Top economist warns of UK crisis 'bigger than worst-case Brexit'

Britain is suffering a productivity crisis more damaging than “even the worst-case Brexit scenario,” one of Britain’s leading economists has warned.

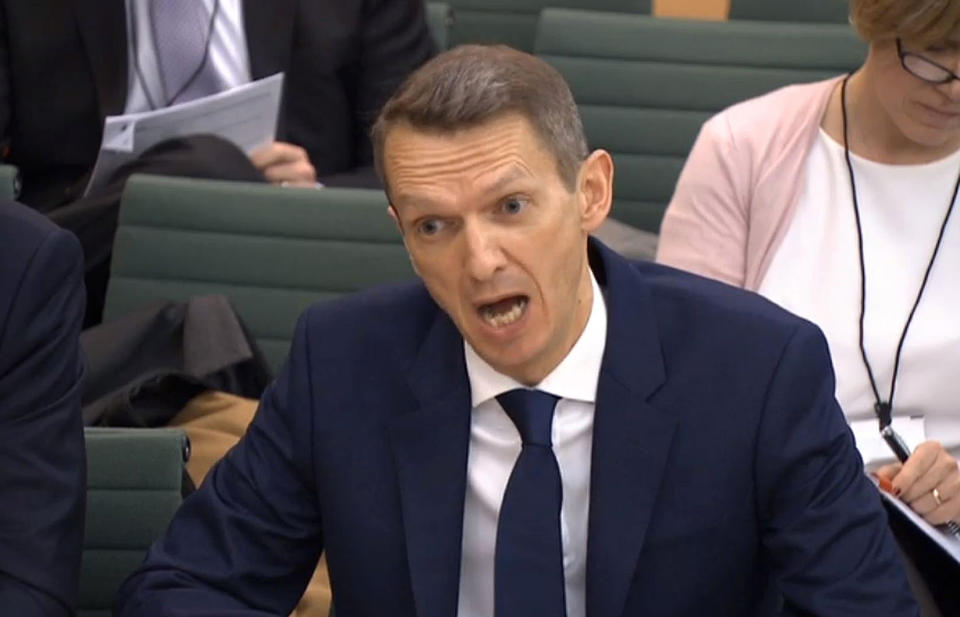

Andy Haldane, the Bank of England’s chief economist, said stagnant productivity since the financial crisis over a decade ago was the “single most pressing issue facing the UK economy.”

He said the failure to become more productive was to blame for a “lost decade” on pay, with the average UK worker’s wages still worth less now after inflation than before the crisis.

The failure to significantly increase output for every hour worked has limited the cash available for firms to expand, invest, hire or raise payouts to staff or shareholders.

Official figures last week showed productivity levels edged up just 0.1% in the year to last summer.

Gains are reported to have averaged just 0.3% a year in the 2010s, compared with average growth of 2% a year in the decade before the financial crisis.

READ MORE: Think tank warns ‘awful’ productivity puts pay rises at risk

The analysis suggests the UK may have missed out significant opportunities for growth, which could have benefited firms, their workers, the wider economy and the taxpayer.

“The costs of this crisis are already multiples of even the worst-case Brexit scenario,” wrote Haldane in the foreword to a new report on productivity by the RSA and Carnegie UK Trust.

The Bank of England has previously warned a no-deal Brexit would wipe 5.5% off UK GDP, with unemployment and inflation doubling if close trade ties with the EU were severed overnight.

Haldane, also chair of the UK’s industrial strategy council, highlighted new research suggesting higher pay and better quality jobs could help fix the productivity gap.

The findings, by academics Derek Bosworth and Chris Warhurst of the Warwick Institute for Employment Research, featured in the report launched on Thursday.

READ MORE: The areas of Britain where people earn the most

“A higher rate of pay can spur worker satisfaction and motivation, thus leading to higher levels of productivity,” wrote Haldane of the research.

“It suggests higher pay can itself hold the key to higher levels of productivity. The recent experience of the UK, and a number of other countries who have introduced minimum wage legislation, suggests this theory has support in real-world experience.”

He also questioned parts of the economic orthodoxy of the past few decades, noting research showed higher quality work could also spur more satisfaction, motivation and thus productivity at work. The academics’ research pointed to better pay and benefits, social support, safety, work-life balance and staff representation as elements of “good work.”

Noting the rise of the ‘gig economy’ in recent years, Haldane wrote pointedly: “It suggests there are natural limits to the benefits of a ‘flexible’ labour market in boosting an economy’s efficiency.”

READ MORE: Boris Johnson vows to raise minimum wage four times faster than inflation

He said evidence suggested Britain’s poor recent productivity could even be explained by a rise in low-quality jobs over the past decade.

The UK could see the most gains from tackling the “long tail” of companies with the poorest quality jobs, rather than focusing on average productivity levels, he argued.

Matthew Taylor, chief executive of the RSA, added: “It’s no secret that the new government has been elected in part by workers who’d not normally think of voting Conservative. Many of these people don’t feel they are sharing in the UK’s prosperity.

“Government cannot do everything, but it can focus on creating the conditions for good work for all, so that people in low-skilled jobs have more control over their working hours, benefit from a sense of progression and lifelong learning, are aware of their rights at work and ultimately see the link between hard work and fair pay restored.”

Yahoo Finance

Yahoo Finance