Does Luna Innovations Incorporated's (NASDAQ:LUNA) CEO Pay Matter?

In 2017, Scott Graeff was appointed CEO of Luna Innovations Incorporated (NASDAQ:LUNA). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Luna Innovations

How Does Scott Graeff's Compensation Compare With Similar Sized Companies?

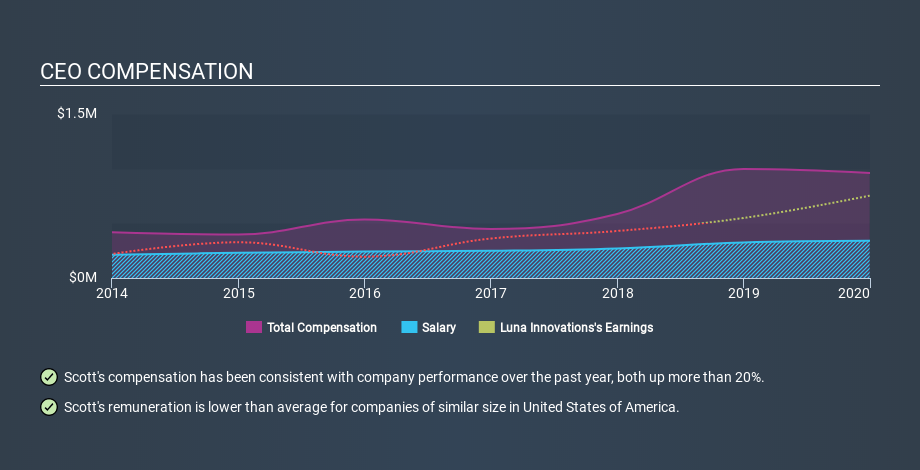

According to our data, Luna Innovations Incorporated has a market capitalization of US$186m, and paid its CEO total annual compensation worth US$961k over the year to December 2019. That's less than last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$340k. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of US$100m to US$400m. The median total CEO compensation was US$1.4m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Luna Innovations stands. On an industry level, roughly 36% of total compensation represents salary and 64% is other remuneration. Luna Innovations does not set aside a larger portion of remuneration in the form of salary, maintaining the same rate as the wider market.

At first glance this seems like a real positive for shareholders, since Scott Graeff is paid less than the average total compensation paid by similar sized companies. However, before we heap on the praise, we should delve deeper to understand business performance. The graphic below shows how CEO compensation at Luna Innovations has changed from year to year.

Is Luna Innovations Incorporated Growing?

On average over the last three years, Luna Innovations Incorporated has seen earnings per share (EPS) move in a favourable direction by 115% each year (using a line of best fit). It achieved revenue growth of 48% over the last year.

This demonstrates that the company has been improving recently. A good result. The combination of strong revenue growth with medium-term earnings per share improvement certainly points to the kind of growth I like to see. You might want to check this free visual report on analyst forecasts for future earnings.

Has Luna Innovations Incorporated Been A Good Investment?

I think that the total shareholder return of 309%, over three years, would leave most Luna Innovations Incorporated shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Luna Innovations Incorporated is currently paying its CEO below what is normal for companies of its size.

Many would consider this to indicate that the pay is modest since the business is growing. The pleasing shareholder returns are the cherry on top; you might even consider that Scott Graeff deserves a raise! Most shareholders like to see a modestly paid CEO combined with strong performance by the company. But it is even better if company insiders are also buying shares with their own money. Looking into other areas, we've picked out 2 warning signs for Luna Innovations that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance