Editas (EDIT) Misses on Q2 Earnings & Sales, Gets New CEO

Editas Medicine, Inc. EDIT) incurred a loss of 69 cents per share in the second quarter of 2019, wider than the Zacks Consensus Estimate of 59 cents but narrower than the year-ago quarter’s loss of 82 cents.

Collaboration and other research and development revenues, comprising the company’s total revenues, came in at $2.3 million, down 68.9% year over year. Moreover, the top line missed the Zacks Consensus Estimate of $6 million.

Editas has no approved product in its portfolio at the moment. The company generates collaboration revenues and other research and development revenues. Its collaboration revenues declined in the quarter due to lower revenues recognized under Editas’ collaboration with Celgene CELG. Meanwhile, an out-license arrangement was entered into during the second quarter of 2018, which had generated some collaboration revenues in the year-ago quarter.

The company has a collaboration and licensing pact with Juno Therapeutics — now part of Celgene - to use the latter’s gene-editing approaches including CRISPR-Cas9 for developing engineered T cell medicines to tackle cancer.

This year so far, Editas’ stock has risen 8.3% against the industry’s decrease of 4.4%.

Quarter in Detail

In the reported quarter, research and development expenses were $23.6 million, down 27.8% from the year-ago period’s figure, mainly owing to lower spending associated with the sublicensing and success payment. General and administrative expenses were almost flat at $14.4 million.

Along with the earnings, Editas announced the appointment of Cynthia Collins as president and chief executive officer (CEO). Collins has been acting as the interim CEO since January when Katrine Bosley announced her decision to step down from the position.

Pipeline Update

The company’s lead pipeline candidate is EDIT-101 that uses CRISPR gene editing to treat Leber congenital amaurosis type 10 (LCA10) – a rare genetic illness that causes blindness.

Editas is developing EDIT-101 in partnership with Allergan AGN. Both companies plan to initiate patient dosing in the phase I/II dose escalation study called Brilliance on EDIT-101 in LCA10 in the second half of 2019. The Brilliance study opened for patient enrolment in July.

Editas is also pursuing the development of CRISPR candidates for eye diseases other than LCA10, including Usher Syndrome type 2A (USH2A) and recurrent ocular Herpes Simplex Virus type 1 (HSV-1) fibrosis. It expects to be ready for investigational new drug (IND) enabling activities for a USH2A program by the end of the year.

It is also designing novel medicines for non-malignant hematologic diseases such as sickle cell disease and beta-thalassemia. Editas has initiated IND enabling activities for EDIT-301, an experimental CRISPR medicine designed to treat sickle cell disease and beta-thalassemia by editing the beta-globin locus.

Genomic editing using CRISPR technology to repair a defective genetic material that causes diseases is probably one of the most promising and exciting healthcare innovations seen in decades. There are only a handful of companies making medicines using this revolutionary technology. Other than Editas, companies such as CRISPR Therapeutics AG CRSP and Intellia Therapeutics are either planning to conduct or have already started clinical studies to develop curative CRISPR/Cas9-based medicines. The company has two CRISPR platforms, one using the Cas9 protein and the other, the Cpf1 protein.

Editas currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

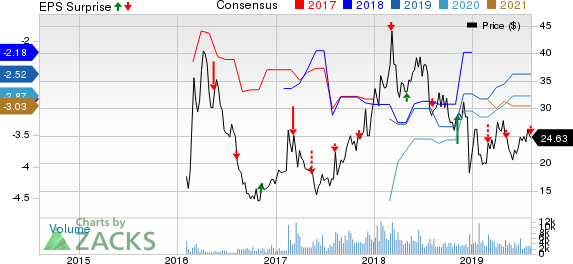

Editas Medicine, Inc. Price, Consensus and EPS Surprise

Editas Medicine, Inc. price-consensus-eps-surprise-chart | Editas Medicine, Inc. Quote

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allergan plc (AGN) : Free Stock Analysis Report

Editas Medicine, Inc. (EDIT) : Free Stock Analysis Report

Celgene Corporation (CELG) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance