Vision Technologies

Westell Technologies, Inc.

Whoop Wireless

Zinwave

For more information about this report visit https://www.researchandmarkets.com/r/wzdi77

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance