Eaton (ETN) Q4 Earnings Beat Estimates on Organic Growth

Eaton Corporation ETN reported fourth-quarter 2023 earnings of $2.55 per share, which surpassed the Zacks Consensus Estimate by 3.2%. The bottom line increased 23.8% year over year and beat the guidance of $2.39-$2.49 per share.

GAAP earnings for the reported quarter were $2.35 per share compared with $1.80 in the year-ago quarter. The difference between GAAP and operating earnings for the reported quarter was due to charges of 22 cents for intangible assets amortization, 2 cents for a multi-year restructuring program and 4 cents for acquisitions and divestitures.

Eaton’s 2023 adjusted earnings were $9.12 compared with $7.57 in 2022, indicating an increase of 20.5%. Its adjusted earnings were above the guidance range of $8.95-$9.05 per share.

Revenues

Total quarterly revenues were $5.9 billion, which surpassed the Zacks Consensus Estimate of $5.89 billion by 1.2%. Total revenues improved 10.8% from the year-ago quarter. ETN’s fourth-quarter revenues gained from a 10% increase in organic sales.

Eaton’s 2023 revenues were $23.2 billion compared with $20.8 billion in 2022, suggesting a year-over-year increase of 11.8%.

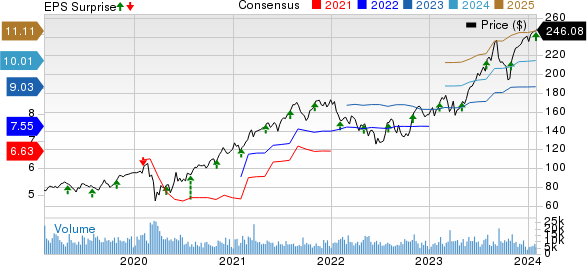

Eaton Corporation, PLC Price, Consensus and EPS Surprise

Eaton Corporation, PLC price-consensus-eps-surprise-chart | Eaton Corporation, PLC Quote

Segmental Details

Electrical Americas’ total fourth-quarter sales were $2.67 billion, up 16.6% from the year-ago quarter due to increased organic sales. Operating profits were $763 million, up 40% year over year.

Electrical Global’s total sales were $1.5 billion, up 67% from the year-ago quarter, driven by organic sales and positive currency translation. Operating profits were $284 million, up nearly 6% from the year-ago quarter.

Aerospace’s total sales were $895 million, up 10.2% from the year-ago quarter, driven by organic sales and positive currency translation. Operating profits were $200 million, up 0.5% year over year.

Vehicle’s total sales were $723 million, up 2.3% from the year-ago quarter, driven by positive currency translation. Operating profits were $129 million, up 20.6% year over year.

The eMobility segment’s total sales were $165 million, up 18.7% year over year, driven by organic sales of 18% and foreign exchange gain of 1%. Operating loss in the quarter was $16 million compared with a loss of $2 million in the year-ago quarter.

Highlights of the Release

Selling and administrative expenses were $956 million, up 20.1% from the year-ago quarter.

ETN’s fourth-quarter research and development expenses were $201 million, up 20.3% from the prior-year period. Interest expenses for the quarter were $27 million, down 38.6% from the year-ago quarter.

Eaton’s backlog growth, with orders, increased 18% in Electrical Americas and 13% in Aerospace on a rolling 12-month basis.

Financial Update

As of Dec 31, 2023, the company’s cash was $488 million, up from $294 million as of Dec 31, 2022.

As of Dec 31, 2023, ETN’s long-term debt was $8,244 million, down 0.9% from $8,321 million as of Dec 31, 2022.

Guidance

Eaton’s first-quarter 2024 earnings are expected to be $2.21-$2.31 per share. The Zacks Consensus Estimate is $2.19 per share, much lower than the mid-point of the company’s guidance.

Eaton expects adjusted earnings per share of $9.95-$10.35 for 2024.

The company expects its 2024 operating cash flow to be $3.62 billion and free cash flow to be $2.86 billion.

Zacks Rank

Currently, Eaton has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

EnerSys ENS is scheduled to report fiscal third-quarter 2024 results on Feb 7, after market close. The Zacks Consensus Estimate for earnings is pegged at $2.55 per share, indicating a year-over-year increase of 100.79%.

The long-term (three to five-year) earnings growth of EnerSys is pinned at 14%. The Zacks Consensus Estimate for fiscal 2024 earnings per share is $8.56, implying year-over-year growth of 60.93%.

Ingersoll Rand Inc. IR is scheduled to report fourth-quarter results on Feb 15. The Zacks Consensus Estimate for earnings is pegged at 76 cents per share, suggesting a year-over-year increase of 5.6%.

The long-term earnings growth of Ingersoll Rand is pinned at 14.04%. The Zacks Consensus Estimate for 2024 earnings is $3.10, implying year-over-year growth of 8.01%.

The Manitowoc Company MTW is scheduled to report fourth-quarter results on Feb 14, 2024. The Zacks Consensus Estimate for earnings is pegged at 19 cents per share, indicating a year-over-year decline of 74.3%.

The Zacks Consensus Estimate for 2024 EPS is pegged at $1.6, implying a year-over-year decline of 1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance