ECB Officials Get Cautious on More Cuts as Wages Pick Up

(Bloomberg) -- European Central Bank officials offered wary views on further interest-rate cuts at a time when pay pressures are proving stubborn, with one even raising the prospect that another move won’t materialize.

Most Read from Bloomberg

Real Estate Investors Are Wiped Out in Bets Fueled by Wall Street Loans

Here’s Everything Apple Plans to Show at Its AI-Focused WWDC Event

Putin’s Wartime Central Banker Tells Him What He Doesn’t Want to Hear

A day after the Governing Council delivered on its promise to lower rates but revealed a consumer-price forecast that left investors querying where policy is headed next, data showed accelerating wage increases — and governors signaled that they’re now back in a watchful phase.

“The central bank needs to make its decisions rather cautiously and not to rush too much with cutting the interest rate,” Estonia’s Madis Muller told Aripaev radio on Friday, while his Irish colleague, Gabriel Makhlouf, said policymakers don’t know “how fast we’re going to carry on, or if at all.”

The remarks underscore how the aftermath of a bold move to diverge euro-zone monetary policy from the path of the US Federal Reserve has left the ECB in a tentative and hesitant mood about its next step.

The decision on Thursday was only the second so far by a Group-of-Seven central bank to lower borrowing costs after the Bank of Canada’s move on Wednesday, but was also easily the most awkward of the two.

ECB President Christine Lagarde unveiled forecasts that showed officials will now take longer to bring inflation back to their 2% target, prompting questions from journalists on why she went through with the move.

She fell back on the central bank’s mantra that it will take “data dependent” decisions on a “meeting-by-meeting” basis. Paying full heed to that would preclude clear signals on the next step, an approach hawkish policymakers particularly agree with.

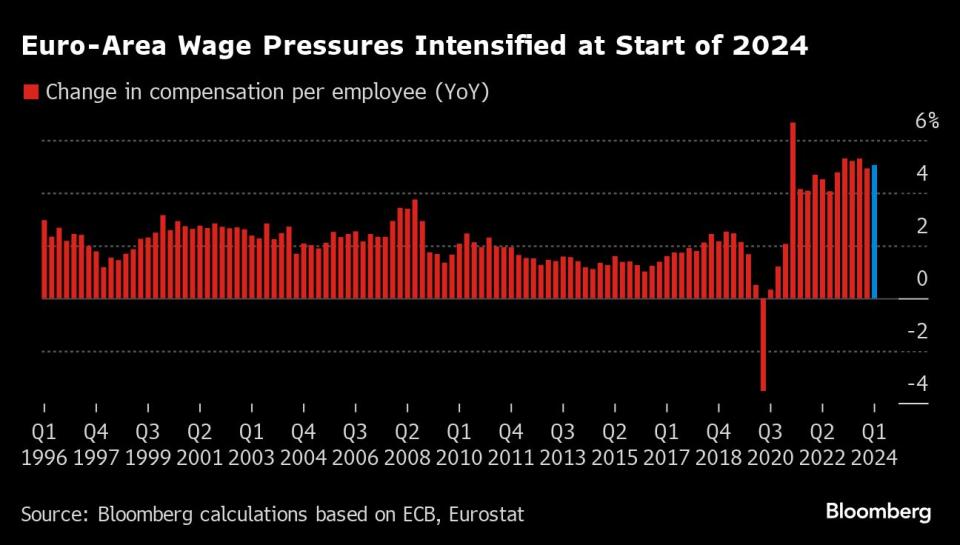

One datapoint they’re focusing on is wages. On Friday, the ECB’s preferred measure showed acceleration at the start of 2024, with compensation per employee rising by 5.1% from a year ago in the first quarter, up from a revised 4.9% in the previous three months.

“Domestic price pressures remain strong,” Latvian central bank chief Martins Kazaks said in a blog post earlier in the day. “The labor market is tight and unemployment is low, which keeps upward pressure on wages.”

Traders pared wagers on the extent of rate cuts from the ECB, with just 33 basis points seen for the remainder of this year — equivalent to one more quarter point move and a one-in-three chance of a further reduction.

Three quarter-point reductions were virtually fully priced as recently as late May. German bonds fell modestly for a second day, sending the 10-year yield two basis points higher to 2.57%, which is still below the recent high of 2.71%.

Austria’s Robert Holzmann, the sole dissenter against the rate decrease, said on Friday that the move this week was a hawkish cut, meaning that the Governing Council will be “somewhat more cautious in the future.” Many colleagues seem to conform to that description.

“We’re now confident that the disinflation process is working,” Makhlouf told Irish radio. “It doesn’t mean, incidentally, that we know how fast we’re going to carry on or if at all because — this is the phrase we’ve been using — ‘the road is bumpy.’”

While Finnish central bank chief Olli Rehn insisted that inflation is predicted to reach its 2% target in the next year, Kazaks cautioned that “victory is not yet in hand.”

Bundesbank chief Joachim Nagel said the ECB shouldn’t be “on autopilot” about lowering rates, Slovenia’s Bostjan Vasle and Mario Centeno of Portugal repeated that officials won’t precommit to a particular path for borrowing costs, a point echoed by Executive Board member Isabel Schnabel.

Vice President Luis de Guindos told Spanish radio that the Governing Council faces a huge level of uncertainty and will act depending on data and its own forecasts.

France’s Francois Villeroy de Galhau also stayed non-committal, saying that “we will adapt the precise rhythm of our next rate cuts without hurrying or procrastinating as the outlook for disinflation is confirmed.”

“Maintaining optionality is key to successfully steering inflation to its medium-term targeted level,” Christodoulos Patsalides of Cyprus told Bloomberg.

That may be so, but officials are already all but excluding a second cut in July, and some also question if such a step would be wise at the following meeting in September, according to people familiar with the matter.

Gediminas Simkus, the Lithuanian central bank chief, declined to offer a view on the July decision when questioned in Vilnius, saying only that the ECB needs “strategic patience” to assess data arriving in the next month or two.

If economic trends turn out in with ECB forecasts, “there will be more cuts” but “when, at what speed, what trajectory — lets wait and see,” he said.

“A level of restriction is still needed,” Simkus said. “When I hear triumphant statements that it’s over, inflation is overcome, I say ‘let’s wait: the road is bumpy.’”

--With assistance from Alice Gledhill, Leo Laikola, Ott Ummelas, Olivia Fletcher, Paul Tugwell, Kamil Kowalcze, Marton Eder, William Horobin, James Regan, Joao Lima, Henrique Almeida, Jan Bratanic, Jennifer Duggan, Milda Seputyte, Rodrigo Orihuela, Aaron Eglitis, Georgios Georgiou and Jasmina Kuzmanovic.

(Updates with comments from Centeno, Villeroy starting in 15th paragraph)

Most Read from Bloomberg Businessweek

Sam Altman Was Bending the World to His Will Long Before OpenAI

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance