EDAG Engineering Group Leads Trio Of Premier German Dividend Stocks

Amidst a backdrop of recent interest rate cuts by the European Central Bank, Germany's market has shown resilience with modest gains in major indices such as the DAX. This context sets an intriguing stage for investors considering dividend stocks, particularly as these assets often appeal to those seeking steadier returns in fluctuating economic climates.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.39% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.55% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.78% | ★★★★★★ |

Südzucker (XTRA:SZU) | 6.39% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.41% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.73% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.10% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.90% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.10% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.20% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

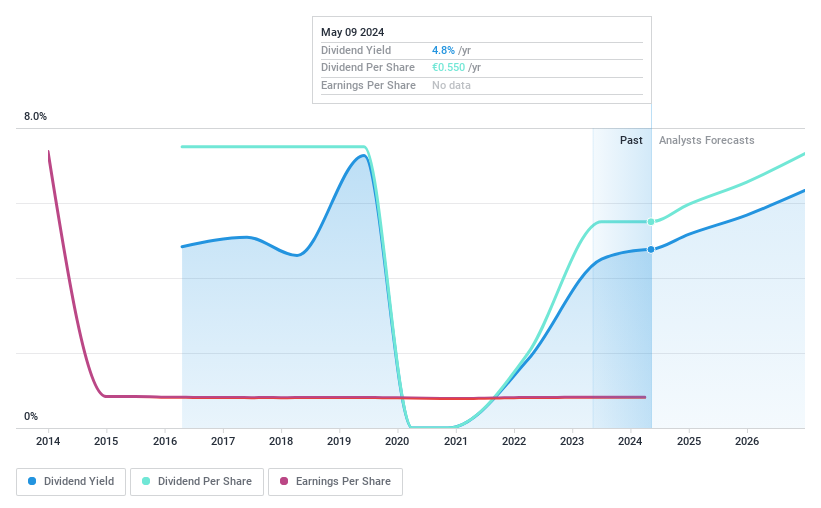

EDAG Engineering Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EDAG Engineering Group AG specializes in designing vehicles, derivatives, modules, and production facilities for the automotive and commercial vehicle sectors globally, with a market capitalization of €300 million.

Operations: EDAG Engineering Group AG generates its revenue primarily through three segments: Vehicle Engineering (€488.93 million), Production Solutions (€268.86 million), and Electrics/Electronics (€111.45 million).

Dividend Yield: 4.6%

EDAG Engineering Group AG, with a P/E ratio of 10.9x, offers a value proposition below the German market average of 18x. Despite its appealing dividend yield of 4.58%, placing it in the top 25% of German dividend payers, the company's dividend history is marked by instability and volatility over the past eight years, including a recent decline in payments. Dividends are well-covered by both earnings and cash flows with payout ratios at 49.7% and 46.4%, respectively. However, recent financials show a slight decrease in net income from €8.34 million to €7.04 million year-over-year for Q1 2024, alongside stable sales growth.

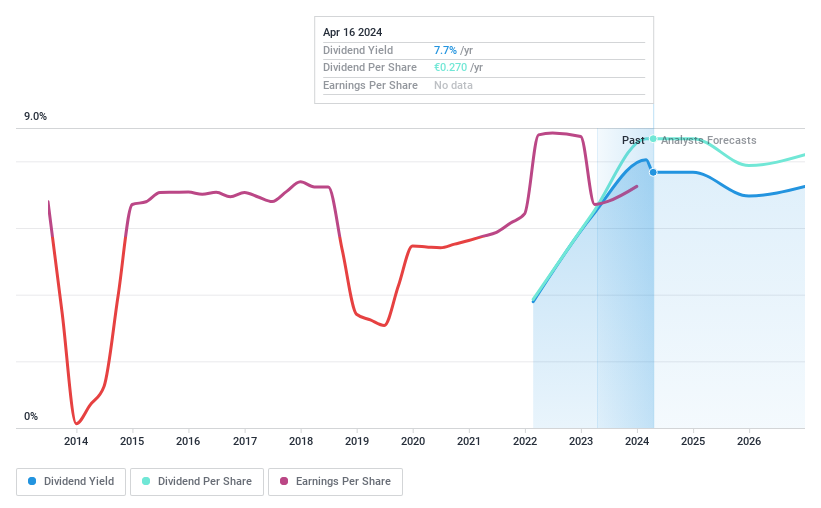

MPC Münchmeyer Petersen Capital

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager, operating with a market capitalization of approximately €156.50 million.

Operations: MPC Münchmeyer Petersen Capital AG generates its revenue primarily through Management Services (€30.83 million), followed by Transaction Services (€7.73 million).

Dividend Yield: 6.1%

MPC Münchmeyer Petersen Capital AG has shown a promising dividend profile with a current yield of 6.08%, ranking in the top 25% of German dividend payers. The dividends, initiated just two years ago, are well-supported by both earnings and cash flows, with payout ratios at 72.6% and 73.6% respectively. Recent financials indicate robust growth, with net income rising to €5.88 million from €3.72 million year-over-year for Q1 2024. However, the firm's short dividend history suggests potential volatility in its future payouts.

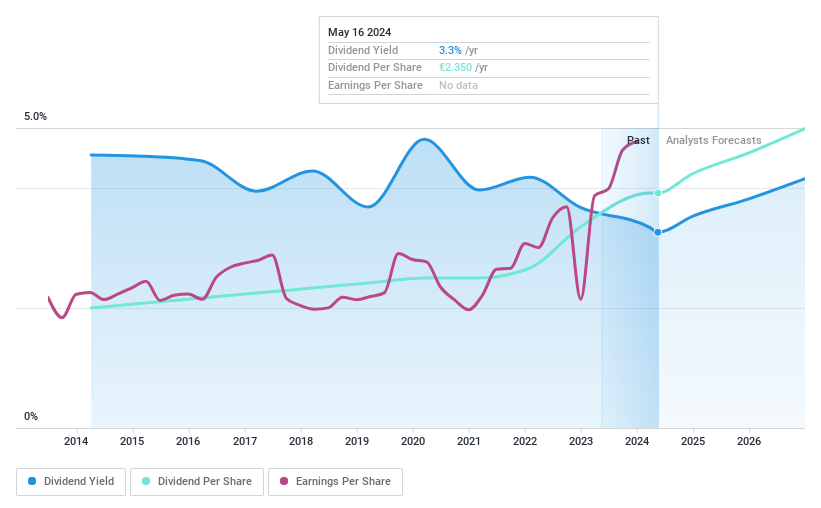

Talanx

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Talanx AG operates globally, offering insurance and reinsurance products and services, with a market capitalization of approximately €19.08 billion.

Operations: Talanx AG's business encompasses a broad range of insurance and reinsurance services across the globe.

Dividend Yield: 3.2%

Talanx AG has demonstrated consistent dividend payments over the past decade, with a recent increase to €2.35 per share. Despite trading 63.8% below estimated fair value and a low yield of 3.18% relative to Germany's top dividend payers, its dividends are well-supported by earnings and cash flows, maintaining payout ratios at 34.7% and cash payout ratios at 7.5%. Recent financial growth includes a net income rise to €572 million in Q1 2024 from €423 million the previous year, suggesting solid financial health.

Key Takeaways

Explore the 33 names from our Top Dividend Stocks screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:ED4 XTRA:MPCK and XTRA:TLX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance