What falling inflation means for mortgages, savings and investments

Inflation fell to 2pc in May, according to the Office for National Statistics. The drop from 2.3pc in April means price growth is in line with the Bank of England’s target of 2pc. It is the lowest rate of inflation since July 2021.

The drop will raise hopes that the Bank of England will reduce its Bank Rate over the summer, and with it the cost of borrowing. The Rate has sat at 5.25pc, a 16-year high, since August last year as the central bank has tried to tackle inflation.

However, services inflation currently sits at 5.7pc, above economists’ expectations of where it would be in May. As a result the market now expects the Bank Rate to fall to 5pc by the end of the year, with a chance of the first rate cut as early as August – but it could be as late as November.

This could have a significant impact on your finances – including savings, mortgages and investments. Here, Telegraph Money explains what your options are.

What is inflation?

Inflation is the term used by economists and governments to describe the speed at which prices are rising.

In Britain, we usually measure inflation by comparing the price of a particular item to its price at the same time the previous year.

For example, if a chocolate bar costs £1 in April 2023 and then in April 2024 it costs £1.04, its price has risen by 4pc and thus inflation for this particular item stands at 4pc.

However, statisticians have to calculate the pace of price rises across the whole of the economy and use a variety of methods to estimate this as accurately as possible.

The most closely followed of these methods used by the Government and the Bank of England (BoE) is the Consumer Price Index, often abbreviated to CPI, which is published each month by the Office for National Statistics (ONS).

This calculates inflation based on a typical basket of goods and services which statisticians at the ONS update every year.

What does falling inflation mean for your mortgage?

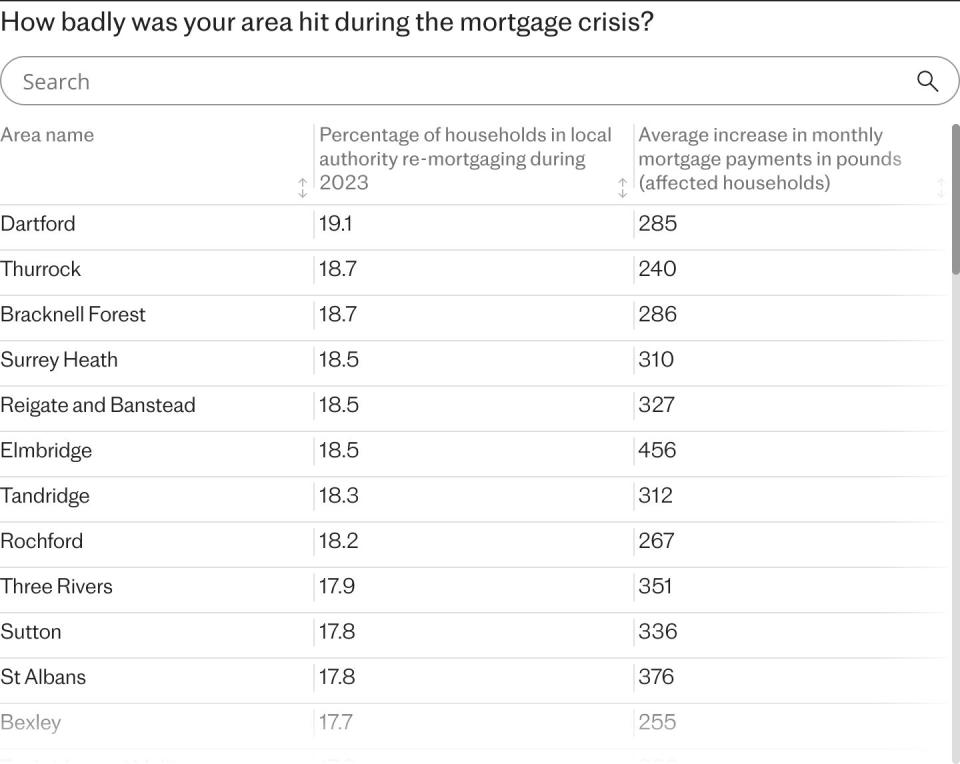

Mortgage rates have remained high over the past two years, adding financial pressure across the housing market.

For first time buyers, higher rates of borrowing have made it harder to get on the housing ladder, while existing homeowners face a mortgage shock when coming off ultra-low fixed rate deals and on to new loans at today’s rates.

The average two-year fixed rate mortgage is currently 5.97pc, according to analyst Moneyfacts.

Fixed rate and variable rate mortgages are linked to the Bank Rate, although not necessarily directly.

Some tracker mortgages are linked to the Rate, often sitting one or two percentage points above it, while fixed rate mortgages are priced based on swap rates – market expectations of where the Bank Rate will be at a certain point in the future.

While falling inflation and an expected drop in the Bank Rate is good news for mortgage holders, rates are unlikely to fall dramatically over the summer, leaving borrowers still facing much higher costs than two years ago.

David Hollingworth, Associate Director at L&C Mortgages said: “It’s been a choppy backdrop for mortgage rates in recent months with fixed rates edging higher in May as markets anticipated that base rate would remain higher for longer. Market rates seem to have eased back again a touch in recent weeks to unwind some of the hikes.

“Today’s news is unlikely to cause a ripple as far as mortgage rates are concerned and looks unlikely to be enough to tee up any surprise move to base rate. Consequently, mortgage borrowers hoping for an early cut in interest rates may have to wait longer than had been expected earlier in the year.”

Nicholas Mendes of broker John Charcol added: “Given that mortgage rates are influenced by swaps reflecting market expectations of future interest rates, we are likely to see a shift in fixed-rate pricing, suggesting a positive turn as we move into the second half of the year.

For mortgage holders nearing the end of their fixed-rate period, it is advisable to begin exploring remortgaging options at least six months before their current deal expires. This proactive approach ensures sufficient time to arrange new terms, ensuring a seamless transition when the current product concludes.”

What can you do if you need to get a mortgage?

For homeowners coming to the end of their fixed rate mortgage it is important to remember you can start reviewing your options three to six months in advance and lock into a deal without committing to it. If rates then go up before you need to finalise your loan you are safe, but if rates fall in the interim you can choose a better rate.

“Assess your financial situation, check your credit score, and compare the current mortgage rate,” said Mr Mendes.

“Consulting a mortgage broker can provide valuable guidance tailored to your specific need, such as whether to switch to a new fixed rate, opt for a variable rate or remortgage with a different lender.”

For those buying for the first time, now would be a good time to get everything ready for a mortgage application said Alice Haine, personal finance analyst at Bestinvest: “While easing inflation combined with solid wage growth means affordability levels are improving for buyers as their money can stretch that little bit further, a rate reduction could boost their prospects even further.

“House prices have flatlined in recent weeks as uncertainty around the timing of a rate reduction and the impact a new government could have on the market causes some buyers and owners to put moving plans on pause.”

What are the best deals on the market?

For first-time buyers looking to borrow up to 90pc of the house price, the best deals on the market include Lloyds Bank’s two-year fixed rate at 5.22pc with a £999 product fee and First Direct’s five-year fixed rate at 4.78pc with a product fee of £490.

For those with 25pc equity looking to remortgage Lloyds Bank’s two-year fixed rate at 4.83pc with a product fee of £999. If you have 25pc equity and are looking to fix for five years The co-operative Bank has a deal at 4.52pc with a product fee of £999.

If you are remortgaging or buying for the first time with 40pc equity, Lloyds Bank is offering a two-year fixed rate of 4.75pc with a £999 product fee. If you are looking to fix for five years with 40pc equity, Santander has a 4.28pc rate deal with a £999 product fee.

What does falling inflation mean for your savings?

Lower inflation brings both good and bad news for savers. With inflation at just 2pc it is very easy to beat it with the current rates on the market.

The average easy access savings rate is currently 3.11pc, according to Moneyfacts, but the most competitive accounts still pay over 5pc.

This is a positive, since inflationary price rises eat into the value of savings – put simply, if your savings aren’t matching or exceeding inflation, the rising prices mean your money won’t be able to buy as much as it previously could.

However, savings rates are unlikely to stay this high for long. Much like mortgages, savings rates tend to rise and fall with the Bank Rate – and providers may well take today’s inflation dip as a sign that the Bank Rate will soon follow suit, and reduce savings rates in anticipation.

Last year, while the Bank Rate was still rising, we saw savings rates peak at a little over 6pc. Despite being frozen since August, rates have been steadily falling since then in anticipation of when it starts to fall.

What can you do about it?

Today’s inflation fall is likely to put further downward pressure on savings rates – so, as a minimum, you should check your current rates and make sure you’re beating the inflation rate.

Planning ahead, it might be a good time to commit to a fixed-term account if there’s cash you won’t need to access for at least a year.

“These cuts could mean lower returns for savers who haven’t secured fixed rates,” said Adam Thrower, head of savings at Shawbrook Bank. “The silver lining? Longer-term fixed-rate savings accounts are gaining traction. These accounts offer the chance to lock in higher, guaranteed returns for a set period, especially valuable for those saving for long-term goals like retirement.”

What’s the best deal on the market?

For easy access accounts, Cahoot Sunny Day Saver is offering 5.2pc, with no minimum deposit, according to Moneyfacts, up to £3,000. Interest is paid annually on the account’s anniversary. Chase pays 5.1pc, with no minimum deposit on balances up to £1,000,000.

For a fixed account, Vanquis Bank pays 5.21pc for a one year bond with a minimum deposit of £1,000.

Longer-term bond rates, which usually pay more, currently have lower rates – but could still be worth considering if rates start to fall more widely later this year. You can get 4.75pc from Atom Bank for a five-year fix.

What does it mean for your pensions and investments?

The stock market is not officially linked to inflation or the Bank Rate, but as both are significant indicators of the state of the economy, they can have a big impact on investor sentiment.

Jason Hollands, managing director of Bestinvest by Evelyn Partners, said: “The combination of easing inflation, the prospect of lower borrowing costs and an improving UK growth outlook should also prove supportive for UK equities, especially the more domestically focused small and medium sized names, which have been deeply unloved in recent times.”

“This could be a good entry point for investors, as UK equity valuations remain very cheap compared to global equities, a point evidently not lost on the wave of bids for British companies by foreign acquirers and private equity funds we have seen recently.

“The UK stock market has certainly been confronted with many challenges including a dearth of IPOs and companies being lured to overseas exchanges, but better economic news, high levels of share buybacks and a wave of bids are creating lots of opportunities for investors.”

Low inflation may impact retirees, or those who are due to retire soon, due to its impact on bonds. Pension “lifestyling” strategies tend to move towards less risky investments as you reach retirement, in order to shield your money from market fluctuations – often, this means increasing your proportion of bonds.

Bonds become more attractive in periods of rising inflation as the value of the income in real terms is increased. This is good news for those who already hold bonds, but more expensive for those who are yet to buy.

Yahoo Finance

Yahoo Finance