Dover (DOV) Stock Rallies 28% YTD: What's Working in Favor?

Shares of Dover Corporation DOV have rallied 28.8% year to date, aided by its stellar first-quarter 2019 results and an upbeat outlook for the ongoing year. Also, improved performance in the Engineered Systems and Fluids segments, strong bookings and backlog, cost-reduction initiatives, as well as restructuring programs are some of its key growth drivers. The company has also trounced its industry’s rise of roughly 18.2% over the same time frame.

Dover, a Zacks Rank #2 (Buy) stock, has a market cap of roughly $13.2 billion. The company has an expected long-term earnings per share growth rate of 11.3%.

Let’s delve deeper and analyze the reasons behind the company’s impressive price performance and find out if there is room for further appreciation:

Strong Q1: Dover’s first-quarter 2019 adjusted earnings per share and revenues climbed 37.7% and 5.3%, respectively, on a year-over-year basis, and also beat the respective Zacks Consensus Estimate.

Upbeat Outlook: Dover maintained its adjusted earnings per share guidance of $5.65-$5.85 for full-year 2019, backed by encouraging March-end quarter results. This was driven by productivity and cost initiatives, improved segmental performance, organic growth, and solid booking and backlog. This January, Dover closed the Belanger acquisition, which is expected to be accretive to margins and adjusted earnings in the current year.

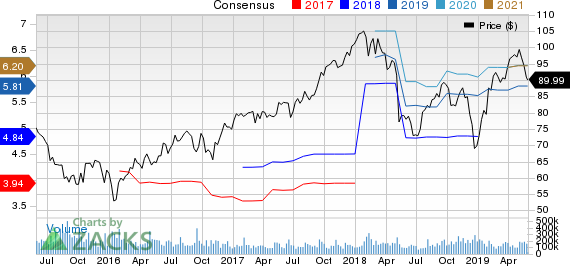

Healthy Growth Projections: The Zacks Consensus Estimate for Dover’s current-year earnings is currently pegged at $5.81, reflecting year-over-year growth of 16.9%. The same for 2020 stands at $6.21, indicating a year-over-year rise of 6.8%. Further, the Zacks Consensus Estimate for 2019 earnings moved up 1%, over the past 90 days, while the same for 2020 has moved 0.3% north.

Positive Earnings Surprise History: The company outpaced the Zacks Consensus Estimate in all of the trailing four quarters, the average positive earnings surprise being 8.61%.

Growth Drivers in Place

The company’s current-quarter results are likely to improve on solid order backlog. Through 2019, impressive performance in the Engineered Systems and Fluids segments, along with stellar organic growth, benefits from cost-containment actions, footprint-optimization projects, and retail refrigeration will negate the impact of weak demand in the Refrigeration & Food Equipment segment.

Dover also expects to benefit from its targeted cost-reduction initiatives this year. The company has executed restructuring programs to better align costs and operations with the current market conditions through targeted facility consolidations, headcount reduction and other measures.

Dover is progressing well with its efforts to simplify the portfolio and focus on markets with growth prospects. In sync with this, it successfully completed the spin-off of the upstream energy businesses — Apergy — last May. Following the spin-off, the company no longer owns the Energy segment and has three reportable segments. Thus, the divestment will enable Dover to focus on less volatile core platforms by delivering innovative equipment and components, specialty systems, consumable supplies, software and digital solutions, as well as support services.

Dover Corporation Price and Consensus

Dover Corporation price-consensus-chart | Dover Corporation Quote

Other Stocks to Consider

Some other top-ranked stocks in the Industrial Products sector are DMC Global Inc. BOOM , Lawson Products, Inc. LAWS and Harsco Corporation HSC, each sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

DMC Global has an estimated earnings growth rate of 83.5% for the ongoing year. The company’s shares have soared 48.8%, in the past year.

Lawson Products has an expected earnings growth rate of 24.5% for the current year. The stock has appreciated 59.4% in a year’s time.

Harsco has a projected earnings growth rate of 9.1% for 2019. The company’s shares have gained 0.2%, over the past year.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dover Corporation (DOV) : Free Stock Analysis Report

DMC Global Inc. (BOOM) : Free Stock Analysis Report

Lawson Products, Inc. (LAWS) : Free Stock Analysis Report

Harsco Corporation (HSC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance