Dongwha EnterpriseLtd Leads Trio Of KRX Growth Stocks With High Insider Stakes

The South Korean stock market has shown steady growth, rising 7.2% over the past year and remaining stable in the last week, with expectations for earnings to grow by 29% annually in the coming years. In such a promising environment, stocks like Dongwha Enterprise Ltd that combine robust growth prospects with high insider ownership may offer appealing opportunities for investors looking for aligned interests and potential resilience.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Vuno (KOSDAQ:A338220) | 19.5% | 103.8% |

HANA Micron (KOSDAQ:A067310) | 20% | 94.1% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's dive into some prime choices out of from the screener.

Dongwha EnterpriseLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongwha Enterprise Co., Ltd. is a South Korean company that manufactures and sells wood materials, with a market capitalization of approximately ₩691.16 billion.

Operations: Dongwha Enterprise's revenue is generated from three main segments: Housing Business (₩0.15 billion), Chemical Business (₩0.24 billion), and Materials Business (₩0.60 billion).

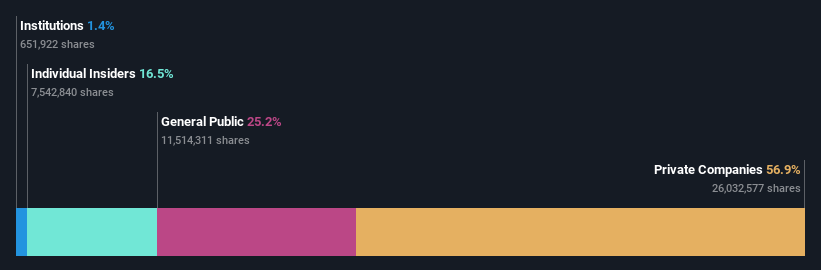

Insider Ownership: 16.5%

Dongwha Enterprise Co., Ltd is navigating a challenging financial landscape with a net loss reduction in Q1 2024, showing improved performance from the previous year. The company's revenue growth at 11.5% annually is set to outpace the broader South Korean market, although it remains below the high-growth threshold of 20%. Despite this, Dongwha is expected to turn profitable within three years, supported by a significant earnings growth forecast of 93.35% per year. However, its return on equity is projected to be low at 6.2%, and its debt coverage by operating cash flow raises concerns about its financial health. Currently trading at a substantial discount to estimated fair value offers potential upside if it can overcome these operational challenges.

HANA Micron

Simply Wall St Growth Rating: ★★★★★★

Overview: HANA Micron Inc. specializes in semiconductor back-end process packaging solutions based in South Korea, with a market capitalization of approximately ₩972.22 billion.

Operations: The company generates revenue primarily from semiconductor manufacturing, contributing approximately ₩1.27 billion, and semiconductor materials, adding about ₩221.85 million.

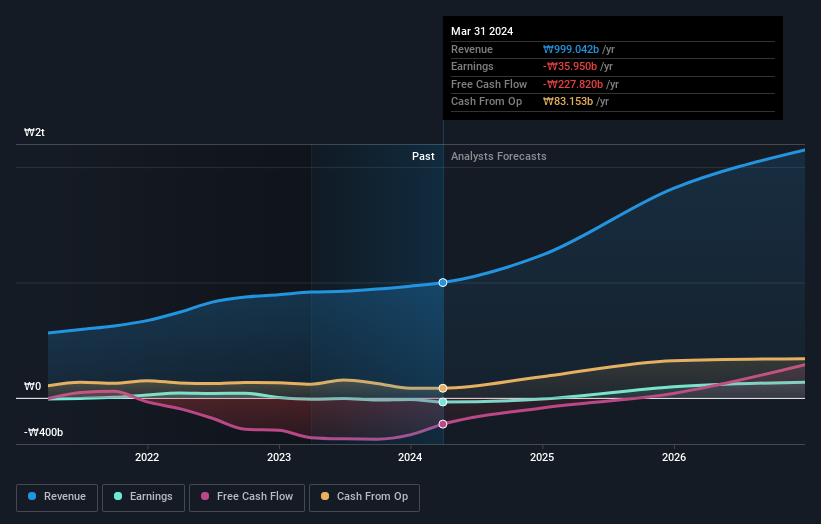

Insider Ownership: 20%

HANA Micron is poised for substantial growth with a forecasted revenue increase of 27.9% annually, outpacing the South Korean market's 10.5%. This growth is supported by an optimistic earnings projection, expecting profitability within three years. Despite recent financial setbacks marked by a significant first-quarter net loss and volatile share price, the company's high insider ownership could signal strong future governance and alignment with shareholder interests. Additionally, a recent KRW 112.5 billion follow-on equity offering could provide necessary capital for further expansion.

ZeusLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zeus Co., Ltd. operates in the semiconductor, robot, and display solutions sectors globally, with a market capitalization of approximately ₩0.54 billion.

Operations: The company's revenue is primarily generated from its Equipment Division, which contributed approximately ₩436.69 million, and its Valve segment, with revenues of about ₩22.95 million.

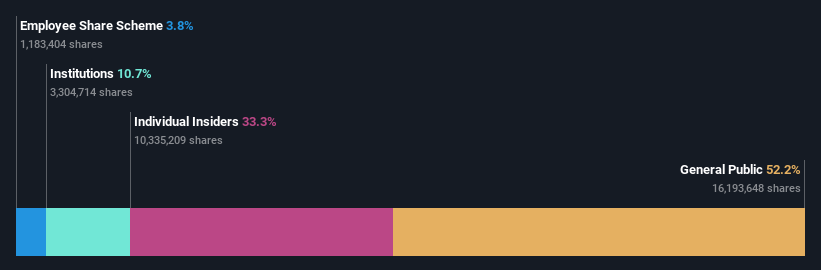

Insider Ownership: 33.3%

Zeus Ltd. is experiencing robust earnings growth, with forecasts suggesting an annual increase of 47.7%, significantly outpacing the South Korean market's 29.2%. Despite a revenue growth rate (18.2% per year) slightly below the desired 20%, it remains well above the market average of 10.5%. However, profitability challenges are evident as profit margins have declined from last year, coupled with shareholder dilution over the past year. Recent strategic moves include a KRW 5 billion share buyback program to stabilize stock prices and enhance shareholder value, reflecting positive steps toward governance and investor alignment despite some financial inconsistencies.

Take a closer look at ZeusLtd's potential here in our earnings growth report.

Our expertly prepared valuation report ZeusLtd implies its share price may be too high.

Summing It All Up

Embark on your investment journey to our 87 Fast Growing KRX Companies With High Insider Ownership selection here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A025900KOSDAQ:A067310 and KOSDAQ:A079370

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance