Easy Come, Easy Go: How Gulf Keystone Petroleum (LON:GKP) Shareholders Torched 97% Of Their Cash

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Gulf Keystone Petroleum Limited (LON:GKP) during the five years that saw its share price drop a whopping 97%. It's up 3.9% in the last seven days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Gulf Keystone Petroleum

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Gulf Keystone Petroleum became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

In contrast to the share price, revenue has actually increased by 32% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

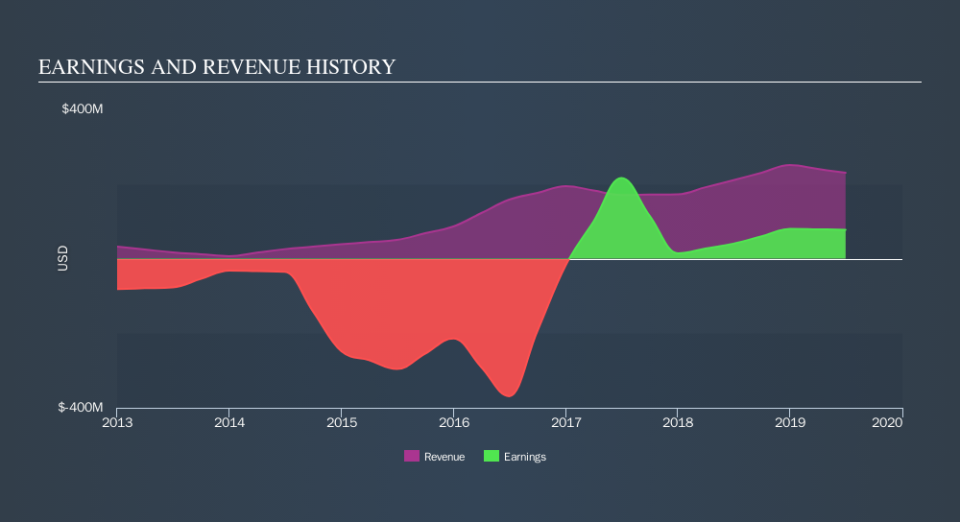

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Gulf Keystone Petroleum has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Gulf Keystone Petroleum stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Gulf Keystone Petroleum's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Gulf Keystone Petroleum's TSR, at -97% is higher than its share price return of -97%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're pleased to report that Gulf Keystone Petroleum shareholders have received a total shareholder return of 23% over one year. There's no doubt those recent returns are much better than the TSR loss of 50% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Before deciding if you like the current share price, check how Gulf Keystone Petroleum scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance