DuPont (DD) Tops Q2 Earnings & Sales Estimates, Raises FY21 View

DuPont de Nemours, Inc. DD recorded earnings (on a reported basis) from continuing operations of $1.04 per share for second-quarter 2021 against a loss of $3.26 per share in the year-ago quarter.

Barring one-time items, earnings came in at $1.06 per share for the reported quarter, topping the Zacks Consensus Estimate of 94 cents.

DuPont raked in net sales of $4,135 million, up 26% from the year-ago quarter. It also beat the Zacks Consensus Estimate of $4,003.1 million. The company saw a 23% rise organic sales in the quarter. It also witnessed double-digit sales growth across its segments in the reported quarter.

The company benefited from a recovery in key end-markets such as automotive, construction and industrial and sustained strength in semiconductor and smartphones. However, it faced challenges from higher raw material costs as well as global supply chain and logistics issues in the quarter.

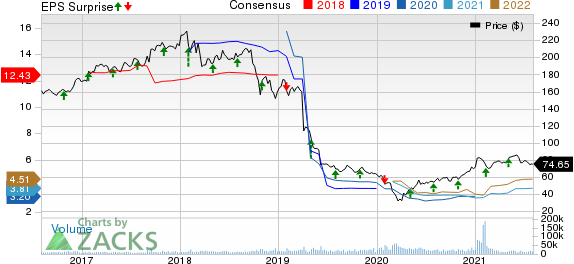

DuPont de Nemours, Inc. Price, Consensus and EPS Surprise

DuPont de Nemours, Inc. price-consensus-eps-surprise-chart | DuPont de Nemours, Inc. Quote

Segment Highlights

The company’s Electronics & Industrial segment recorded net sales of $1.3 billion in the reported quarter, up 19% on a year-over-year comparison basis. Organic sales rose 17% on 17% higher volumes. Sales were driven by gains in Industrial Solutions on broad-based demand, especially in displays, electronics, healthcare and automotive markets. Continued strength was also witnessed in Interconnect Solutions and Semiconductor Technologies.

Net sales in the Water & Protection unit were $1.4 billion, up 14% year over year. Organic sales rose 11% on 11% higher volume. Sales were driven by a more than 30% growth in Shelter Solutions on strong demand in North American residential construction and retail channels for do-it-yourself applications along with continued recovery in commercial construction. The company also saw strong demand in Water Solutions.

Net sales for the Mobility & Materials division were $1.3 billion in the reported quarter, up 61% year over year. Organic sales jumped 55% on 13% higher pricing and 42% volume increase. The company saw sustained recovery in its end-markets, especially automotive, from the impacts of the pandemic. Strong gains in volumes were witnessed across Engineering Polymers, Advanced Solutions and Performance Resins in the reported quarter.

Financials

DuPont had cash and cash equivalents of $3,962 million at the end of the quarter, up around 6% year over year. Long-term debt was $10,627 million, down roughly 32% year over year.

The company also generated operating cash flow of $440 million and free cash flow of $224 million in the quarter. Moreover, it returned around $800 million to shareholders through share repurchases and dividends during the quarter.

Outlook

DuPont raised its guidance for net sales and adjusted earnings per share for 2021 factoring in sustained momentum in its major end-markets. Net sales for the year are now forecast to be between $16.45 billion and $16.55 billion, compared with $15.7 billion and $15.9 billion expected earlier.

The company also expects adjusted earnings per share for 2021 in the band of $4.24-$4.30, up from the prior view of $3.60-$3.75.

For the third quarter of 2021, DuPont sees net sales in the band of $4.18-$4.23 billion. Adjusted earnings are predicted in the range of $1.11-$1.13 per share for the quarter.

Price Performance

DuPont’s shares are up 42.3% over a year compared with a 39.6% rise recorded by the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

DuPont currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Nucor Corporation NUE, ArcelorMittal MT and The Chemours Company CC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nucor has a projected earnings growth rate of 444.9% for the current year. The company’s shares have surged around 138% in a year.

ArcelorMittal has an expected earnings growth rate of 1,484.4% for the current year. The company’s shares have shot up around 202% in the past year.

Chemours has an expected earnings growth rate of around 66.8% for the current fiscal. The company’s shares have rallied roughly 74% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ArcelorMittal (MT) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance